Pandemic-era stimulus-induced savings are running out. Joe Pinsker reports on the fall in American savings in The Wall Street Journal. Some analysts he talked to seem surprised that massive stimulus was correlated with massive inflation and that the savings evaporated quickly in the face of higher prices. Pinsker writes:

The cushion of savings many built up during the pandemic is thinning out. In some households, it is already gone.

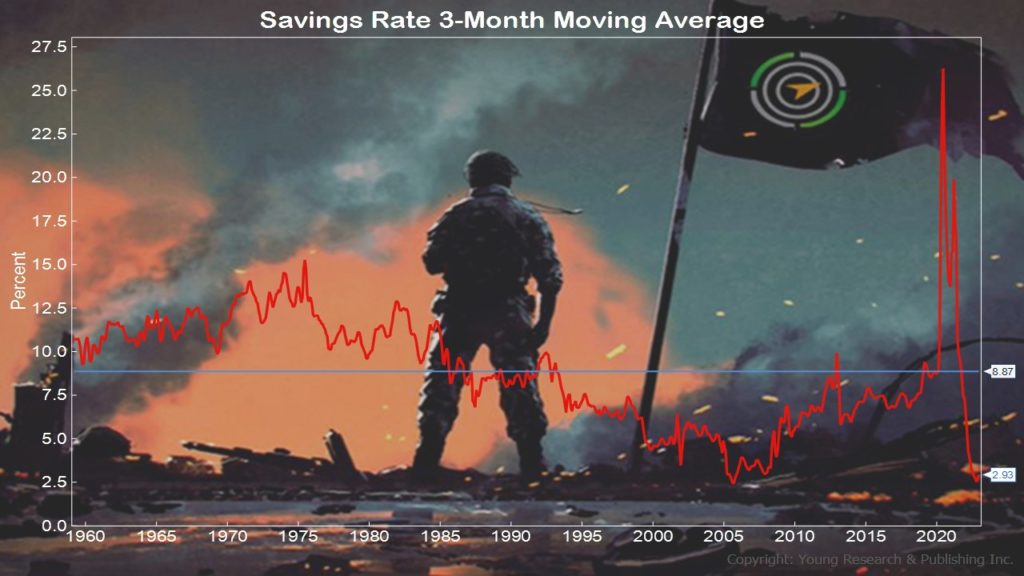

Americans have spent down about 35% of the extra savings they accumulated during the pandemic as of mid-January, according to an estimate from Goldman Sachs. By the end of the year, the company forecasts that they will have exhausted roughly 65% of that money.

In 2020 and into 2021, a combination of government pandemic stimulus and reduced spending, for example on restaurants and travel, fattened Americans’ wallets. Households amassed $2.7 trillion in extra savings by the end of 2021, according to Moody’s Analytics.

This cash helped Americans make it through a period of high inflation last year, but the forces that had acted to boost savings reversed direction as pandemic relief unwound and prices soared.

Today, some people are having to cut back on their spending or add to their credit-card balances. Many have had to tap their savings to stay afloat, say economists.

“At the exact same moment you lost the government transfer payments, you got hit with very high inflation, which made your real spending power lower,” said David Mericle, Goldman Sachs’s chief U.S. economist.

Germán Vazquez, a 34-year-old freelance photographer in Philadelphia, said his savings swelled during the pandemic thanks to a combination of spending less while cooped up at home and government financial supports, including stimulus checks and unemployment assistance. His balance grew from $4,000 in early 2020 to $20,000 in early 2022.

Over the past year, it dwindled to $2,000. “I’ve never had the opportunity to have that much money saved in my life, so it almost felt like I failed at something,” Mr. Vazquez said of the comedown.

Mr. Vazquez said his balance dropped last year once government financial supports were withdrawn, inflation rose and his business slowed as fewer people opted to spend on photo shoots of themselves and their families.

Action Line: When governments flood the economy with money via “stimulus,” there’s inevitably a cost. There’s no such thing as a free lunch. In this case, it was inflation. Joe Biden kicked that inflation into high gear by curtailing the oil industry and driving the costs of the supply chain to extremes. Now, after two years of paying Biden’s high prices for fuel and food, Americans have tapped out the savings they accumulated during pandemic stimulus measures. Don’t fall prey to Biden’s inflation. Save til it hurts. I can help. Click here to sign up for my free monthly Survive & Thrive letter.