With some Republicans arguing for higher taxes on corporations, The Wall Street Journal’s Allysia Finley reminds readers of Art Laffer’s research on taxes, which culminated in the well-known Laffer Curve. She writes:

Today, some Republicans have forgotten the lessons of the Laffer Curve—or failed to learn them in the first place. They want to raise taxes on corporations and the so-called rich to raise more revenue to redistribute to the working class. Mr. Laffer has one word for them: Don’t.

“Every single time we’ve raised tax rates on the top 1% of income earners, every single time, the economy has underperformed. Every single time we’ve raised tax rates on the top 1%, tax revenues from the top 1% of income earners goes down,” Mr. Laffer says in a video interview from his home in Nashville, Tenn. “Every time we’ve cut tax rates on the rich, the economy has outperformed.”

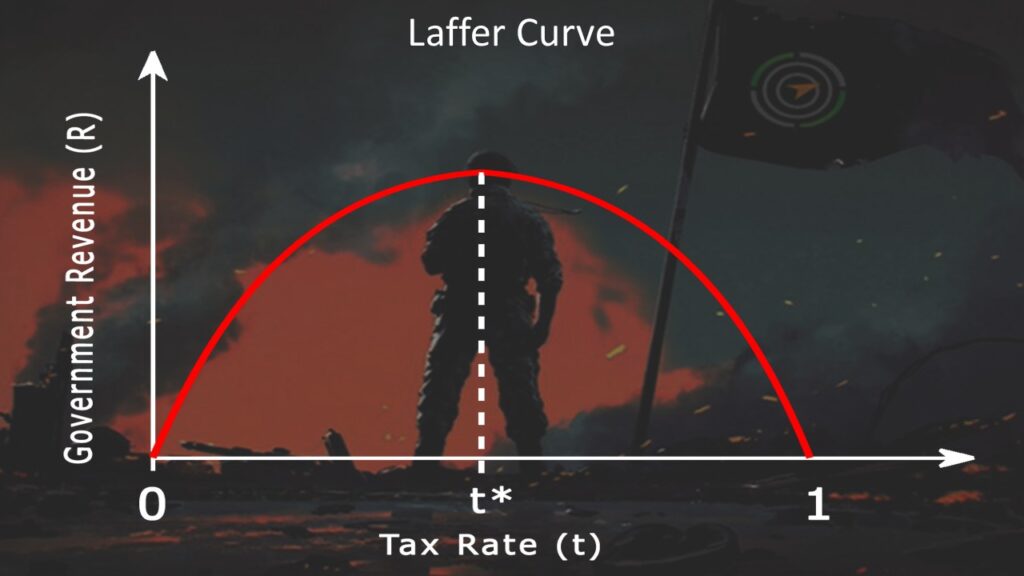

If you didn’t go to business school and are new to the Laffer Curve, the basic concept is that raising taxes will reduce work and potentially lower tax revenues, while lowering taxes can increase the reward for working, and encourage more of it, thereby increasing tax revenues. Laffer developed the idea in 1974. The illustration below is a basic representation showing that governments can find an optimal (for government) rate of taxation that maximizes revenue.

Action Line: The optimal rate for taxpayers is always zero. That’s one reason states with no income tax score so highly in Your Survival Guy’s Super States rankings. However, a government that recognizes that high taxes aren’t only bad for citizens but can also negatively affect its own revenues is better than one that simply believes raising rates will always generate more. Click here to subscribe to my free monthly Survive & Thrive letter.