Your Survival Guy’s boiler room is stacked with buckets of 30-day survival food sprinkled with Spam and other canned delicacies. My son tells me he can’t wait to try some of it. Other members of my family tell me they’d rather starve.

Your Survival Guy also has a weakness in the canned goods aisle. Cans of BOGO tuna and sardines magically jump into my cart like fish out of water. “We’re good on the canned fish,” I’m told. Who knew the term “value” could be so subjective.

Last month investors believed Apple was worth eight percent of the market. (They’ve since re-thought that). As I’ve written to you recently here, here, here, here, here, here, here, and here, only ten names make up a quarter of the total stock market. It’s like shingling your Cape saltbox with ten shingles for the front side, and almost four thousand for the other three. There will always be fools in the rain.

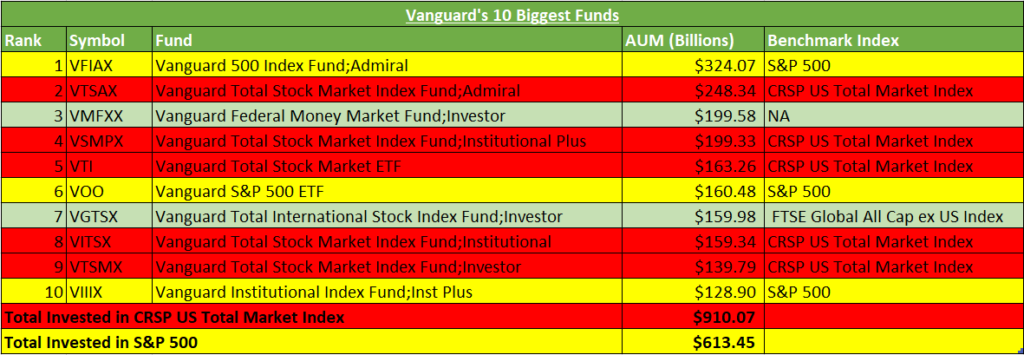

It’s a fool’s errand buying Vanguard’s Total Stock Market Index, for example, and believing “it’s different this time.” You remember the tech bust don’t you? A recent WSJ article titled, “Technology’s Influence Over Markets Eclipses Dot-Com Bubble Peak,” points out that “Companies that do everything from manufacturing phones to operating social-media platforms now account for nearly 40% of the S&P 500.” (And that’s not including Amazon.)

But the cheerleaders continue to cheer. “The longer this backdrop continues, the further they’re going to pull away from the pack,” said a chief investment strategist at a bank you know by name, while another “recommends clients favor technology stocks, e-commerce companies like Amazon and electric-auto maker Tesla, Inc. because of their growth potential.” Failure loves company.

Pull away from the pack and growth potential are not words I like to associate with sound investment council. No matter—what’s NEVER different this time—is there’s always a price to pay even when you feel like you’re doing a good thing.

Action Line: Vanguard’s family of funds mimicking the Total Stock Market Index don’t even begin to reveal the money loaded up in a few names. Consider for a moment the number of funds that own a close mix of the “market” for fear of missing out. FOMO and BOGO aren’t necessarily good yardsticks for “value.” Stick with me; I’ll show you the way.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024