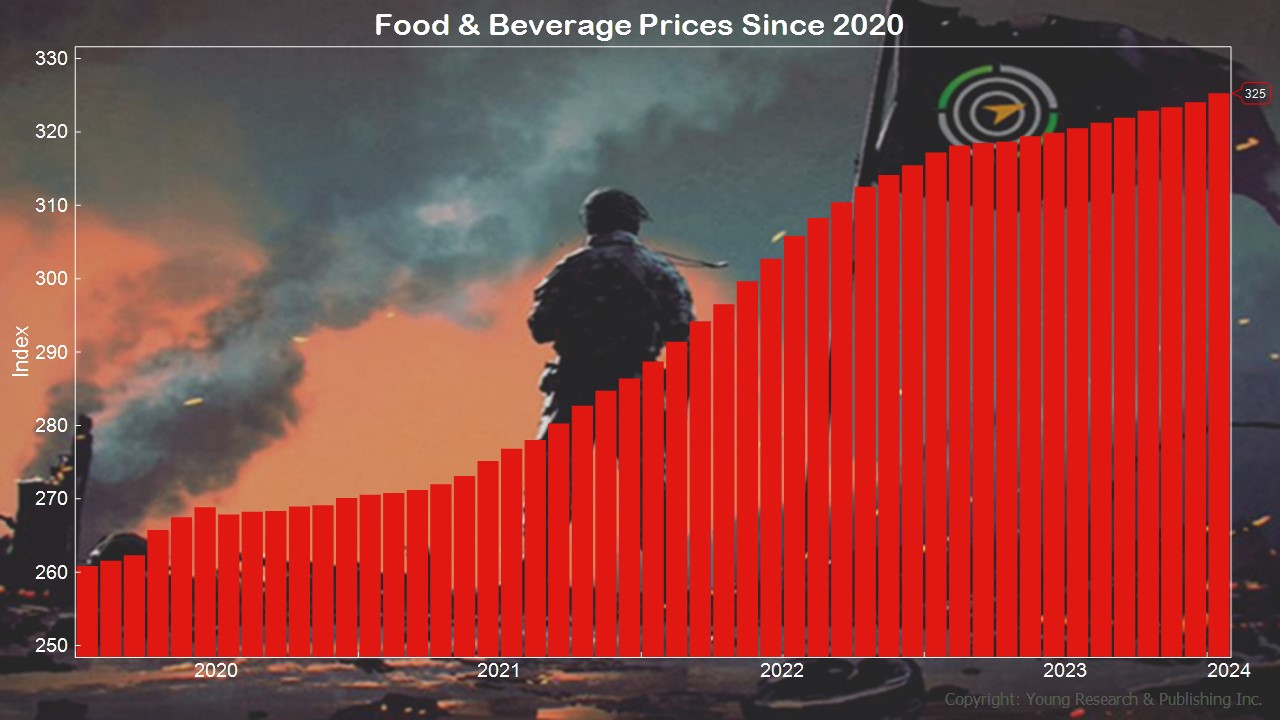

Big business can say inflation is under control, but they miss the point: current overall price levels are absurd. This is exactly what too much money printing creates. Will higher interest rates beat it back? It will take time. Jesse Newman and Heather Haddon report in The Wall Street Journal:

The last time Americans spent this much of their money on food, George H.W. Bush was in office, “Terminator 2: Judgment Day” was in theaters and C+C Music Factory was rocking the Billboard charts.

Eating continues to cost more, even as overall inflation has eased from the blistering pace consumers endured throughout much of 2022 and 2023. Prices at restaurants and other eateries were up 5.1% last month compared with January 2023, while grocery costs increased 1.2% during the same period, Labor Department data show.

Relief isn’t likely to arrive soon. Restaurant and food company executives said they are still grappling with rising labor costs and some ingredients, such as cocoa, that are only getting more expensive. Consumers, they said, will find ways to cope.

“If you look historically after periods of inflation, there’s really no period you could point to where [food] prices go back down,” said Steve Cahillane, chief executive of snack giant Kellanova, in an interview. “They tend to be sticky.”

Action Line: Inflation is a monetary phenomenon. Too much money chasing too few goods drives prices higher. Combat inflation by saving til it hurts, and building a portfolio with rising prices in mind. When you want to talk about a plan for inflation, I’m here.