Your Survival Guy learned how to be a successful real estate investor from my dad. He taught me that price always matters, but he also understood the magic of time. If you need to pay a higher price to be in the game, you get in the game, especially when you’re young. When Becky and I were buying our first home, my dad couldn’t believe how much we were paying. But he also realized that when you’re young, you have a better chance of surviving if you happen to pay too much. You have time on your side—and a job—and nothing focuses the mind like a mortgage. But what if you don’t have time? Price … [Read more...]

Why Vanguard Is Too Big For You

If you want clear evidence of why Vanguard is too big, then look no further than the money flow into passive index funds. When investors are lulled to sleep by a bull market, they dream about things like early retirement, vacations, and second homes. What they tend to miss is that reversion to the mean is a fact of life. You can take my word for it and that of the father of index funds Jack Bogle.

Learn more about why Vanguard is too big for you below:

New Update! Why Vanguard is Too Big: Part IX: It’s NOT Different this Time

Your Survival Guy’s boiler room is stacked with buckets of 30-day survival food sprinkled with Spam and other canned delicacies. My son tells me he can’t wait to try some of it. Other members of my family tell me they’d rather starve. Your Survival Guy also has a weakness in the canned goods aisle. Cans of BOGO tuna and sardines magically jump into my cart like fish out of water. “We’re good on the canned fish,” I’m told. Who knew the term “value” could be so subjective. Last month investors believed Apple was worth eight percent of the market. (They’ve since re-thought that). As I’ve … [Read more...]

Where Money Goes to Die

As you’ve seen in this table, the amount of money in the Vanguard Total Stock Market Index family is enormous. It’s where money goes to die, and is perhaps one of the greatest bubbles no one sees. You have advisors recommending this index approach until they’re blue in the face. They give presentations to the investment committee of pensions, foundations, LLCs, hedge funds, you name it, and say, “Well Bob, with this fund, you have a slice of the stock market.” A good follow-up question is how much of the total is dependent on just ten stocks? Action Line: Lots of careers are … [Read more...]

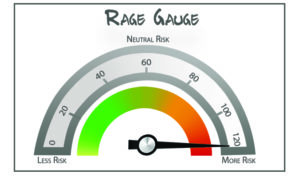

New! November Rage Gauge™ LAST CALL Before the Election

Your November Rage Gauge™ is in, and it’s at a record high, but you don’t need me to tell you that—just look around you. This week you learned Social Security’s cost of living adjustment will average about twenty bucks a month next year. You remember a time when a crisp twenty-dollar bill meant something to you. It meant I had to cut my neighbor’s lawn twice or scoop ice cream for five hours. Today you’re looked at as old-fashioned when presenting one for payment—as if cash is an inconvenience. “Just Venmo me.” What could possibly go wrong with the digitalization of the dollar? What … [Read more...]

Why Vanguard is too Big: Part VIII: You Can’t Know What You Don’t Know

Let’s clear something up real quick. If you’re invested with Vanguard and it’s a major undertaking to shift your portfolio to Fidelity Investments—there are worse places to be stuck. In an industry littered with terrible, high-cost products, you’re lucky to be at low cost, no front or back-end load Vanguard. But what you might own at Vanguard and seeing how its assets continue to expand is concerning. As an aside, Vanguard has had some great managers retire such as the GNMA fund’s Michael Garret, from sub-advisor Wellington Management. You never hear about his retirement party. It makes it … [Read more...]

Why Vanguard is too Big: Part VII: What Do You Have to Lose? A LOT

You wouldn’t believe the conversation I had yesterday with a prospective client. It’s as if he’s done everything we’ve recommended over the years and we were set to talk yesterday—after all of those years later—to see how it all turned out. I’m here to tell you, quite well, indeed. This gentleman is wealthy beyond his imagination and I bet, having not met him face to face yet, I wouldn’t be able to pick him out of a lineup. That’s the beauty of quiet wealth: You control how you move about the world with no pressure to live up to some silly image. Long ago, my new friend and his wife … [Read more...]

Why Vanguard is too Big: Part VI

Do you know what career risk means? Of course, you do. It means you could lose your job. Well, in the investment world of pensions, mutual funds, and ETFs, career risk means you might lose your job if you underperform an index. That’s why so many pensions, foundations, and the like are piling into the Jabba the Hutt funds, like Vanguard’s Total Stock Market Index. If they lose a pile of money, at least they can say, “Hey, so did everyone else. We performed just like the market did”. You’ve read here, here, here, here, and here about my concerns with Vanguard being too big. That goes for all … [Read more...]

Why Vanguard is too Big: Part V: How You’re Being Forgotten

I’m not trying to be unfair to Vanguard, or other companies with airplane-hangar-sized call centers, but nowadays you tend to feel like a number. You feel like what’s more important to the big guys is telling you how many assets they have under management. It’s in the trillions. How does that help you? It doesn’t. It also doesn’t help when the phone rep you’re speaking with is either fresh out of college or is worth a fraction of what you’ve been able to save over a lifetime of work. There tends to be some value in working with someone who has actually made some money, don’t you think? It … [Read more...]

Why Vanguard is too Big: Part IV: Meet the Jabba the Hutt of Funds

When you spend hours on vanguard.com like I do, you realize how hard it is to get the information you’re looking for. Take for example the bloated Vanguard Total Stock Market Index Fund. The thing is a behemoth, with so much money stuffed into it, it’s a wonder it can even move the needle. Jabba the Hutt comes to mind—you deserve better. Not to tool on Jabba, but take a look at what you’re really getting yourself into. Consider for a moment the title—Total Stock Market—where you think you’re buying a diversified fund. Not necessarily the case. How can it be when ten stocks account for over a … [Read more...]

Why Vanguard is too Big: Part III: BOND ALERT

In times like these, you can’t afford to fight other people’s social crusades. Vanguard has announced a new ESG bond fund. You need to know the pitfalls of ESG and avoid them. Vanguard has announced: We’re pleased to announce that Vanguard ESG U.S. Corporate Bond ETF (VCEB) is now available. This latest addition to our ESG (environmental, social, and governance) offerings was designed to complement our equity lineup of ETFs and mutual funds, satisfy evolving investor preferences, and enhance our low-cost approach. It’s time for Vanguard to get back to its roots. The venerable firm, … [Read more...]