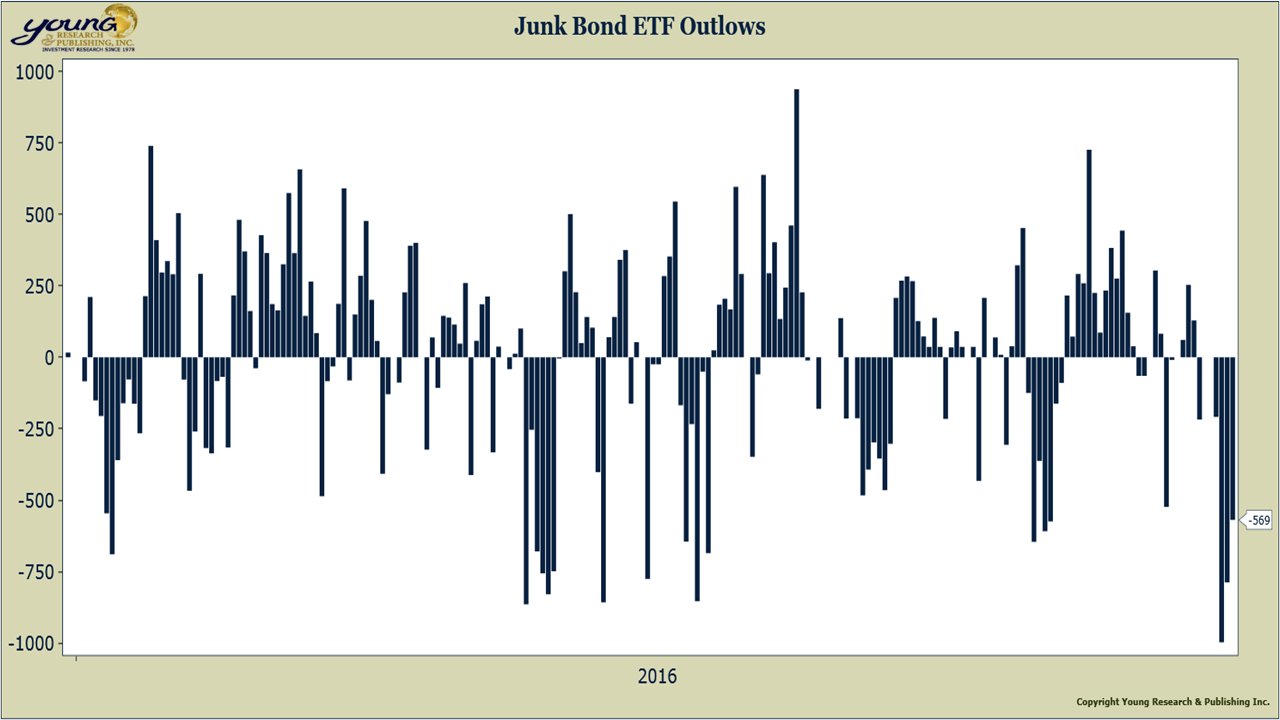

High yield ETFs focused on long-duration bonds are seeing a massive exodus by investors worried about rising rates. On Friday, BlackRock’s iShares iBoxx $ High Yield Corporate Bond ETF (HYG) suffered a record outflow of $1 billion. That’s in contrast with shorter duration funds that have even seen some inflows as investors readjust. On the same day, State Street’s SPDR® Bloomberg Barclays High Yield Bond ETF (JNK) watched $182 million walk out the door. Financial Times reporters Joe Rennison and Eric Platt write of the phenomenon:

“The recent pullback in the larger high-yield ETFs such as HYG and JNK, while in part perhaps due to the sell-off in oil, is primarily the result of concern with rising rates rather than credit, with people increasingly wary of exposure to longer duration assets,” said John Dixon, a high-yield bond trader at Clearview Trading.

Some ETFs that invest in shorter dated or floating rate assets have seen some inflows in recent weeks. Powershares senior loan ETF (BKLN) saw inflows of $200m last week.

HYG saw outflows of almost $1bn on Friday, according to Bloomberg data, the largest one-day flow for the ETF. HYG and JNK are no stranger to big daily flows as investors often move money between ETFs and the underlying bond market, using the ETF as a placeholder for funds until bonds can be acquired. JNK saw $182m leave the fund on Friday.

BlackRock iShares investment grade bond index also saw outflows of $785m on Thursday and $543m on Friday, according to Bloomberg data.

Analysts said it may also show some investors seeking to take profits ahead of the potential for price volatility around the US election.

“Speculators, who are more influential in the ETFs, are probably focusing on the near-term risk of heightened volatility related to the presidential election,” said Marty Fridson, chief investment officer at Lehmann, Livian, Fridson Advisors.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- “What Do You Do If the Market Crashes?” - April 19, 2024

- Costco Gold Bars Sell Out Despite Premium Price - April 19, 2024

- A Wise Man’s Take on the Boston Bruins Playoff Chances - April 19, 2024

- Is Your Retirement Life a Mess? Let’s Talk - April 18, 2024

- Your Survival Guy Learns from Marie Kondo - April 18, 2024