UPDATE 6.24.24: Do you feel the fog coming in? Remember, planning ahead doesn't necessarily mean you can navigate through the fog, but it means you can hold steady and survive until the fog passes and you can get back on course. That's far better than getting sunk by hitting the rocks because you tried to "do something." Those losses are hard to come back from. Like the Arithmetic of Portfolio Losses, it's much harder to navigate your way back to success after a mistake that crashed you on the rocks. Originally posted August 17, 2023. Your Survival Guy knows a thing or two about … [Read more...]

Search Results for: Investing mistakes

DOWNLOAD REPORT: Your Survival Guy’s Top 10 Investing Mistakes to Avoid

Thank you for choosing my special report, Top 10 Investing Mistakes to Avoid. You are one of the serious survivors ready to take control of your family's personal and financial security. … [Read more...]

Investing Mistakes to Avoid: #1 Y-O-U

Having dinner last night, my father-in-law Dick Young asked, “Survival Guy, what’s investing mistake #1?” “I don’t know yet,” I said. “Let me tell you about living off your portfolio. It’s hard,” he said. “I’ve been writing about this my entire adult life. I didn’t expect how tough it would be to generate income. It’s expensive staying at Le Bristol, so you better figure out a way to make it work. I’m just getting comfortable. How’s your dinner?” … Part of my inspiration for this series came from reading past issues of Richard C. Young’s Intelligence Report. Each issue was packed … [Read more...]

Investing Mistakes to Avoid: #2 Tomorrowland

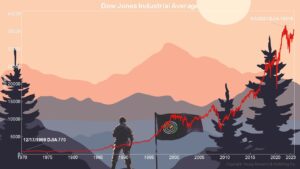

When I was a kid, some of my favorite memories were vacations to Walt Disney World and going on Space Mountain—repeatedly. Then after every ride, I’d stand on the conveyor belt and look at Tomorrowland and think about how cool it would be to someday live in space. That’s a long time ago now, and here I am writing to you from Earth, still wondering if that will ever happen. Maybe. But a lot of investing days and years have passed since then, and if we could time travel from the 70s, investing in stocks would have been a good move if—and that’s a big if—you had time. Just … [Read more...]

Investing Mistakes to Avoid: #3 Back 40 Back

Your Survival Guy and Gal saw Luke Combs on Saturday night at Gillette Stadium in Foxborough, Massachusetts. The song I can’t get out of my head is “Back 40 Back.” Combs didn’t play it (it’s not the song to keep a stadium on its feet), but it’s a reminder of the way life used to be—when there was a back 40 of land or open space that has too often now been replaced by a concrete jungle. I’ve been thinking about when I was a kid, going to Fenway Park to see Jim Rice, Dwight Evans, Carl Yastrzemski, and Fred Lynn. The old Boston Garden, where you could hear and smell the game. Memories of … [Read more...]

Investing Mistakes to Avoid: #4 Mr. Happy Yappy

Like in school, investors should get rapped on the knuckles for not keeping their eyes on their own portfolios. But investors are sensitive to the "other" guy. Investors hate missing the boat. Nothing irks them more. They're fine hearing that someone else is doing worse. But when someone else is smiling carefree and yappin' away about their good fortune, that makes investors' blood boil. Nothing makes the phone ring more than a down quarter. In my conversations with you, we spend time talking about how you, not anyone else, got to where you are. We talk about why you're looking for an … [Read more...]

Investing Mistakes to Avoid: #5 History

When Becky and I were married 25 years ago, we were 26 years old. If you add up our ages, we had 52 years of life experience. Then, we had our first child, and all that experience was kicked to the curb. And then, just when we thought we had everything pretty much under control, we decided it would be a good idea to have another one. Going from one to two isn’t linear. Two kids are many multiples more difficult. Which brings me to my next investing mistake to avoid: Kids. Kidding. They read this. No, the investing mistake to avoid: #5 is History. Don’t think just because you know a few … [Read more...]

Investing Mistakes to Avoid: #6 3X QQQ

If you live in New England, you know how unpredictable the weather has been this summer. Just the other day, we were cruising back from lunch in Edgartown, MA, through Vineyard Sound and, before reaching Woods Hole, were engulfed in a fog bank. Your Survival Guy has radar, but even with that, I worry about the speed and actions of other boaters I can’t control. I throttled back, making our marks slowly, and in less than 20 minutes, we were in clear air moving through the Hole. It happens that fast. Which leads me to my next investing mistake to avoid: Don’t be in a rush to make money. Time … [Read more...]

Investing Mistakes to Avoid: #7 DEI DOA

Your Survival Guy puts in a solid effort to recycle his trash weekly. Rolling out the blue bin to the curb makes me feel good and a bit anxious, wondering if they can track me down for misallocated debris. But, when it comes to my money, I don’t want ESG (environmental, social, and governance) or DEI (diversity, equity, and inclusion) separated from the fiduciary responsibilities. Sure, ESG and DEI might feel good and provide good copy during PowerPoint presentations. But it’s more sizzle than steak. And what about their job as fiduciaries? It’s why I look at all this ESG and DEI as dead on … [Read more...]

Investing Mistakes to Avoid: #8 “Get Back”

Last year (2022) was brutal for the major averages (not including dividends): Nasdaq -33.1%, Russell 2000 -21.6%, S&P 500 -19.4%, and the Dow Jones Industrial Average -8.8%. But not all investors hung around to see things through. And you know this song: Markets are back up this year. Let’s rewind. When the going gets tough, the capitulation begins. And in my observation, a breaking point is reached when a portfolio goes below a certain number. It has nothing to do with the major averages per se. It has everything to do with dollar signs. Will we have enough to live on? And the … [Read more...]

Investing Mistakes to Avoid: #9 Hobbyist or Hobbit?

“We are plain quiet folk and have no use for adventures. Nasty disturbing uncomfortable things! Make you late for dinner!” said Bilbo Baggins to Gandalf in The Hobbit. Which leads me to “Investing Mistakes to Avoid: #9 Hobbyist or Hobbit?” This is a story about a recently retired investor. The hobbyist investor. The most dangerous one of all. You see, it’s the recently retired investor who, with a fresh outlook on life, thinks he doesn’t need “experts” to guide him. Who yearns for one more bite of the apple. Who imagines himself scoring with artificial intelligence or high-yield … [Read more...]

Investing Mistakes to Avoid: #10 Picked Off First

Your Survival Guy has compiled a list of investing mistakes to avoid. It's a list for highly successful, fairly wealthy investors. Today's lesson is what I refer to as "Picked off first." Do not get picked off first base. When you have some money, or in my example, get a hit, you need to protect yourself. You can't afford to be picked off and sent to the dugout. But it happens with far too much frequency because investors are caught sleeping. Here's what I'm talking about. One of the first things you learn about investing in bonds is the risk-free rate of return. You can see it below. … [Read more...]

Your Survival Guy’s Mt. Rushmore of Investing Legends

Your Survival Guy wants you to build your own Mt. Rushmore. For The American Conservative Magazine: If you were in shop class back in high school (remember that?) and you were instructed to build your own Mount Rushmore out of wood, I would have one piece of advice: leave room for expansion. Because when I think of my visit to the site back in the mid-80s as a kid, I remember the magnificence of the late presidents but also how more names were still being considered. Note to self: There will always be someone to add down the road. Which leads me to this: who would be on your … [Read more...]

Investing Habits of the Fairly Wealthy: #8 “Safety”

UPDATE 6.24.24: As reported by Brian Evans of CNBC on Friday, the S&P 500 has gone 377 days without a 2.05% sell-off. That's the longest such stretch since before the Financial Crisis. Is this time different? Evans writes: Wall Street’s climb to record highs has come with conspicuously little volatility. The S&P 500 has gone 377 days without a 2.05% sell-off. That’s the longest stretch for the benchmark since the great financial crisis, according to FactSet data compiled by CNBC. The index hasn’t experienced a gain of at least 2.15% in that time either. This market lull comes … [Read more...]

Investing Habits of the Fairly Wealthy: #9 FTX

You don’t need to know a thing about cryptocurrencies to understand the bankruptcy of crypto-exchange FTX, or that the current trial of founder Sam Bankman-Fried is a story less about blockchain and more about human nature. These stories most often are. Because most financial disasters begin with a new technology and fail not because of the new toy but because of the people. That’s why investors need to have guardrails (to borrow a term from WSJ columnist Dan Henninger’s classic piece), in a world where there are fewer of them all the time. My first guardrail is this: I want you to work … [Read more...]

January RAGE Gauge: “THE MOST Dangerous Investing Environment in My Lifetime”

Good morning from post-winter storm Gail. Your Survival Guy is safe and sound. Not much of a snowmaker here in Newport. But the snow is pretty, especially this time of year. Let me know how you're faring in your neck of the woods. In my conversations with you, you're telling me about your own island life you've created, and I thank you for that. You're telling me you're getting lost in your reading, doing a lot of thinking, and looking forward to when your band gets back together this Spring. In the meantime, your island life is alive and well. You understand you don’t need to spend a lot … [Read more...]

After the Coronavirus: Successful Investing and Good Health

Coronavirus Infects Stock Market: Part XXXI Let’s get this out of the way: There is no magic bullet to successful investing or to good health. Both are a culmination of decisions leaving you with a body (of work) to show for it. Is there any doubt those most susceptible to COVID-19 have a weakened immune system? Is there any doubt those most susceptible to investing mistakes take risks? What’s scary is, both groups oftentimes don’t even realize their precarious state. They don’t see the risks staring back at them in the mirror. They believe, for example that passive index funds … [Read more...]

What’s the Right Amount to Invest in Stocks?

Your Survival Guy has witnessed it all when it comes to investing. I’ve written to you about the top 10 investing mistakes to avoid and the top 10 investing habits of the fairly wealthy (see below). I’ve told you how I see investors get overweight in stocks like it’s an all-you-can-eat buffet. Then they switch to a strict diet of cash, selling out at the bottom of a bear market, never to get back in. It’s why I don’t try to time the market, nor do I advise it for you because you need to be right twice: when to sell and when to rebuy. Avoid the problem altogether. Don’t get greedy. … [Read more...]

Survive and Thrive December 2023: A Stock Market Boom or Bust for 2024?

Dear Survivor, Your Survival Guy received some Christmas emails asking about a certain economist’s stock market prediction that the bubble’s about to burst. My take? Why ruin Christmas? Maybe he’s right, maybe he’s wrong. What I know for sure is he’s in the business of selling books and making headlines. That’s not acting like a fiduciary. I remember back in 1998 when this same economist wrote a book calling for the roaring 2000s. The roar turned out to be the sound from investors pummeled by the tech bust a few years later. Then he called for, in 2004, another boom to come, taking … [Read more...]

“Take Cover! Get Out of the Market!”

In my conversations and emails with you, you tell me about the many predictions being made for next year. As I wrote to you yesterday, one economist, who seems to be wrong at every turn, is calling for a major correction next year—predicting the stock market bubble will burst. Another manager up in Boston is calling for one, too, and has been for a while. I’m not looking to pile on with criticism. But you may have heard another hedge fund guy on Fox talk about commercial real estate “opportunities” as if he’s talking up his book to dig out from losses. Whether it’s his book, a real book, or … [Read more...]

- 1

- 2

- 3

- 4

- Next Page »