UPDATE July 29, 2022: Is America going into a recession? After two-quarters of declines in GDP, it has that look. The NBER makes the final decision on what is and what isn't a recession, but those designations are often made well into a recession or even after it's over in some cases. Practically speaking, Americans are looking at an economic slowdown that they will have to adjust to, no matter what it's called. Preparing your investment portfolio for slower growth is not always easy. If you need help, I would love to talk with you about building a plan like the one I described here. If you … [Read more...]

Richard Young Reports: The Great Money Explosion and Disasters

You and I know disasters happen. Just because they haven’t happened yet doesn’t mean they won’t. But disasters aren’t accidents. People do dangerous stuff—beginning with getting out of bed. It’s the start of your chaotic day. The world is filled with Chaos. As my father-in-law Dick Young reminds me from time to time, “There’s no such thing as accidents.” I try to explain that to my teenaged kids, though they insist “accidents” happen all the time. When it comes to your money, think about it like you’re hiking with a heavy backpack (I hope!) where you have decisions to make about which … [Read more...]

Richard Young Reports: 50+ Years with Fidelity and Wellington

I started in the institutional research and trading investment business at Model Roland & Co. on Federal St. in Boston in August 1971. Just up the street from Model were Fidelity Investments, and Wellington Management, both of whom I called on from my very first hours on the job. Over five decades ago, Ned Johnson, aka “Mister Johnson,” ran the show at Fidelity. At Wellington, Jack Bogle, “Mr. Mutual Fund,” had not yet left Wellington to start Vanguard. My focus in the initial going was international research and trading, and remains so today all these decades later. I still consider … [Read more...]

You’ve Read the Last Issue of Intelligence Report Now What? Part III

In his first issue of Richard C. Young’s Intelligence Report, Dick wrote, “Hugh Johnson is known worldwide as an expert and writer on gardening and wine. In Connoisseur’s June/85 issue Michael and Ariane Batterberry wrote about Johnson’s ability to communicate to his readers saying he ‘never pontificates,’ and that Johnson feels ‘once inflamed by a subject, the wise outsider will write a book about it before he learns too much and becomes an insider, so entangled in arcana that he can no longer strike through the nub of things.” “I hope my Intelligence Report will achieve Johnson’s worthy … [Read more...]

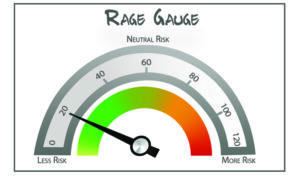

You’ve Read the Last Issue of Intelligence Report: MTI and RAGE Gauge

In case you missed it, here’s what Dick Young wrote in his December 2016 issue of Intelligence Report: My Revitalized Market Tension Index (MTI) When will we know that the economy has entered recession? This month, I am reintroducing my Market Tension Index (MTI) to help you and I determine whether the economy is in recession. This will be the first of what are likely to be many more proprietary indicators and tools I plan to roll out to help you become a more comfortable, confident, informed investor. My revitalized MTI is a composite index of indicators that have historically peaked … [Read more...]

You’ve Read the Last Issue of Intelligence Report: Dave Hammer on WD-40

Turns out you can survive and thrive with WD-40 in your pantry drawer and your portfolio. “During my 14-year run in the institutional research and trading business in Boston, the finest analyst with whom I worked was oil analyst Dave Hammer. Since 1990 Dave has been the managing partner of Hammer Asset Management. We stay in touch to this day,” explains Dick Young. You can see why from his interview in the September 1987 issue of Richard C. Young’s Intelligence Report (excerpt found below). (Edited for length and clarity) This Month’s Special Guest David Hammer He plays the piano, … [Read more...]

You’ve Read the Last Issue of Intelligence Report: Back to Investors Yield: Part II

“Well I remember the mood of euphoria that gripped the stock market back in the holiday season of year-end 1965,” writes Dick Young in his September 1987 issue of Richard C. Young’s Intelligence Report. “I had just entered the investment business and was a broker at a Boston based member firm of the New Your Stock Exchange. It was an exciting period. The market had climbed by nearly 50% in a three-year period end 1965, and investors were spending their profits literally before they were booked. It was a period of casino mentality—no one could lose. The party ended with a thud, and the … [Read more...]