In The Wall Street Journal, Peter Santilli and Corrie Driebusch write that “Last year cryptocurrencies were on fire and appeared to gain more legitimacy after years of being considered a fringe, speculative product.” In the last six months, crypto has lost $1 trillion in market value. It’s fair to ask, has the fire gone out? Santilli and Driebusch write:

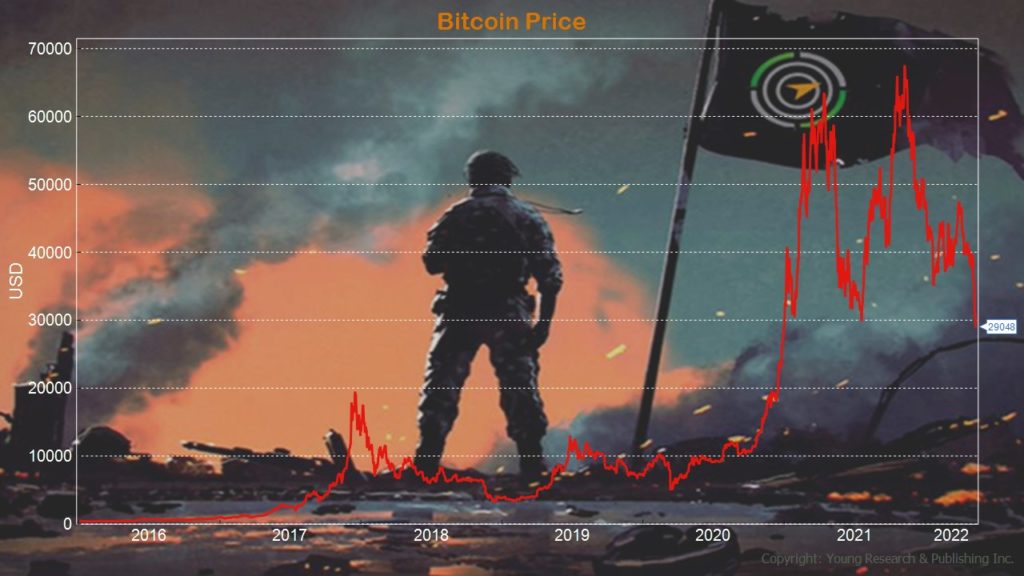

In November, bitcoin and ethereum, two of the most popular cryptocurrencies, reached all-time highs. Bitcoin’s value at 5 p.m. on Nov. 9 was $67,802.30; ethereum was worth $4,800. They are now down 58% and 60%, respectively, from those levels.

Cryptocurrencies were falling even before last week, victims of sky-high inflation. Bitcoin and other digital currencies have been talked about as inflation hedges. But the ripple effect has played out differently. Surging inflation is spurring the Federal Reserve to raise interest rates faster, which investors believe will cause a slowdown in economic growth. The result: Investors are unloading risky assets, including cryptocurrencies.

Also exacerbating the losses is that crypto trading, originally an individual-investor game, is now dominated by institutional investors such as hedge funds. Those who have sought diversification in crypto have been caught wrong-footed.

As the price has moved lower, both individual and institutional investors alike have been bowing out. When Coinbase reported its first-quarter results late Tuesday, it revealed it is hemorrhaging users. By the end of trading Thursday, Coinbase’s stock was 82% below where it closed after its first day of trading just over a year ago.

Action Line: Is the world headed for the “cryptocosm?” Maybe, and maybe not. But what’s clear is that risk in America is rising. Every month I analyze risk in America in my RAGE Gauge report. You can read it by clicking here to sign up for my free RAGE Gauge alert. If you are an investor and you’re more interested in building a plan for the future, let me know here. I’d love to help you.