Cryptocurrencies took a nasty plunge yesterday after Chinese authorities cracked down on their use. That institutional response, shortly after Elon Musk revealed that Tesla would no longer be using bitcoin in transactions, was a double whammy that took the wind out of cryptocurrencies across the board. Since the drop, crypto prices have recovered some of what they lost, but nowhere near all. The Wall Street Journal reports:

The recent price fall has accelerated after three Chinese entities published a statement that financial institutions shouldn’t accept virtual currencies for payment or provide services using them. China has in the past issued other restrictions on cryptocurrencies, which seemingly have had little success in stanching demand among Chinese citizens. Still, the new ban and the reaction shows the crypto market is still sensitive to regulatory efforts.

The selloff extended to other digital currencies as well. Dogecoin fell 27% to about 35 cents, after earlier plunging as low as about 22 cents. Ether was 26% lower at $2,536, after earlier falling more than 40%.

Since early Tuesday, the total value of the cryptocurrency market has declined by more than $470 billion to about $1.66 trillion, according to CoinMarketCap. Bitcoin’s share has fallen to $721 billion.

Those losses are partially a result of how the market is structured. Crypto markets trade 24 hours a day seven days a week on hundreds of exchanges around the world. Once momentum accelerates in either direction there is no closing bell or circuit breaker to slow trading.

Moreover, the downturn fits a recurring pattern in digital currency’s short history. In 2017, Bitcoin’s price rose from $1,000 to nearly $20,000, peaking on the very day that exchange giant CME Group Inc. opened its much-awaited bitcoin futures market. At the time, that debut seemed like a sign of crypto’s arrival. Instead, it marked the end of the rally.

This year, bitcoin peaked April 14, coinciding with the stock-market debut of Coinbase Global Inc., the largest U.S. bitcoin exchange and the first significant player in the industry to go public. Much like the CME launch, in retrospect it seems to have marked the end of a rally.

At the time, that day felt like a victory lap for cryptocurrencies, said Oanda analyst Edward Moya. Coinbase fetched a mammoth $85 billion valuation, making it bigger than most companies in the S&P 500.

Now, however, that day feels like a different kind of turning point, he said. Coinbase’s stock has declined 41% from its opening price that day, including Wednesday’s 5.9% drop.

The volatility in cryptocurrencies is neck-snapping. It’s only good for speculators, not investors. I wrote to you yesterday about the difference between the two:

Other than what someone’s willing to pay you, where does a cryptocurrency’s value come from? Because when it comes to sources of value, with dividends from stocks and interest from bonds, you know where you stand. With cryptos, you hope someone doesn’t jump the line.

When a company pays you a dividend (or a bond pays you interest), it worries about meeting its obligations to you. It sees you, unlike the anonymity of cryptos, banging your tin cup on the boardroom table saying: “Show me the money.”

When a company issues stock, it’s giving up ownership, and with a bond, it’s taking on debt. The company doesn’t care who owns the stocks or bonds—they just want to know where to send the checks.

Your Survival Guy’s noticed how stock and bond prices have been uncharacteristically out of synch for the first time in fifteen years (also pointed out in the WSJ). Investors are worried about inflation. And based on the hubris from the Fed, not everyone’s sure this ship will be docked without a scratch. Make sure your boat isn’t in the way. James Mackintosh reports on those worries in the WSJ, writing:

We saw this last week, with stock prices and bond yields moving in opposite directions every day. The link between the two, measured as the correlation of their daily changes over the past 100 days, is the lowest in more than 15 years. Instead of more inflation being good news for stocks, it is now bad news—while still being bad for bonds, meaning higher yields. Less concern about inflation now means lower Treasury yields, and higher stock prices.

Remember, capital structure is like a channel marker, guiding a company’s financial obligations. As a bondholder, you’re a bosun, senior to the average, stock, deckhand. The capital structure of a crypto? Who owes you anything if the system breaks down? No one.

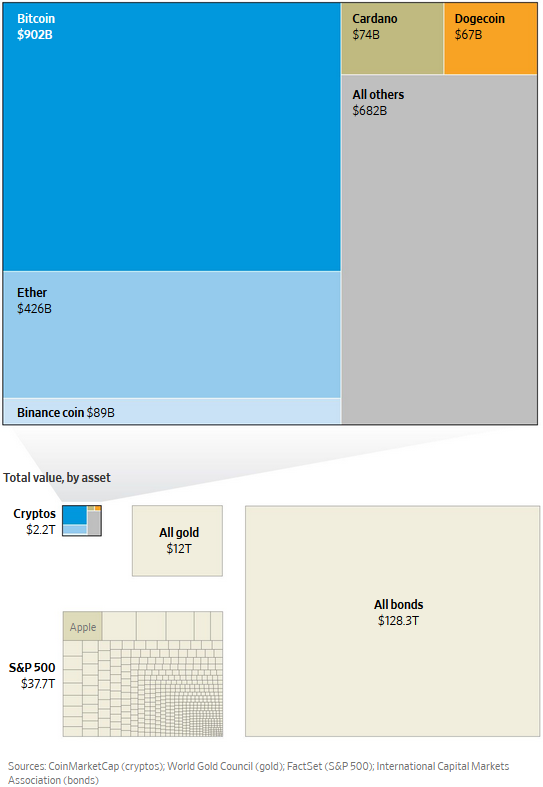

Action Line: Take a look at the market cap of cryptos, stocks, and bonds, and see why there’s plenty of smart money in bonds. Because at the end of the day, your return to port, like the return of capital, matters more than the return on it.

The Wall Street Journal explains the current situation with cryptocurrencies, writing:

Crypto in Context

Thanks to the prolific rise of bitcoin, ether and dogecoin, the value of the total cryptocurrency market has swelled to more than $2 trillion, up from $260 billion a year ago. Dogecoin alone—with a market value of about $67 billion—is worth more than 75% of the companies listed in the S&P 500. Although the digital currencies have surged in recent months, as an asset class, they remain a fraction of global markets for stocks, bonds and gold.

Total value of all cryptos in circulation

TOTAL: $2.2 TRILLION

Action Line: Note that the above market cap of Cryptos declined by about a trillion since I wrote to you yesterday. Wow.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Is Your Retirement Life a Mess? Let’s Talk - April 18, 2024

- Your Survival Guy Learns from Marie Kondo - April 18, 2024

- Don’t Be Left High and Dry - April 18, 2024

- April RAGE Gauge: Real Gold Prices - April 18, 2024

- This Is about Your Survival, Not Anyone Else’s - April 17, 2024