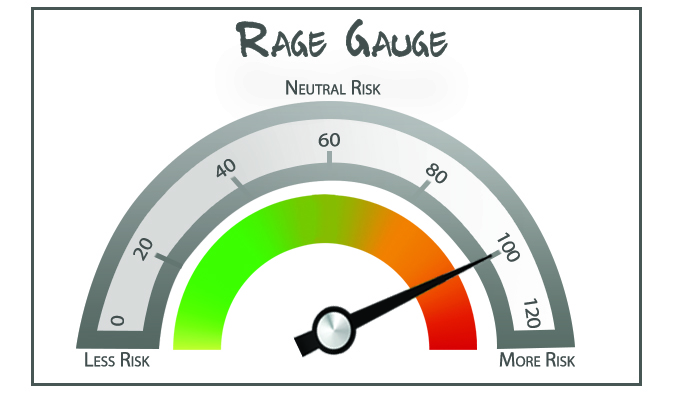

Your Survival Guy’s September RAGE Gauge is in, and all anyone’s talking about is how the Fed is going to cut rates, maybe once, twice, or thrice. Yippee? No, not yippee, as retirees and the savers like you are going to see returns on your cash get gutted right as you’re finally making up some ground from the misguided zero-percent rates of the 2010s to 2020s.

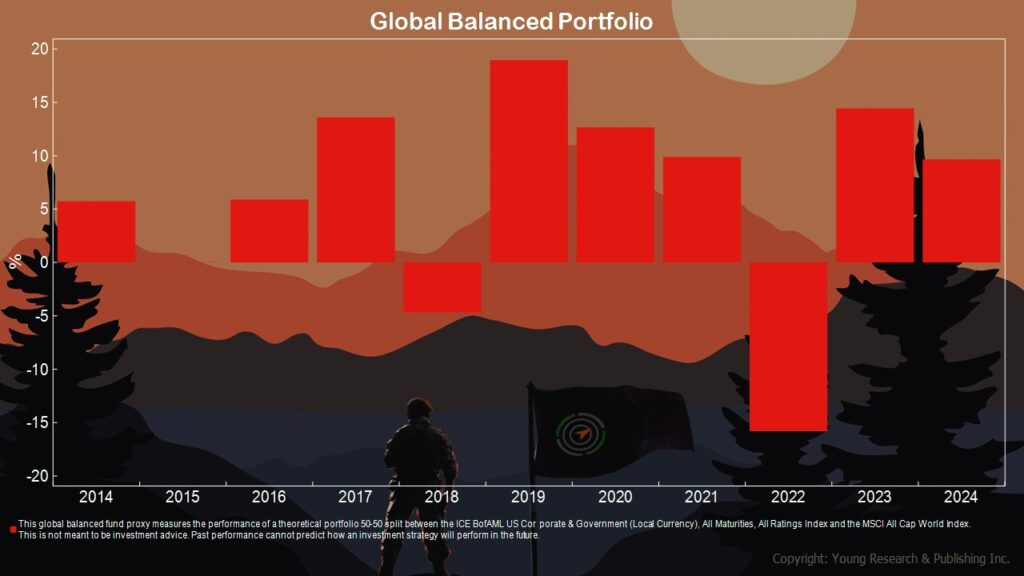

When you look at the performance for the balanced investor through my global balanced portfolio proxy, you can see it’s been pretty good sailing with 10-year average annual performance of 6.5%.

But let’s not confuse a balanced portfolio with cash or Dick Young’s North Star T-Bills. With the prospect of cash rates being gutted, would you be wise to invest in a balanced portfolio with your cash or risk-free money? Your Survival Guy would not. I know the arithmetic of losses and the time it can take for cycles to run their course. You cannot book a trip to Paris with an IOU. “Can I pay you when my portfolio rebounds?”

What we are seeing today is an investing class looking at past performance and making investing decisions while driving through their rearview mirror.

Which is why Your Survival Guy has grave concerns with the marriage between the Vanguard Group, Wellington Management, and Blackstone slinging private equity investments upon Main Street investors through IRAs and 401(k)s. When the president of Blackrock said in a recent Forbes interview that past performance is how this stuff gets sold, you know you’re not in good company.

Imagine a world without salesmen pushing their goods on Mom and Pop. There would not be the amount of money stuck in variable annuities and life insurance products whose main objective is selling fear. And on the flip side, private equity and past performance are sold with greed.

Do not get involved with fear and greed. Do not get involved with hoping prices go higher. Focus on your margin of safety, your risk tolerance, and income needs. The arithmetic of losses should be taught to every investor before they invest, not after they come to you looking for a loan.

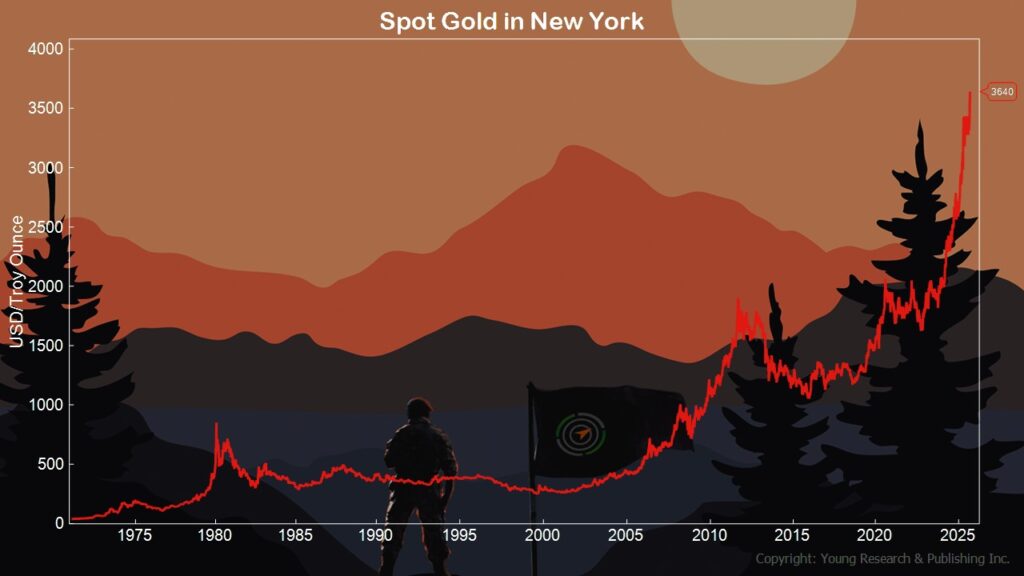

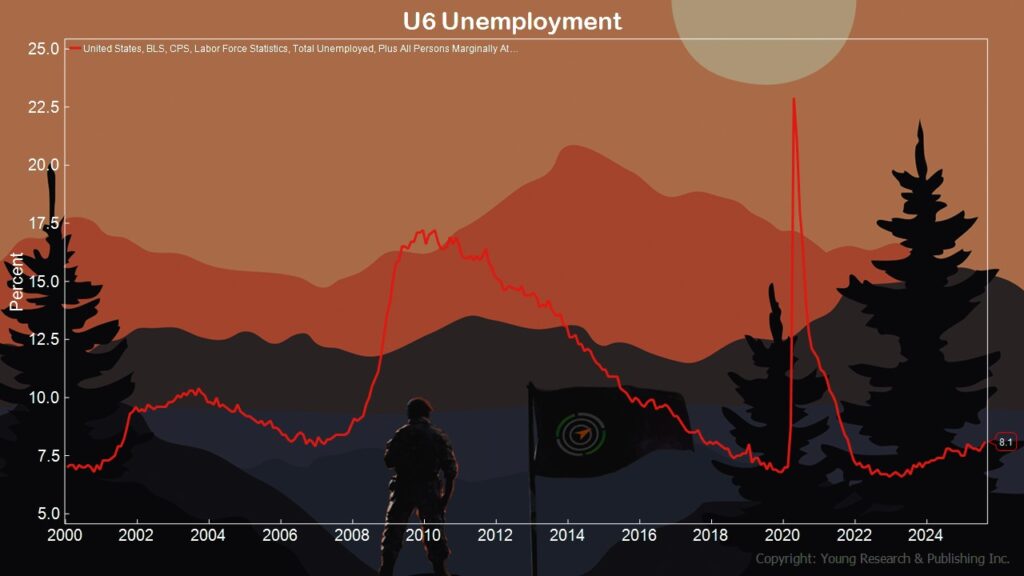

Action Line: Unemployment is creeping up to levels we haven’t seen since the tail end of Covid. Gold is signaling that inflation is still a threat. T-bills suggest rate cuts are on their way. So we’re seeing a market pricing in a Federal Reserve that is more worried about employment than inflation. Hold on tight. Tell me what you’re seeing at ejsmith@yoursurvivalguy.com. And click here to subscribe to my free monthly Survive & Thrive letter.