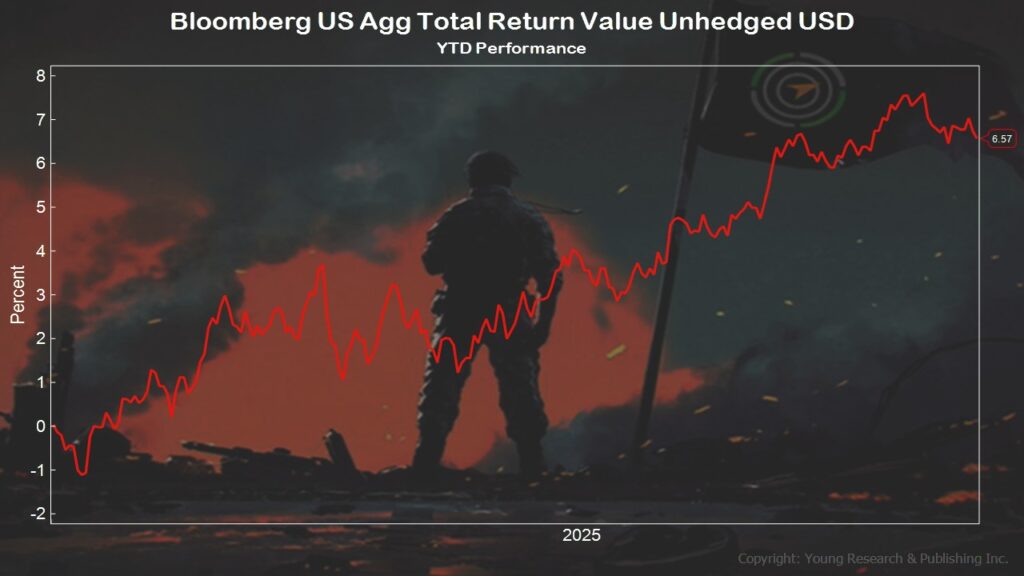

At The Wall Street Journal, Krystal Hur and Sam Goldfarb note the performance of bonds so far in 2025, writing:

Almost everything has lined up for bonds lately.

The Federal Reserve has been cutting interest rates. Jobs growth and consumer spending are slowing, keeping hopes for further cuts alive, but not pointing to an imminent recession that would threaten corporate balance sheets. Inflation pressure has continued to moderate, despite fears that President Trump’s tariffs will drive prices higher.

The widely tracked Bloomberg U.S. Aggregate Bond Index has returned around 6.7% in 2025, accounting for price changes and interest payments. That puts it on pace for the best year since 2020.

Bonds had regained ground after the Fed’s inflation-fighting campaign fueled a historically bad 2022. The Bloomberg Agg—made up largely of Treasurys, investment-grade corporate bonds and agency mortgage-backed securities—returned 5.5% in 2023, though it almost stalled in 2024.

Action Line: Click here to subscribe to my free monthly Survive & Thrive letter.

Action Line: Click here to subscribe to my free monthly Survive & Thrive letter.