Despite some positive data, Americans are edgy about the economy. Consumer sentiment has recently been plumbing the depths it last saw during the Great Recession. Many Americans are concerned about the Federal Reserve’s performance, both past and present, and its effects. Not to worry, though, the Fed’s efforts are focused squarely on… climate change?

Yes, climate change. Yesterday, the Federal Reserve released its long-awaited principles for climate-related financial risk management for large financial institutions. The Fed’s Board of Governors, in conjunction with the FDIC and the Comptroller of the Currency, released this press statement:

Federal bank regulatory agencies today jointly finalized principles that provide a high-level framework for the safe and sound management of exposures to climate-related financial risks for large financial institutions.

The principles are consistent with the risk management framework described in the agencies’ existing rules and guidance. The principles are intended for the largest financial institutions, those with $100 billion or more in total assets, and address physical and transition risks associated with climate change.

The principles are intended to support efforts by the largest financial institutions to focus on key aspects of climate-related financial risk management. General climate-related financial risk management principles are provided with respect to a financial institution’s governance; policies, procedures, and limits; strategic planning; risk management; data, risk measurement, and reporting; and scenario analysis. Additionally, the principles describe how climate-related financial risks can be addressed in the management of traditional risk areas, including credit, market, liquidity, operational, and legal risks.

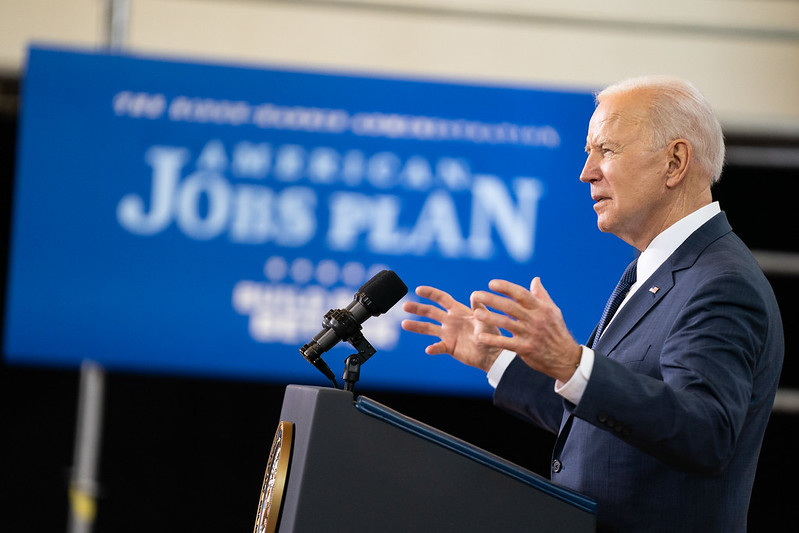

Action Line: The radical left has been pushing to get the Federal Reserve involved in climate change for years. Joe Biden’s administration made it a priority for the central bank, despite the Fed’s stated mission to keep inflation low, employment high, and interest rates reasonable. What does any of that have to do with climate change? Don’t take your eye off what’s important. Click here to subscribe to my free monthly Survive & Thrive letter. Make it a priority.