Here is a perfect example of how the booming stock market is not reflective of the current state of the economy. It’s a different story, especially looking at subprime and auto loans. Manya Saini reports in USA Today:

Subprime auto loan delinquencies, where borrowers have gone at least 60 days without making a payment, rose to 6.65% in October, up from 6.50% in September and 6.23% a year earlier, according to Fitch Ratings data.

For prime borrowers, those with stronger credit histories, the rate held steady at 0.37%, unchanged from both the previous month and a year ago, indicating they remain largely shielded from the financial strain affecting lower-income consumers.

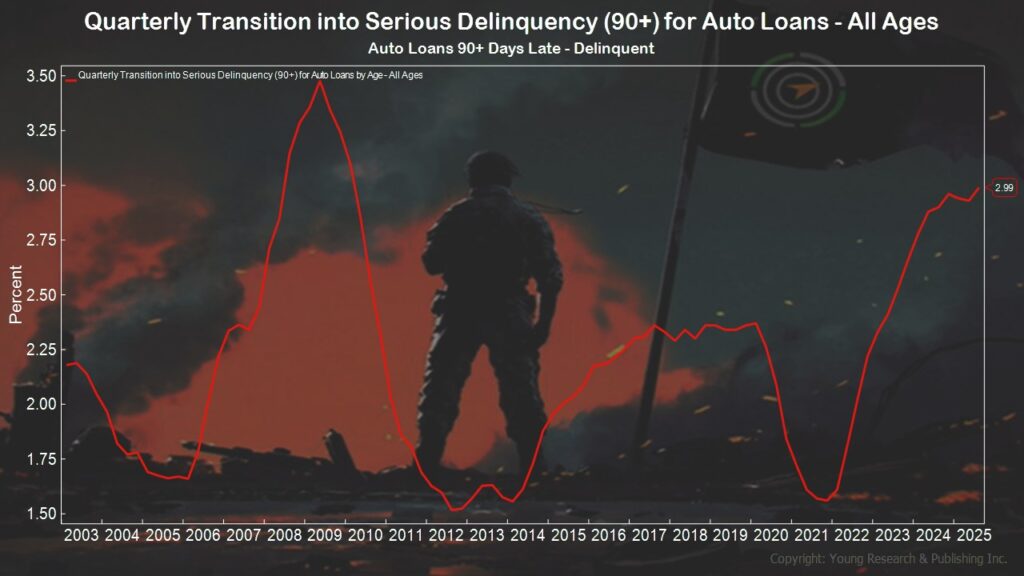

And according to the Federal Reserve, the percentage of loans for all ages in serious delinquency (90 days or more late) has increased to 2.99%, a level not seen since the Financial Crisis.

Action Line: Rising delinquencies don’t necessitate a crisis, but investors and anyone paying attention to markets should keep their eyes on what’s happening with auto loans and consumer debt more broadly. Click here to subscribe to my free monthly Survive & Thrive letter.