One of the more misunderstood components of compound interest is time. Everyone understands the rate of return. It’s all you hear about, from your uncles to your nephews. “What did it return this year?” they ask. Time, on the other hand, is boring except when you do it over a couple of generations. Then it becomes a whole lot of fun.

Saving til it hurts and working for as long as you can while being patient are all components of time, and they are in your control. When investors throw up their hands in despair I can tell you they did not pay attention to what was in their control.

When markets go down you want to have time on your side to get through it. Selling at the bottom to ease the pain stops time. It doesn’t work for you any more. Sitting in cash at the bank isn’t much better. Time stands still. I don’t want that for you.

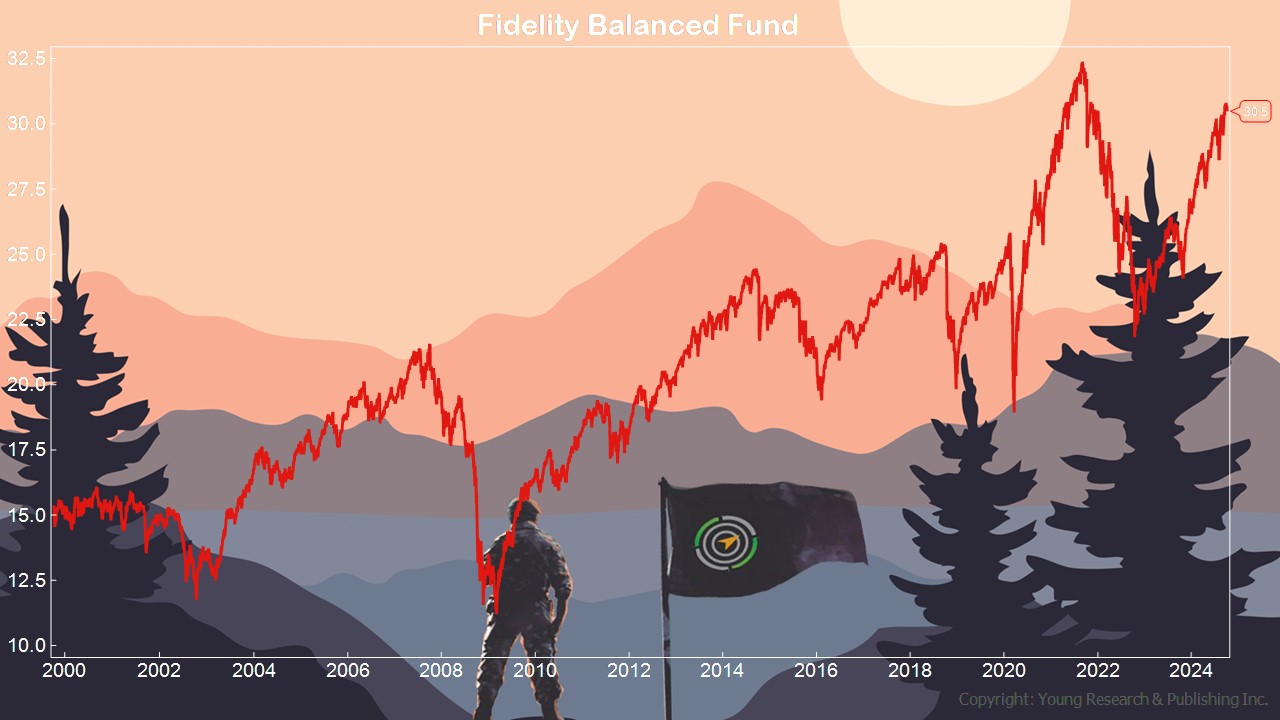

As a back of the napkin example, look at the Fidelity Balanced Fund over time. Its allocation target is roughly 70/30 stocks/bonds.

You can dial in your fixed income with Fidelity Limited Term Bond Fund to adjust your bond side. Today, it has an SEC yield of 4.75%.

Action Line: I want you to enjoy your retirement life. Time may not always be on your side when it comes to stock prices. Developing the right plan for you is part science and mostly art. When you are ready to talk, let’s talk, but only if you’re serious. Email me at: ejsmith@yoursurvivalguy.com