In my conversations with you, you tell me how you made your money. You saved ‘til it hurt, had the kitchen table talks, put water in your Cheerios, in some cases lost it all, then made it back and then some. Each story is different, yet as the saying goes, happy families are the same. You all, at some point, got serious about being providers and didn’t rely on someone else because guess what? They never show up. Believe me when I tell you this: There’s a lot of money out there. I’m not talking about the billionaires; I’m talking about the Main Street millionaires. Family first Americans who … [Read more...]

“I Can’t Charge $20 for Happy Meals.”

"I can’t charge $20 for Happy Meals." Those are the words of Scott Rodrick, the owner of eighteen McDonald's in Northern California, where legislators have increased the minimum wage to $20 per hour for fast food workers. So Rodrick and many other franchisees are being forced to make hard decisions regarding employees whom they can no longer afford to employ. Rather than helping fast food workers, California's politicians are putting them out of work or preventing them from getting hired at all. That's what happens when politicians implement price controls. Heather Haddon reports in The Wall … [Read more...]

Save Til It Hurts: Women Face Unique Retirement Challenges

You know that Your Survival Guy is most interested in keeping you happy and well during retirement. The best way to do that is to save til it hurts while you're working so your savings doesn't run out when you need it most. For women, who tend to earn less but also live longer than men, retirement presents a unique challenge. In The Wall Street Journal, Anne Tergesen explains the stories of four single women who are facing retirement. Here's the story of one retiree, Marianne Simpson, who lives in Chicago, retired with $2 million, and spends $132,000 annually. That spending rate is way above … [Read more...]

How You Livin’? Crossing on the Queen Mary 2

Happy Friday. As my nephew asked me the other day, home from college and all the stuff one learns: “Uncle E, how you livin’?” “How I’m livin’?” I thought to myself. I haven’t thought about it. But it gets right to the point, doesn’t it? Which brings me to my conversations with you. I know how you’re livin’—quite well—because you tell me. Here’s what you’re doing. Fly fishing the Keys, catching some rays in St. Somewhere, hitting the powder out West, spending plenty of time relaxing on the beach, paying exorbitant prices for boat drinks, building houses and dreams, planning more trips, … [Read more...]

More Bad Ideas from Progressives Could Leave You Hitchhiking

Residents of Minneapolis may have to start hitchhiking to their doctor's appointments because progressives in the city have passed a law that will drive ride-sharing services like Uber and Lyft out of the city. Ryan Mills explains at National Review: Twice a week, Jim Grathwol’s son, Matthew, travels to a Minneapolis clinic to have his blood drawn and to receive anti-psychotic injections that are vital to maintaining his mental health. Three times a week, the 33-year-old Minnesotan travels to and from Alcoholics Anonymous meetings. He’s also going back to school to finish a degree in … [Read more...]

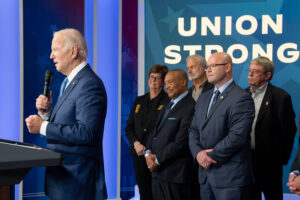

How ESG Enabled Biden’s Union Allies

You know all about ESG (Environmental, Social, and Governance) investing from reading this site regularly. Most of the attention ESG gets is for the E, environmental. But the S and G are just as dangerous. The push for ESG has enriched Biden's union allies and hurt the retirement security of Americans. F. Vincent Vernuccio of the Institute for the American Worker and Sam Adolphsen of the Foundation for Government Accountability explain in the NY Post: In 2022, the Department of Labor rolled out a rule letting private-sector investment managers prioritize ESG, which sacrifices the financial … [Read more...]

“Hmmm, Stocks Have Been Doing Well,” They Think

You’ve seen the debt load we’re gifting the grandkids. As I noted yesterday, one way to tackle it is by making cuts and buckling down, chipping away at it like one manages the family budget. The government? Since it can create its own money out of thin air, it chooses to inflate the debt away. With all that fiscal Covid money running dry, it looks like the Fed wants to come to the rescue with more easy money. As an appointed official, not elected by you and me, Fed Chair Powell must be hearing the footsteps from Main Street voters looking for some monetary discipline. Just when we see … [Read more...]

How Your Survival Guy is Investing Today

Your Survival Guy recently made a six-figure addition to my dividend-centric portfolio. Does that mean every single position pays a dividend? Not necessarily. It just means I favor dividend-payers over non-dividend-payers. On the fixed income front, I have plenty for my age (52 years), with some gold as part of the mix. When you’re in your 50s, you want to build in some stability with bonds. As you get closer to retirement, I like the idea of gradually increasing that percentage. You need to figure out the right mix for you as you build your retirement plan. Action Line: In my … [Read more...]

Is Your Water Safe from Cyberattack?

At first the question "Is your water safe from cyberattack?" seems somewhat funny. Is there a computer attached to the sink? No, not directly. But millions of Americans rely on water pumped into their homes by city and town water distribution systems that rely heavily on computers. Those computers have become a favorite target of hackers from places like Iran and China. Bloomberg's Ari Natter reports: The Biden administration is warning states to be on guard for cyberattacks against water systems, citing ongoing threats from hackers linked to the governments of Iran and China. “Disabling … [Read more...]

The Chickens Will Come Home to Roost

When your pharmacist knows more about Nvidia than pills, we might have a problem. That’s the nature of runaway stocks. They pull everyone in because “this time, it’s different.” But at what price? Your Survival Guy’s seen this movie before. Three times already this century, it ended with heartache and blame. No one likes losing money, and no one likes to admit they were wrong. But wrong they were in thinking there wasn’t any risk in chasing performance and yield. Take a look at the chart of the 5-year treasury yield below. That’s as good a measure as any of the increase in the cost of … [Read more...]

- « Previous Page

- 1

- …

- 4

- 5

- 6

- 7

- 8

- …

- 473

- Next Page »