The stock market/Wall Street has made a full recovery from March, but it certainly doesn’t feel that way on Main Street.

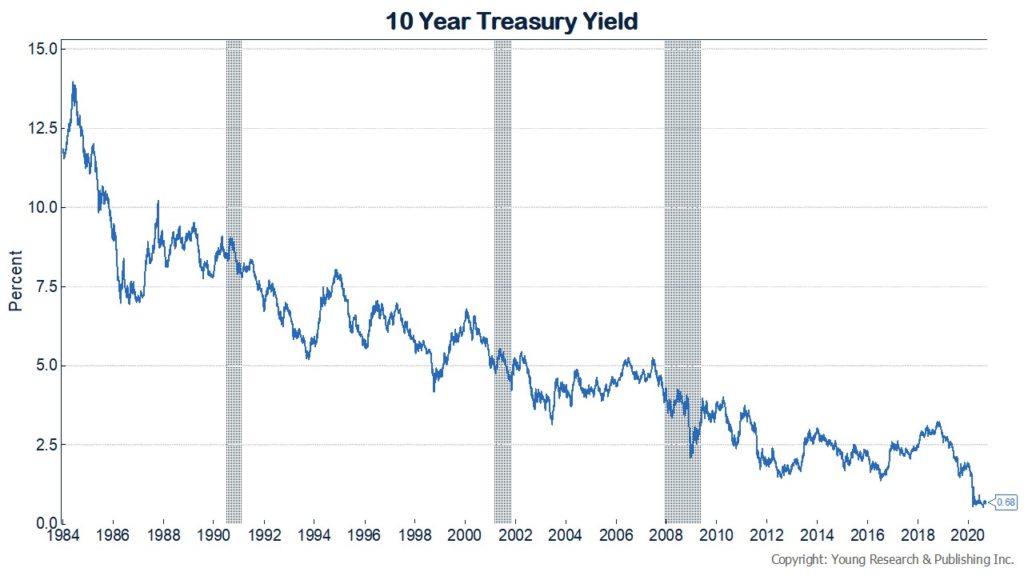

The 10-year treasury pays you peanuts and that’s about what local businesses have earned compared to pre-virus.

Why will they stay in business, especially in cooler New England when outside dining is basically gone for the winter?

Cities like Boston that depend on sports/entertainment/dining are not coming back this season.

In times like these, you can be your own barber—you can handle a bad haircut—but will you be your own investment counselor too?

Sometimes you need to know when to sell when everyone around you is buying.

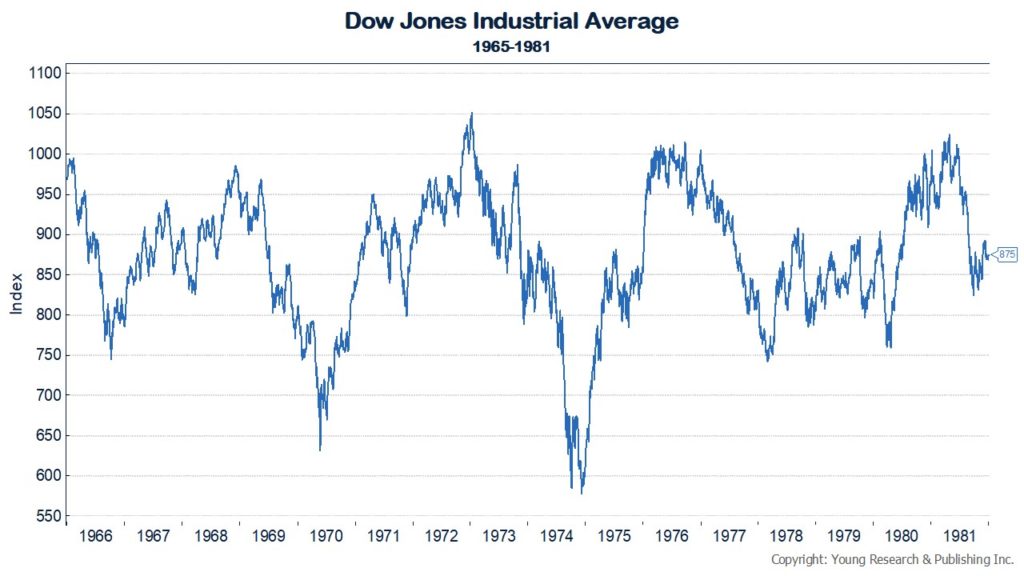

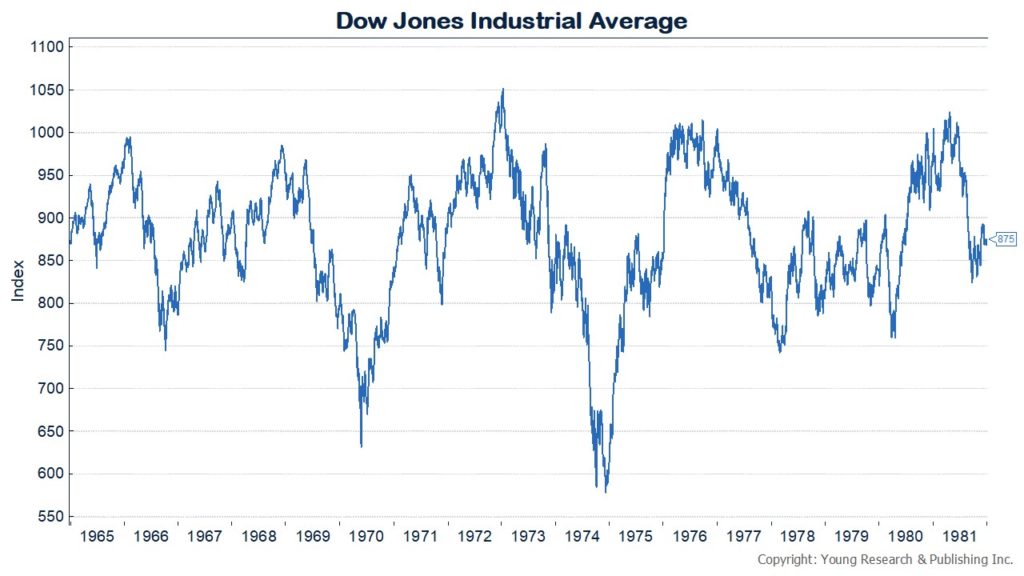

Consider how the long winter for stocks endured the 16 years from the end of 1965 to the end of 1981—an entire retirement for many—and ask yourself: If I was nervous in March, how will I feel if stocks do nothing for the rest of my lifetime?

In other words, it makes sense for you to be paid in cold, hard cash if you’re going to expose your life’s work to the whims of the Davey day traders?

Time to get some dividend religion and pray.

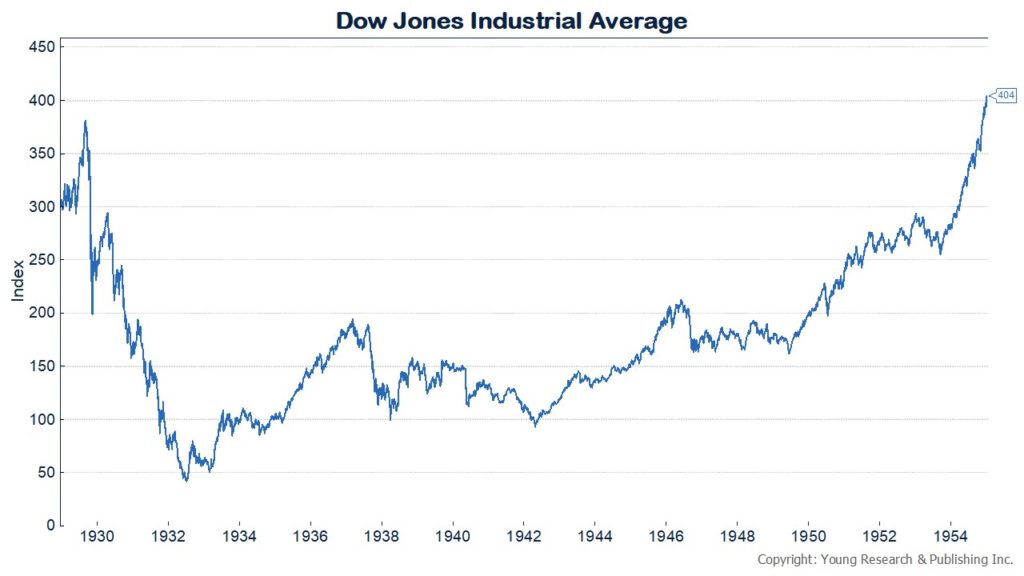

When stocks move sideways, make sure you’re being paid to invest. Because the stock market has a history of doing just that.

From 1929-1954:

From 1965-1981:

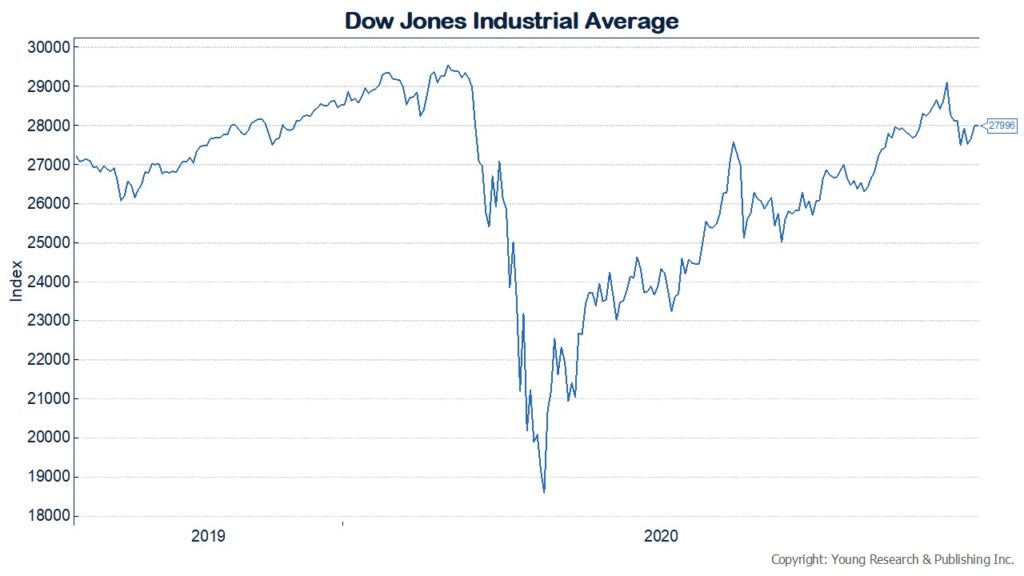

Over the last year:

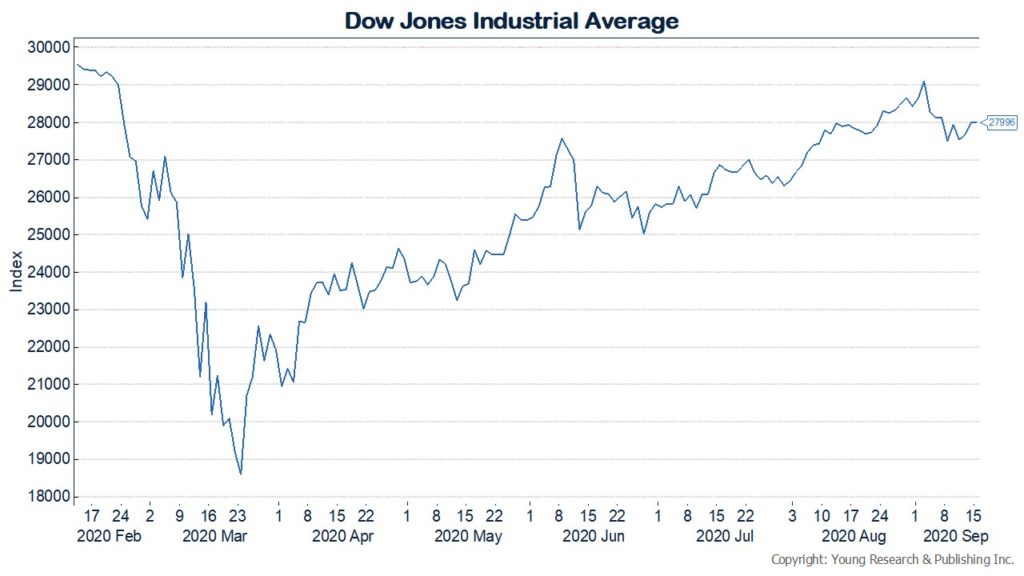

February high to today:

Action Line: Don’t suffer through a hard winter alone. Keep warm by reading my free monthly Survive and Thrive newsletter. Click here to sign up. I’ll help you fight the inertia that can hold you back from making the right decisions for your family’s personal and financial security.