Your Survival Guy wants you to have your wealth and keep it too. Don’t let taxes wag the dog, but do, dear reader, pay attention. At The Tax Foundation, Janelle Fritts runs down the Foundation’s 2023 ranking of individual income taxes among the states. She writes:

This week’s map examines states’ rankings on the individual income tax component of our 2023 State Business Tax Climate Index. The individual income tax is important to businesses because states tax sole proprietorships, partnerships, and, in most cases, limited liability companies (LLCs) and S corporations under the individual income tax code. However, even traditional C corporations are indirectly impacted by the individual income tax, as this tax influences the location decisions of individuals, potentially impacting the state’s labor supply, and higher individual income taxes increase the price of labor. States with gross receipts taxes also extend those to pass-through businesses in addition to C corporations, which is also accounted for in this component of the Index.

States that score well on the Index’s individual income tax component usually have a flat, low-rate income tax with few deductions and exemptions. They also tend to protect married taxpayers from being taxed more heavily when filing jointly than they would filing as two single individuals. In addition, states perform better on the Index’s individual income tax component if they index their brackets, deductions, and exemptions for inflation to avoid unlegislated tax increases.

States with a perfect score on the individual income tax component (Alaska, Florida, South Dakota, and Wyoming) have no individual income tax and no payroll taxes besides the unemployment insurance tax. The next highest-scoring states are Nevada, Tennessee, Texas, Washington, and New Hampshire.

Nevada taxes wage income at a low rate under the state’s Modified Business Tax but does not tax investment income. New Hampshire taxes interest and dividend income but not wage income. Tennessee, Texas, and Washington do not tax wage income but don’t receive a perfect score on this component because they apply their gross receipts taxes to S corporations, which, in most states, would be taxed under individual income tax codes. (Washington and Texas also apply these to limited liability corporations.)

The top ten states in The Tax Foundation’s ranking are:

- Alaska 1 (tied)

- Florida 1(tied)

- South Dakota 1(tied)

- Wyoming 1(tied)

- Nevada 5

- Tennessee 6

- Texas 7

- Washington 8

- New Hampshire 9

- Utah 10

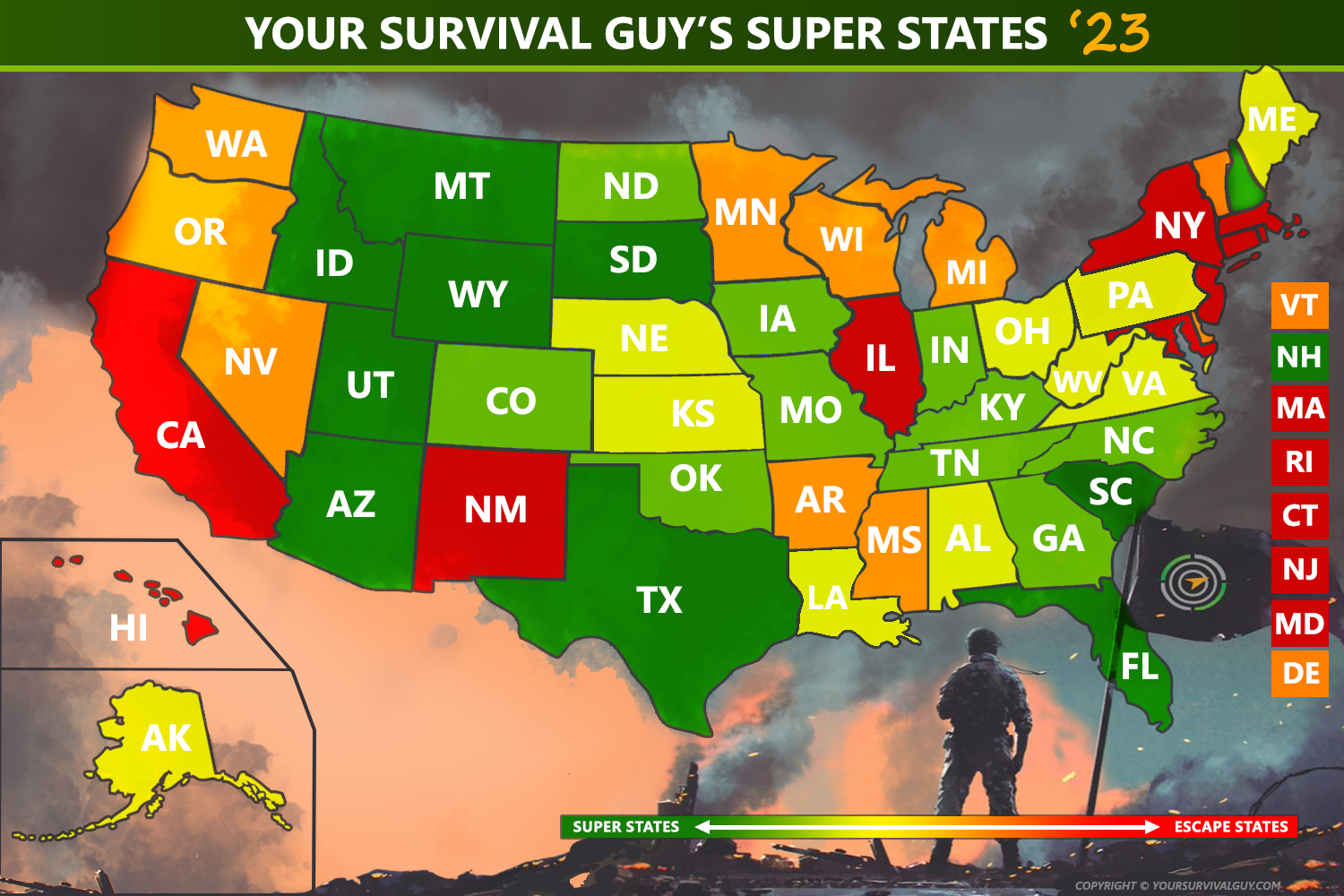

Action Line: For more on America’s best states, click here to read Your Survival Guy’s Super States 2023. And click here to subscribe to my free monthly Survive & Thrive letter to be one of the first to receive updates on the Super States.

P.S. Find your Super State on my map below: