I’ve been working with Dr. Lee for 16-years. He was only 53 when he became a client. Even back then he was the millionaire next door.

But for about two weeks of every month, he doesn’t have any neighbors. That is unless you happen to have a cabin on Kodiak Island, Alaska. Even then you probably won’t see each other. Overlooking the water, his cabin is a fly cast away from world-class King Salmon fishing. He loves to fish.

He also loves to share his knowledge and to keep learning.

Before he retired he would sharpen his professional axe teaching university students about oral healthcare. Today he still attends a financial seminar every year to keep up on the world of finance and investing. You wouldn’t believe some of the horror stories he’s told me from investors he’s spoken to at these events. Oftentimes he sums up the seminars like this: “You know E.J., it turns out compound interest still works.”

Dr. Lee knows investing is simple. He also knows realizing investment success is difficult to do. That’s why we’ve worked so well together for so many years.

E.J.-I was out at my cabin on Kodiak recently with some friends. Talk got around to how can you afford to do this. I told them about what we recently talked about and the idea for this Thank You note was born. I’m the one in the center holding the homemade note. They all send their thanks since this probably wouldn’t have been possible without your help. Have a great day. Lee

The Land of Giant Bears | Full Documentary – Planet Doc Full Documentaries

Part of my effort on your behalf is to help you avoid inertia, get into the compounding game, and always be prepared for the worst. Always think about your risks first and realize the success you and your family deserve. It’s that simple.

Here’s what Dr. Lee wrote to me later about investing:

It’s not Rocket Science. Simple. Start early follow the Young philosophy and stay the course. Einstein‘s 8th wonder of the world will do the rest for you. Lee

That eighth wonder of the world is compound interest. The best way to begin understanding the power of compound interest is to consider saving for your grandchild. Back in July, I wrote about such a scenario:

The short answer is, early. The earlier you can start saving for your grandchild, the greater the impact you’ll have on their life.

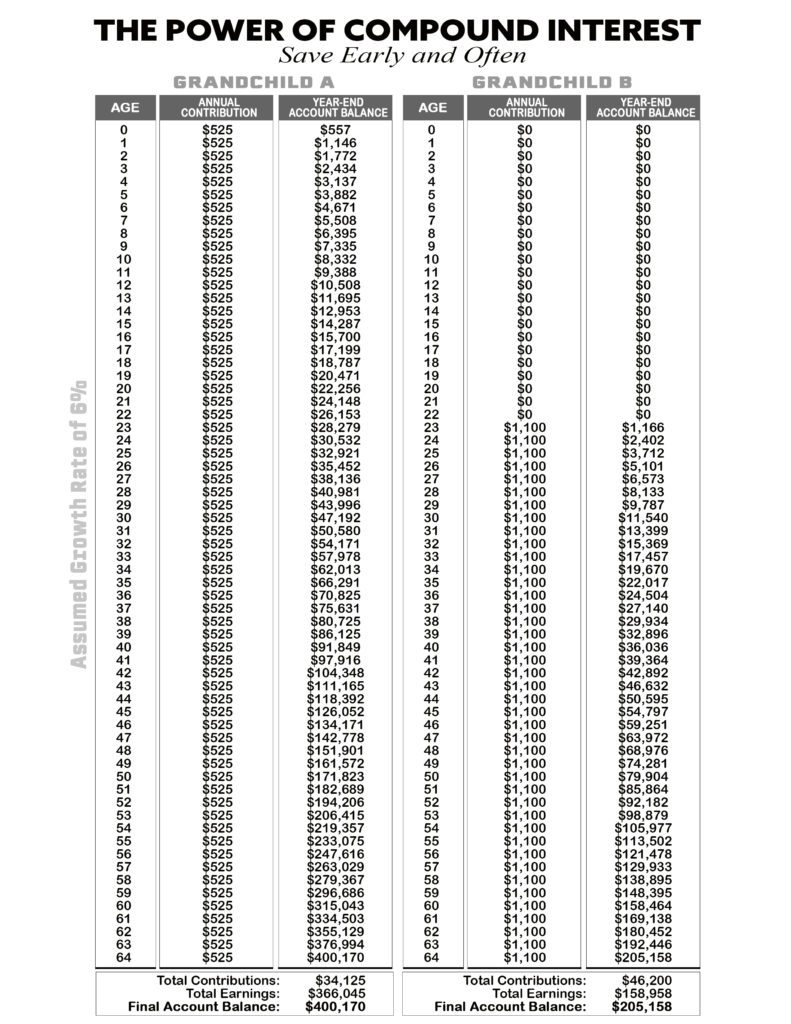

Take a trip with me. Let’s say you help a grandchild get into the savings game when they’re born by contributing $525 per year to an account you establish for them. (I favor UGMAs for this purpose). You diligently save each year for her first 21 years.

Then when she turns 22, she continues along the same path, saving $525 on her own each year until she’s 64.

Look at my table below to compare her success to someone who begins his investment savings at age 22 at double the savings rate of your granddaughter, saving $1,100 each year. Even though he’s saving twice as much each year, when he turns 64 he’ll have half as much as your granddaughter simply because you helped put time on her side with your early generosity (I’ve used a long-term expectation for stocks of 6% growth per year).

So, how do you save money for your grandchild? Easy, put time on their side.

You must be the one to harness the power of compound interest by saving early and often.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024