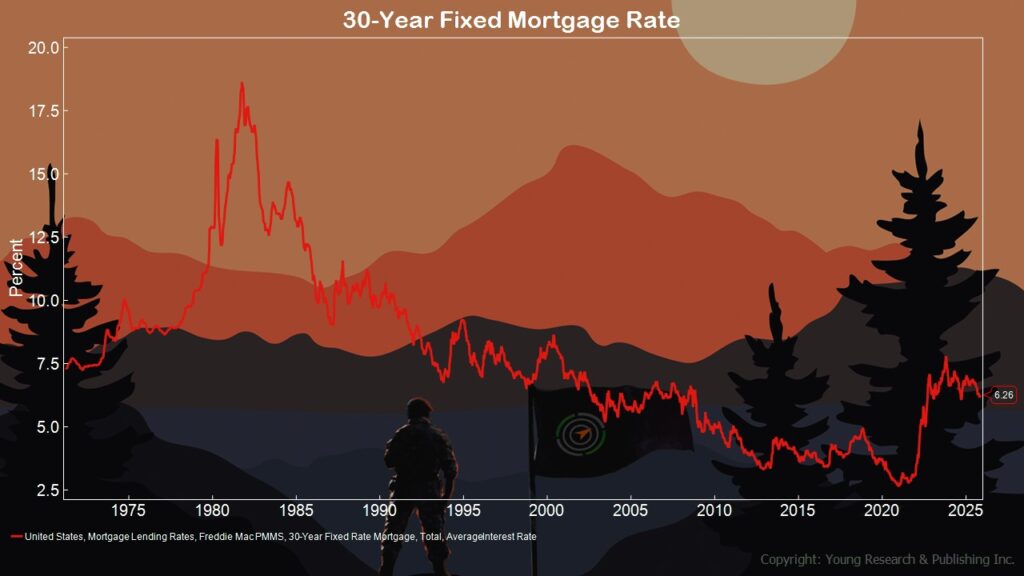

I want you to get into real estate ownership. Rates may not be coming down, but neither is inflation. Telis Demos explains the rising number of refinance applications in The Wall Street Journal, writing:

“Marry the house, date the rate,” real-estate agents have been known to advise prospective buyers. Now, Americans are jumping on opportunities to refinance and save money on their monthly mortgage payments. But what is the market going to make them pay for that privilege?

The recent decrease in mortgage rates has led to a pop in the number of people who are looking to refinance home loans they took out when rates were closer to 7% or 8%. The Mortgage Bankers Association’s weekly refinance application activity index in mid-November was more than double what it was a year prior.

That isn’t a surprising reaction to falling 30-year fixed mortgage rates. The weekly national average has gone from around 6.8% a year ago to under 6.3% now, according to Freddie Mac tracking. But the extreme speed at which people are moving to find new rates has been startling.

Historically, even people who always intended to refinance at some point have tended to wait until they have a big incentive in the form of a decline in rates. Refinancing can be a time-consuming process, with costs ranging from appraisals to lawyers.

Nowadays, though, people are moving much faster than they used to. At the pace of prepayments in October, over half of the balances of mortgages with an incentive to lower their interest rate by an average of 0.75 percentage point would be paid down early over the course of a full year, according to data on 6- to 24-month-old Freddie Mac loans compiled by the alternative-asset manager Mariner Investment Group’s Bright Meadow Capital team.

You can see in the charts below the falling mortgage rates and the rising number of refinance applications.

Action Line: Click here to subscribe to my free monthly Survive & Thrive letter.