What’s happening with the economy, both in America and around the world? There are a lot of mixed signals. The first chart I want you to look at is the price of oil. You can see global politics and the fog of war right there in the chart as the price of oil fluctuates in response to events in the Middle East.

Another of Your Survival Guy’s favorite views of the economy is the Young Research Moving the Goods Index. Long-time readers of Richard C. Young’s Intelligence Report will remember the Moving the Goods index, a measure of the health of the companies transporting goods across the nation and the globe. After some recent declines, the index is recovering.

But what about the goods themselves? The Young Research Luxury Goods Index, another of Dick Young’s favorites, shows an uncertain future for the producers of luxury goods. A lot of that uncertainty has to do with the troubles with Chinese buyers, which Your Survival Guy has written about.

But what about the goods themselves? The Young Research Luxury Goods Index, another of Dick Young’s favorites, shows an uncertain future for the producers of luxury goods. A lot of that uncertainty has to do with the troubles with Chinese buyers, which Your Survival Guy has written about.

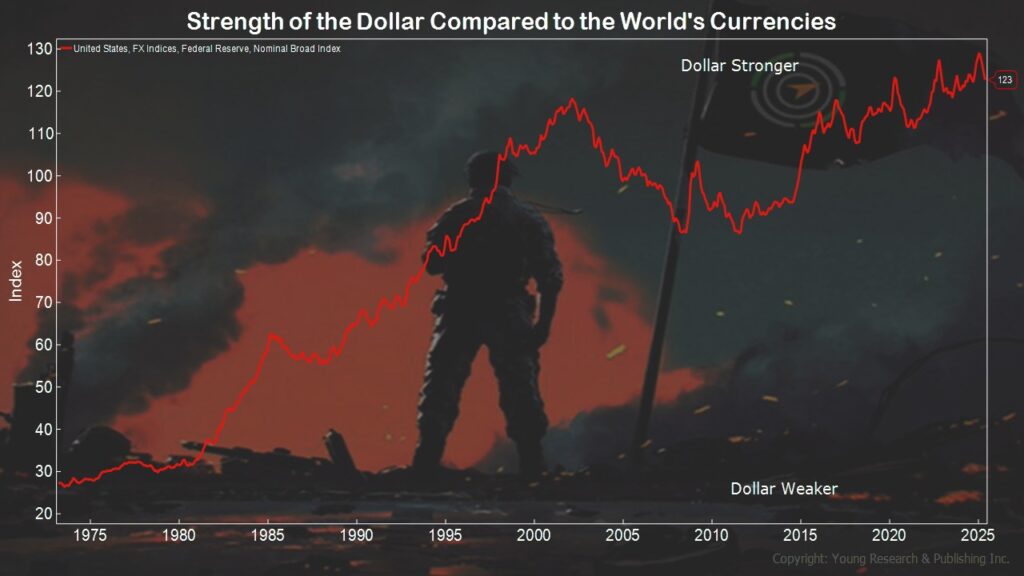

With global conflict and worry about tariffs and energy prices, the dollar has declined in value compared to other currencies in 2025. That can ultimately help reduce the trade deficit in the long run, but in the short run it makes imported goods more expensive for American buyers.

With global conflict and worry about tariffs and energy prices, the dollar has declined in value compared to other currencies in 2025. That can ultimately help reduce the trade deficit in the long run, but in the short run it makes imported goods more expensive for American buyers.

So how is the market reacting to these signals and all the myriad others it receives each day? The S&P 500 has recovered from its April volatility and is once again nearing all-time highs.

Action Line: No chart can give you all you need to know about the economy. That’s why Your Survival Guy suggests a balanced portfolio that keeps in mind your margin of safety. When you want to talk about your portfolio, email me at ejsmith@yoursurvivalguy.com. And click here to subscribe to my free monthly Survive & Thrive letter.