In response to recent market volatility, it’s a great idea to reground yourself and your investment plan. It’s a good time to get back to basics and think about how you felt during the turbulence. Were you stressed? Did you talk to your advisor? Did you stick to your plan? Building good habits before market volatility can help you endure the headlines and the nervousness. I’m reposting my series on the Investing Habits of the Fairly Wealthy. Each one is a timeless bit of knowledge you can use today as effectively as when I wrote them back in 2023. When you want to talk about your plan, email me at ejsmith@yoursurvivalguy.com.

Originally posted on November 2, 2023.

Dear Fairly Wealthy Investor,

You might be better off staying in bed. It’s that bad. One morning, you wake up, and there’s a full-page spread in the Wall Street Journal on the perils of a balanced portfolio. It reports how owning stocks and bonds in a 60-40 mix is dead.

Nonsense.

And it’s not just them. When you’re in the business of selling newspapers, newsletters, or email subscriptions, it’s what gets attention that sells. Which is a disservice to you, my valued reader.

You and I know investing is hard because we know the work it takes to save ’til it hurts. These guys are about selling. Not investing. They need eyeballs today, tomorrow, and the next day, simply for their survival. That’s not my game.

I’m Your Survival Guy.

I tell you what I’ve learned over a lifetime of working in the trenches, taking live fire side by side with investors in real markets, and living to fight another day. Yes, I hope we get through these tough times together. But what I do isn’t for everyone.

Which brings me to investing habit number 5: Math. Investing is math. And like a math test in high school, you need to stick to your own work to understand the lesson. You need to do the math. Prices are not math; they come, and they go, like yesterday’s paper.

But not without doing a major disservice to the patient investor trying to live in dangerous times.

When you can’t even watch the six o’clock news because it gives your grandchildren nightmares—that’s not a good environment. When protesters fill the streets, that’s not a good environment. When tent cities litter sidewalks near the Children’s Museum, that’s not a good environment. When homeless zombies take over the Commons in your neck of the woods, that’s not a good environment.

Your Survival Guy offers you plenty of reasons why you want to understand that investing is math. It’s up to you to make the connection. It’s up to you to understand the path forward for your family.

Action Line: When you’re ready to talk, let’s talk. But only if you’re serious.

Warm regards,

Your Survival Guy

- Investing Is Math

- The Magical Word We’re Taught about in School

- “Survival Guy, What’s Your Take on the Dollar?”

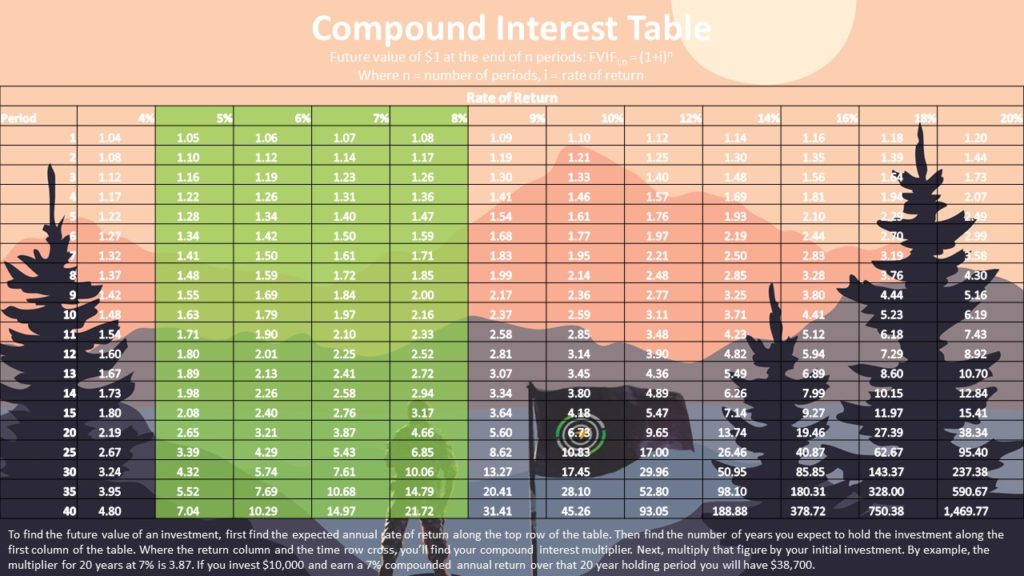

P.S. You don’t need to compound big numbers to get big results. With the T-bill paying over five percent, for now, you can double your money in no time. But will it pay.

Read about all of the Top 10 Investing Habits of the Fairly Wealthy here.