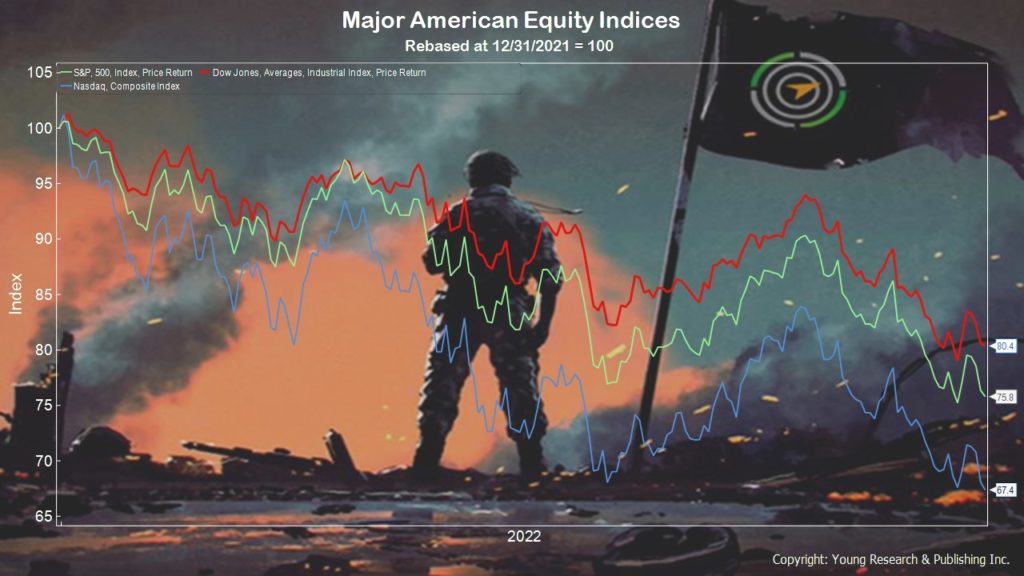

You occasionally hear the term “flight to quality,” in turbulent markets. Things aren’t (as of now) so bad that investors are fleeing, but they may be strolling to quality. The Dow Jones Industrial Average, America’s “blue chip” index, has been outperforming the S&P 500 and Nasdaq so far in 2022. You can see on my chart below that both the S&P 500 and Nasdaq are trailing the DJIA year-to-date.

According to S&P Global, which owns the Dow Jones indices, to be considered for inclusion in the DJIA a company must have an excellent reputation, demonstrate sustained growth and be of interest to a large number of investors. Additionally, “Companies should be incorporated and headquartered in the U.S., and a plurality of revenues should be derived from the U.S.”

Those characteristics are much more stringent than those for the S&P 500 and Nasdaq composites. Investors favoring the DJIA over those indices during the sell-off are signaling that they value quality over other attributes.

Action Line: It’s times like these that remind investors of the value of quality companies and the value of an investment plan focused on blue-chip names with excellent reputations. If you need help building a plan that focuses on quality, let’s talk. In the meantime, click here to subscribe to my free monthly Survive & Thrive letter, and you’ll learn more about me and how I help American families improve their personal and financial security.