When you start thinking about disaster preparedness, one common theme I’ve learned and observed is how one’s mindset is a huge part of the equation. One’s temperament can work wonders in times of trouble. That’s not to say it’s any easier, because it’s not easy. But understanding and acknowledging that the way things are today isn’t necessarily how things will always be helps ease the shock. Panic, surprise, and losing self-control can only make matters worse.

Let’s touch on panic, which in the stock market we witnessed a handful of times just this month, with huge jolts in volatility. Volatility, though, means there must be sellers, and there must be buyers. Nothing’s being created by trading. If markets closed, for example, you just wouldn’t have the trading or change in ownership. Companies would continue earning or not earning money.

Markets are a bundle of emotions being acted upon. It’s why I want you to be an investor, not a speculator hoping and praying on prices to get you through tough times. Because it’s the investors’ mindset I’m talking to and not the speculators who are trading their life away. And what I like most about the investor is that he knows markets will not always be working in his favor, but if he focuses on getting paid, he may just live to fight another day.

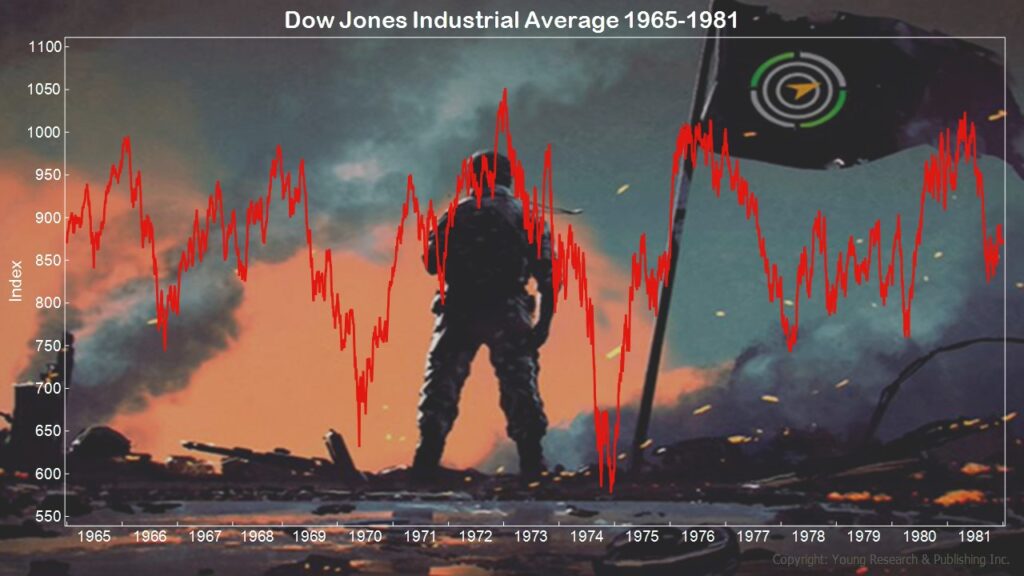

Look at the DJIA here and remember there were plenty of dividends collected while prices did nothing.

Action Line: Even when we can control our emotions, there are certain times in life when it helps to have a guide. One key area where Your Survival Guy can help is by not being emotional about your money or being as tense as you might be with it. It doesn’t mean I don’t care, because I do. But stripping out emotions from your money helps to make good decisions, especially in times like these. When you want a guide, email me at ejsmith@yoursurvivalguy.com, and pick up a map by clicking here to subscribe to my free monthly Survive & Thrive letter.