By Joyseulay @ Shutterstock.com

If you live in New England, you know how unpredictable the weather has been this summer. Just the other day, we were cruising back from lunch in Edgartown, MA, through Vineyard Sound and, before reaching Woods Hole, were engulfed in a fog bank. Your Survival Guy has radar, but even with that, I worry about the speed and actions of other boaters I can’t control. I throttled back, making our marks slowly, and in less than 20 minutes, we were in clear air moving through the Hole. It happens that fast.

Which leads me to my next investing mistake to avoid: Don’t be in a rush to make money. Time is your friend. It’s when investors are in a rush, meaning using leverage, that they eliminate their most valued partner in investment success, the ability to be a long-term investor. Because when leverage is involved, you might be right about the direction of markets but get hung up on the rocks because the timing was wrong. Markets don’t care about your lunch schedule.

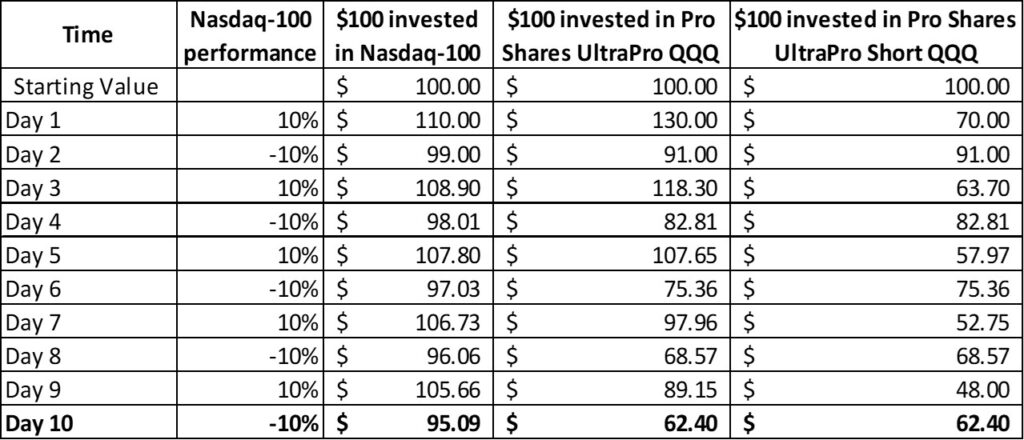

In my title for mistakes to avoid #6, 3X QQQ, I’m using a simple example to illustrate the use of leverage to amplify returns (or losses). Two of the more active volume ETFs are Pro Shares UltraPro QQQ and ProShares UltraPro Short QQQ. They seek investment results that correspond to three times the daily performance of the Nadaq-100 index (the inverse for the Short QQQ) using derivatives.

With three times the return of the Nasdaq-100, an investor can be wiped out completely in Pro Shares UtraPro QQQ with a daily loss of more than 33%. But here’s the other math to worry about. The funds mirror returns for a single day. In other words, here’s how returns would look if Nasdaq-100 was up 10% one day and down 10% the next over ten trading sessions:

You can see how easily money can be washed away.

Markets don’t necessarily work in lockstep like the above sequence, but what this helps illustrate are two things: 1) the arithmetic of losses, and 2) the potential devastation of leverage. You may run out of money before the markets or the fog lifts. For me, slow and steady wins the race.

Action Line: I treat each dollar like it’s the last one I’ll ever make. I don’t use leverage. Ever. When you’re ready to talk, let’s.

Read every one of the Investing Mistakes to Avoid here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- The Grid Pushed to Its Limits - May 8, 2024

- How Will America Fill Its Data Center Power Gap? - May 8, 2024

- Which States Tax Social Security? - May 8, 2024

- The People’s Chemist and Your Survival Guy - May 7, 2024

- RIP Charlie Munger: Keeping It Simple Never Goes out of Style - May 7, 2024