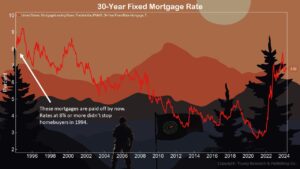

Want to buy a home or know someone you love who wants to? Don’t let current mortgage rates keep you from building equity. Get in the game. This whole idea of young couples renting is not helpful. There’s nothing like a mortgage to focus one’s mind on being a producer. And if you are retired or soon to be, then pay that mortgage off. This isn’t about inflation. It’s about owning your home, not the bank. Action Line: A home is a long-term investment. When you want to talk about investing long-term, I'm here. In the meantime, click here to subscribe to my free monthly Survive & Thrive … [Read more...]

AI Data Centers Could Consume 25% of U.S. Power

You have read about the massive power needs of data centers for AI and cryptocurrencies. Places with cheap power, like Texas, are experiencing a "gold rush" as data centers are built there to take advantage of the resources. This is how Your Survival Guy likes to invest in AI and cryptocurrencies. In The Wall Street Journal, Peter Landers explains the future of powering data centers and what that means for the grid, writing: Chip-design company Arm ARM -0.62%decrease; red down pointing triangle made its name by devising ways to minimize smartphones’ power consumption and extend battery life. … [Read more...]

“I Got Five Candy Bars for a Nickel”

Are you in control of Your Retirement Life? In my conversations with you, you tell me you are in control and then some. You tell me you’re looking forward to getting away to places far and wide, from Disney to New Zealand and on cruises in between. Nice. You know Your Survival Guy’s a big proponent of spending money. Yes, live within your means, but please, you gotta live. If you’re a member of my Survive and Thrive Club, you know Your Survival Guy is looking forward to an Atlantic crossing on the Queen Mary 2. It ain’t free, and inflation is alive and well, but as my mom reminds me, “I … [Read more...]

Take a Picture of Your Grocery Receipt

If you want to see what inflation looks like, take a picture of your grocery store receipt and check back in a few months. In The Wall Street Journal, Bob Henderson explains how risks in commodity markets around the world could put pressure on prices here in the U.S. Inflation is too much money chasing too few goods. The Federal Reserve has printed the money, and if the amount of goods gets cut, it'll get even worse. He writes: A surge in prices for the raw materials that power manufacturing and transportation shows investors betting on a prolonged expansion—and a potential rebound in … [Read more...]

Clean Up Your Bond Clutter, Contact Your Survival Guy

You know from recent posts how Your Survival Guy feels about too much power in too few hands. What I’m talking about is when the big three fund companies, BlackRock, State Street, and Vanguard, with their immense size, vote your shares with their politics. There was a time when indexing in stocks made sense. But what we have today is so much money chasing the same stuff. It’s like frogs in a pot. Too much consolidation of money with both stocks and bonds. When it comes to your bond money, I like a bond ladder where you control the height or length of it with differing maturities and … [Read more...]

How Effective Are Bond Ladders?

I don’t want to bore you with the details of academic studies, but it turns out that bond ladders work. Don’t take my word for it, Derek Horstmeyer, professor of finance at Costello College of Business, George Mason University, discusses his latest research in The Wall Street Journal, writing: As the Federal Reserve has signaled it will begin to cut interest rates this year, risk-averse investors have been turning to one bond strategy that works well when short-term rates are lower than long term: bond laddering. Bond laddering is an investing technique that involves buying Treasury bonds … [Read more...]

Get Around 5% on Fidelity’s Treasury Money Market

If you like getting close to 5% on your money markets, then check out Fidelity’s Treasury Money Market. Remember, even if the Fed cuts rates, it may take a while, and you might be surprised at how it unfolds. Farah Elbahrawy reports for Bloomberg: Investors are still flocking to cash funds, and Bank of America Corp. strategists say history suggests redemptions won’t begin until a year after the Federal Reserve starts cutting interest rates. Money-market fund flows rose in anticipation of the first cut over the past five rate reduction cycles, before inflows slowed meaningfully when the … [Read more...]

“I Can’t Afford to Lose Any More Money,” They Say

As you know from here, here, and here, your investment success may hinge more on how you invest rather than what you invest in. My efficient frontier (EF) series gets to the heart of this. It's a tool for looking back at the risk/reward relationship between stocks and bonds. What it helps to illustrate is that there can be more risk in having all your eggs in one basket. Easy to understand. Hard to do. The key to the EF for you is less about understanding stocks and bonds and more about you understanding you. What is your risk tolerance? What can you handle? I can tell you from experience … [Read more...]

Fight Inflation in the Grocery Store with This

It’s not every day you see shoppers whistling through the store with a cart full of gold. But looking at inflation today, isn’t that the best way to fight it? I think so. Forget bitcoin, get yourself some yellow metal, and become an inflation fighter. Katherine Hamilton discusses shoppers buying gold bars at Costco in The Wall Street Journal, writing: Craig Beauregard and Julia Edwards were at Costco COST -0.11%decrease; red down pointing triangle shopping for groceries in December when they spotted a deal that was too good to pass up: a one-ounce bar of gold. Beauregard, 33 years old, … [Read more...]

Your Investment Success or Failure May Come…

Your investment success or failure may come from how you invest, not necessarily what you invest in. As you know, the pangs of pain from losing money far outweigh the euphoria of making it. We are human. We like to win. We hate to lose. Why, then, do we tend to invest in areas that are going up instead of areas that are going down and offer good “value?” FOMO or fear of missing the boat? To understand risk and reward, I’ll point you to the efficient frontier. The Efficient Frontier, created by Harry Markowitz in 1952, measures the efficient diversification of investments that delivers … [Read more...]

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- …

- 244

- Next Page »