Now what? Good question. The April RAGE Gauge is in, and outside the market turmoil, Americans are feeling better about their prospects. When it comes to saving for retirement though, there’s a lot of hand wringing going on right now. I’ve heard plenty of stories about impetuous investors selling shares, asking, “Why me?” Well, for starters, maybe you should have held more than a handful of stocks in one sector.

Because when you begin dissecting this market over the past year or so, it hasn’t been that bad at all. In fact, it’s been quite good.

When you look over the past year, you get away from the chaos of today.

Imagine flying at 40,000 feet, well above turbulence. You can take a deep breath. Stretch out a bit and take in the view. Life is good.

Your Survival Guy likes what he sees over the last 52 weeks, specifically in consumer staples, gold, GNMA, Wellesley, Wellington, and limited term bond funds—all proxies for retirement-type portfolios focused first on risk management and asset allocation. All areas I write to you about regularly.

52-Week Scorecard

| Fund | 52-Week Return |

| S&P 500 Consumer Staples | 16.1% |

| SPDR® Gold Shares | 39.0% |

| Vanguard GNMA Inv | 7.6% |

| Vanguard Wellesley® Income Inv | 8.1% |

| Vanguard Wellington™ Inv | 6.5% |

| Fidelity Advisor Limited Term Bond Z | 7.0% |

Now what? Same story. Focus on your margin of safety.

Is this a good time to buy? I don’t know.

But if you’re reinvesting dividends and interest, you’re already a buyer.

If you’re an income investor, you already have streams of income coming into your account. You probably aren’t under pressure to sell to maintain your lifestyle because all your life, you were careful to live within your means. You’re the investor I’m speaking to. You’re the investor I want to work with and help to continue your success.

When you look at my chart of the Efficient Frontier, you see that since 2000, if you aimed to achieve the highest return (100% stocks), you also took on the highest amount of risk (horizontal axis). This is true across most of the Efficient Frontier, where more return demands more risk-taking.

You don’t need to be John Dutton to see how best to run your ranch.

But, as you can see, the little hook on the left, where you begin diversifying away from 100% bonds and adding stocks, shows you that diversification can actually increase return while lowering risk. That’s why Harry Markowitz, creator of the Efficient Frontier, called diversification “the only free lunch in investing.” So, in a small way, you can have your cake and eat it, too.

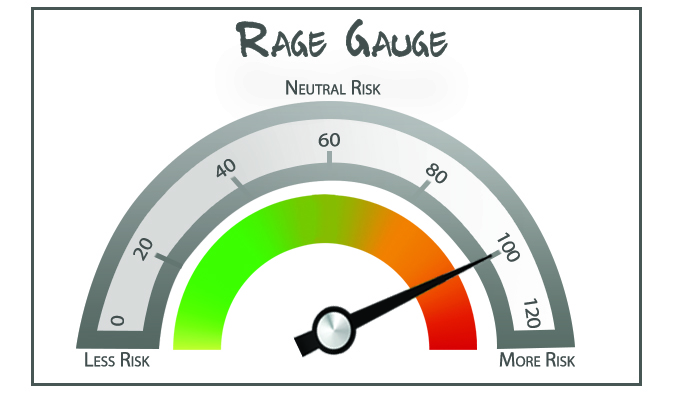

The level of risk in the market is high. Stocks still aren’t cheap. But the stock market isn’t everything. Americans are looking at their broader prospects and feeling pretty good overall. I’m holding my RAGE Gauge at elevated risk levels.

Action Line: When you want help, email me at ejsmith@yoursurvivalguy.com. And click here to subscribe to my free monthly Survive & Thrive letter. My most recent letter talks about bonds, when to buy and sell, and gold miners.