Twenty years after the Tech Bubble decimated investors' savings, there are echos of it in the S&P 500. Reuters' Noel Randewich and lewis Krauskopf report: At the height of the dot-com era, technology stocks accounted for over 35% of the S&P 500’s value. Today, the tech sector accounts for about 25% of S&P 500 market capitalization, according to Refinitiv Datastream. But combining the tech sector with the communications sector, which includes Internet-related companies like Alphabet, Facebook and Netflix (NFLX.O), the group accounts for 35% of the S&P 500. There is growing … [Read more...]

Potential Index Fund Component Loses 98%

If you want to get an inside look at how the sausage is made with certain index funds, take a look at this story by Jacky Wong in The Wall Street Journal: The giants of passive investment need to get more active. Marble mining company ArtGo’s 3313 117.86% Hong Kong-listed shares fell 98% Thursday after index compiler MSCI, MSCI +1.24% in a rare U-turn, dropped its plan to add the company to its indexes. MSCI said the decision followed further analysis and feedback from market participants about the stock, which had soared 3,800% this year. A Heard on the Street column Wednesday may have … [Read more...]

The Truth Behind the S&P 500: Part VIII

I've written to you many times about the scary truth behind the S&P 500. The reality is, if you're buying a tracking fund, you're really putting your faith in the few stocks that dominate the value weighted index. Now that those big stocks are getting slapped with reality, the underbelly of index investing is being laid bare. Aimee Picchi, writing at CBS MoneyWatch calls it "the hidden bear market." She writes: No bull: More than two-thirds of the S&P 500's individual stocks are now either in a "correction" or a bear market. More than 350 companies out of the 500 tracked by the … [Read more...]

The Truth Behind the S&P 500: Part VII

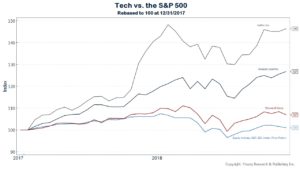

When three companies—Amazon, Microsoft, and Netflix—comprise almost half of the performance year-to-date for the S&P 500, what happens to the index when they fall out of favor? It has long been my belief that investors don’t measure the risk inherent in a market-cap weighted index such as the S&P 500. They are invested in passive mutual funds that mimic an approach that has become more top heavy by the day. Investors should not be surprised when huge drops accompany huge gains. Read more about the Truth Behind the S&P 500 in Parts I, II, III, IV, V, and VI. … [Read more...]

The Truth Behind the S&P 500: Part VI

I have grave concerns with the S&P 500 (See parts one, two, three, four and five of my series dedicated to those concerns). You can see in my chart below the index would need to fall by 38% based on yesterday’s closing value to trade at a normalized valuation. Doing as well as the S&P 500, or the market, is a double-edged sword. Receiving market performance guarantees you’ll never beat it. Believe me you’ll want to beat it when it crashes, because the grief from losses far outweighs the jubilation from gains. … [Read more...]

The Truth Behind the S&P 500: Part V

As I've written to you before, the S&P is constructed somewhat like an actively managed fund. Real people choose which stocks go in, and which remain out. Robin Wigglesworth writes in the Financial Times that David Blitzer, the current head of the S&P Dow Jones' index committee, has done what few others have been able to do by creating decent low risk returns. But Wigglesworth also points out that it is unlikely Blitzer's success can be maintained (that's not a knock on Blitzer who isn't attempting to generate maximum returns with his picks). It's just math. As volatility increases … [Read more...]

The Truth Behind the S&P 500: Part IV

This is the time of year when you need to be extra careful about what you invest in, especially when you’re buying a so-called passive index fund that tracks the S&P 500. I have many concerns about the S&P 500 index approach, as I point out here, here, and here. Add one more issue to the list: “Passive” investors paying for someone else’s actions. Recently, the PNC S&P 500 Index Fund announced it will pay out $4.19 in cap gains per share, as pointed out in by Jason Zweig in his weekly WSJ column The Intelligent Investor. “This week, the fund’s per-share value was around … [Read more...]

The Truth Behind the S&P 500, Part II

The S&P 500 is perhaps the largest “managed” fund in the world. Contrary to widespread belief, it is not an index of only the largest companies in America by market-cap as I explain here. It is an index comprising 500 stocks that are actively chosen by a committee. The committee, led by economist David Blitzer picks 500 stocks from a listing of 1,000 of the largest companies in America. It also decides the sectors and the sector-weightings. In the late 90s, for example, when technology was on fire, the committee finally decided to make technology its own sector. The committee had … [Read more...]

The Truth Behind the S&P 500

Let’s get a few things straight about the S&P 500. First, it’s a market-cap weighted index of large-cap companies based in the U.S. A company’s market cap is calculated by multiplying its shares outstanding by its stock price. The bigger the company’s market-cap the bigger its influence on the direction of the S&P 500. Imagine Apple or Amazon as the 800-pound gorillas and you get an idea of how the index works. How is it constructed? The S&P 500 is not a collection of the largest 500 companies by market cap in the U.S. It is constructed and managed by a committee. Part of the … [Read more...]