Update: 7.1.2020: From Wellington: "Effective at the close of business on June 30, 2020, Michael F. Garrett has retired from Wellington Management Company LLP and no longer serves as a portfolio manager for Vanguard GNMA Fund. Brian Conroy and Joseph F. Marvan remain as the portfolio managers of the Fund." Originally posted June 7, 2017. Do you know Michael F. Garrett? There’s no reason that you should, but to me, the Senior Managing Director at Wellington Management Company LLP in Boston, Massachusetts might be one of the most important names in the fixed-income world today. He’s the … [Read more...]

Forbes: Weakening Dollar Trend Isn’t Good

“Everyone understands the basic need for fixed weights and measures in daily life: the amount of liquid in a gallon, the number of ounces in a pound, the number of minutes in an hour. None of these amounts fluctuate; they are unchanging,” writes Steve Forbes. Here’s his latest Fact & Comment on the greenback. The dollar. Markets are finally waking up to the implications of the weak dollar, which has been declining for months. The greenback’s slide has been nowhere as bad as it was in the early 2000s, but the trend isn’t good. Treasury secretary Steven Mnuchin let the cat out of the bag a … [Read more...]

Dividends are on the Rise

Dividends are the backbone of the Retirement Compounders. Now Michael Wursthorn reports in The Wall Street Journal that dividends are on the rise. Dividends are on the rise when investors have fewer reasons to buy the stocks that pay them out. More than a fifth of the companies in the S&P 500 have boosted their dividends to shareholders so far this year, while none have slashed their payouts, a first since 2011, according to S&P Dow Jones Indices. The increases are getting bigger too, with companies on average raising their payouts by 14%, the biggest jump since 2014. The … [Read more...]

Don’t Put Your Greed too far Ahead of Your Fear

This morning The Wall Street Journal tells the story of Harvey Hajiyan, a financial adviser who has been making big bets in the market on margin. In speaking to the Journal, Hajiyan said a phrase that should be a warning bell to any investor "all the strategists agreed." Any time everyone is in agreement on something, you should pick your head up and take note. Someone isn't pricing in risk properly, and if you're just coasting along with the crowd, that someone is you. Use Mr. Hajiyan's tale as a reminder of what happens when investors put greed too far ahead of fear. The Journal's Michael … [Read more...]

How Not to Choose Your Investment Advisor

When financial advisors take it too far to embellish their credentials, it’s the investor who typically pays the price no matter how well-intentioned an advisor may be. In this case you have advisors giving speeches outside of Harvard and West Point with no affiliation to the institutions what so ever and taking credit as being invited guests. The huckster putting these gigs together is Clint Arthur, a former taxi driver and butter salesman who, according to columnist Jason Zweig, “trains businesspeople—including, so far, about three dozen financial advisers—in media skills.” “In order … [Read more...]

Are You a Baby Boomer with a Retirement Income Problem?

Originally posted October 23, 2017. You need income in retirement. It’s that simple. But to many, retirement income, and the lack thereof, is a problem that will never be solved. Over the weekend I read an article in the local paper about how dreadfully ill-prepared the Baby Boomer generation is when it comes to retirement income. And it’s a subject that comes up quite often in my conversations with prospective clients. They ask me, “How will I get income from my investments?” After I explain how we construct portfolios, I tell them that a good rule of thumb is to draw no more than … [Read more...]

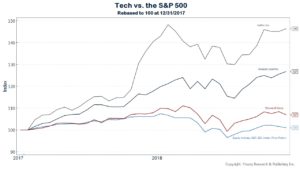

The Truth Behind the S&P 500: Part VII

When three companies—Amazon, Microsoft, and Netflix—comprise almost half of the performance year-to-date for the S&P 500, what happens to the index when they fall out of favor? It has long been my belief that investors don’t measure the risk inherent in a market-cap weighted index such as the S&P 500. They are invested in passive mutual funds that mimic an approach that has become more top heavy by the day. Investors should not be surprised when huge drops accompany huge gains. Read more about the Truth Behind the S&P 500 in Parts I, II, III, IV, V, and VI. … [Read more...]

Paul Singer Epically Savages Bitcoin

You can count hedge fund manager Paul Singer as among the bitcoin skeptics. He recently savaged bitcoin and cryptocurrencies as a form of investment saying: “When the history is written, cryptocurrencies will likely be described as one of the most brilliant scams in history....It is not just a fraud. It is perhaps the outer limit, the ultimate expression, of the ability of humans to seize upon ether and hope to ride it to the stars....But is it not glorious that when the equivalent of nothing attracts priests and parishioners who run up the price, the very willingness of the mob to buy it … [Read more...]

Global Earnings Generate Dividends and Deals

Strong earnings in Europe are leading to increases in dividend payouts and an uptick in M&A activity on the Continent. Global diversification is more important than ever. As always, investors should focus on harvesting dividends to create a portfolio that generates income for compounding, and funding retirement. Nina Trentmann reports on Europe's strong performance: European companies have struck several deals since the beginning of the year, including Sanofi SA ’s SNY 0.48% proposed takeover of Bioverativ Inc. for more than $11.5 billion. Swiss industrial firm ABB Ltd. ABB -0.20% is … [Read more...]

Happy Presidents’ Day

"Never spend your money before you have it." - Thomas Jefferson (Randall, Henry S. The Life of Thomas Jefferson, Volume 3. New York: Derby & Jackson, 1858, p.525.) … [Read more...]

- « Previous Page

- 1

- …

- 194

- 195

- 196

- 197

- 198

- …

- 245

- Next Page »