You have watched as American politicians and business leaders have pushed back against the ESG movement to protect shareholder returns. Now, the movement to put shareholders ahead of politics has made it to Europe. Niall O'Shea and Hugh Wheelan report for Reuters: March 14 - Ignored, ridiculed, embraced, sanctified, attacked. If you’ve been living it for long enough, it’s hard not to see the grim humour in the parable of ESG. That catch-all term, which covers “sustainable”, “responsible” and “impact” investment, is nursing a splendid hangover, and having to contemplate the consequences of … [Read more...]

Wall Street Abandons the Climate Extortion Racket

Wall St. has slowly been turning against the climate extortion racket, possibly beginning with Vanguard's decision to leave the Net Zero Asset Managers initiative back in December 2022. Even ESG champion BlackRock has been backpedaling hard on the investment craze. Now, The Wall Street Journal's editorial board reports on what might be the beginning of the end for ESG. According to the editors, JPMorgan Asset Management, BlackRock, and State Street Global Advisors have decided to leave the climate extortion racket. They write: Has the tide turned on environmental, social and governance … [Read more...]

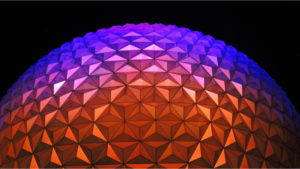

Disney Signals Problems with the ESG Agenda

You have read about Disney's war against Florida Gov. Ron DeSantis and parental rights. Now, it appears that Disney is realizing the error of getting involved in America's culture wars in order to boost its ESG rankings. Johnathan Turley writes in The Hill: In recent filings, Disney appears to acknowledge that Smith’s invisible hand is giving the “House of Mouse” the middle finger. In a new corporate disclosure, Disney acknowledges that its controversial political and social agenda is costing the company and shareholders. In its annual SEC report, Disney acknowledges that “we face risks … [Read more...]

Keep Other People’s Politics Away from Your Money

Keep other people’s politics away from your money. Your Survival Guy favors the selection and ownership of individual stocks to avoid the ESG crowd. In The Wall Street Journal, Matt Cole and Jeff Sherman discuss what they call "the charities hiding in your 401(k), writing: Environmental, social and governance investing is like the wrinkle in the rug; stomp it down and you shift the problem somewhere else. As investors and lawmakers push against ESG’s presence in portfolios, it is infiltrating index funds wearing a new disguise: the public-benefit corporation, or PBC. Unlike a standard … [Read more...]

GREENWASHING: What’s in a Name?

“What’s in a name? That which we call a rose, By any other name would smell as sweet.” — Juliet Capulet What's in a name? It turns out the SEC demands that the names of funds be descriptive of at least 80% of what the fund is doing. This new rule was adopted after many funds added language to their names suggesting they were part of the ESG movement but didn't follow up by changing their portfolios to match the strategy. This is a technique known as "greenwashing." The SEC has had enough of the practice, and has acted to purge the misnamed funds. Douglas Gillison and Michelle Price report for … [Read more...]

HOT POTATO: S&P Drops Its ESG Rankings

You may have seen that ESG is becoming a hot potato for companies as the scrutiny of both its philosophy and methodology are rising. Now S&P Global (the firm known best for its S&P 500 stock market index) has decided to discontinue its ESG ratings for corporate borrowers. Patrick Temple-West reports in the Financial Times: S&P Global has stopped handing out scores to corporate borrowers on ESG criteria, at a time of rising questions about their utility and political attacks on such metrics. The debt rating agency has since 2021 published scores from one to five for a company’s … [Read more...]

Investors Souring on ESG

You have watched as ESG has become a force in markets, propelling the desires of woke money managers to the forefront of the conversation in markets. Now there are signs that investors have had enough, or almost enough, of "environmental, social, and governance" focused products that give money managers all the control that is supposed to belong to shareholders. A new survey of investment professionals by Bloomberg finds that they're not very interested in ESG at all. Tim Quinson reports for Bloomberg: The outlook for ESG is getting bleaker based on the results of Bloomberg’s latest … [Read more...]

BlackRock’s Funds Are Under Attack

What happens when a massive hedge fund takes on the world's largest money manager? They go to war. Hedge fund Saba Capital Management is trying to buy up shares of BlackRock's closed-end funds trading at discounts to net asset value (for less than the value of the underlying shares) and then install new board members who will make changes to the funds to realize their value. If the strategy works, it could give Saba plenty of profit. So far, the attack on the funds by Saba has failed, and now the hedge fund is suing BlackRock. The Wall Street Journal's Jack Pitcher reports: “The truth is … [Read more...]

A Job Boom for Corporate Culture Warriors

You know Your Survival Guy doesn't want company executives mixing their culture war initiatives with their fiduciary duty to shareholders, but they do it anyway. You invest, and they win. Now, new regulations and corporate DEI and ESG mandates have created a job boom for corporate culture warriors. The Wall Street Journal's Allysia Finley explains: This boom owes in part to Biden administration regulations. But the bigger drivers are progressive employees who demand that their employers indulge their politics as well as ESG police like BlackRock that order corporations to produce detailed … [Read more...]

Serving Two Masters is No Way to Invest

Are you working with a fiduciary? What is a Fiduciary? In “The Fiduciary Principle: No Man Can Serve Two Masters,” the founder of The Vanguard Group, John (Jack) Bogle, explained the fiduciary duty as follows: “The fiduciary is expected to act at all times for the sole benefit and interests of the principal, with loyalty to those interests.” Nowhere in Bogle’s full definition (here) does he mention allowing a firm’s politics to guide it. But that’s exactly what has happened with ESG. The ESG Cartel Is Vanguard Voting Against Your Political Beliefs? Was Silicon Valley Bank a Victim … [Read more...]

- 1

- 2

- 3

- 4

- Next Page »