Dear Survivor,

Not to beat a dead horse, but Your Survival Guy understands how hard it is to beat inertia and do what you know is right. I’m talking about your retirement life and creating a plan you can live with, with the peace of mind and comfort you deserve. I’m talking about crafting a diversified, balanced portfolio, something Ben Graham would suggest lies somewhere between 70 to 30 percent in stocks.

Your Survival Guy isn’t interested in “beating” the market. I pay scant attention to benchmarks. That doesn’t mean I don’t know the score. I do. And then some. Bonds are having their best year since 2020. A balanced portfolio is coming pretty darn close to beating, if not beating, the Dow Jones Industrial Average. Stay tuned.

The reason I like bonds is that, historically speaking, they can smooth out returns, helping investors sleep well at night rather than being forced to sell their stocks until they can sleep. And anyone who says sleep is overrated hasn’t had their life savings invested all in stocks during a market crash.

But that’s not what this morning is all about. It’s about an email I received over the weekend from a reader suggesting more be invested in stocks, 100%, because the money is going to his children—it’s a legacy portfolio.

And my stance remains the same. I want you to invest for your retirement life and for your life, period. Because the fastest way to gift your kids $1 million is to start with $2 million.

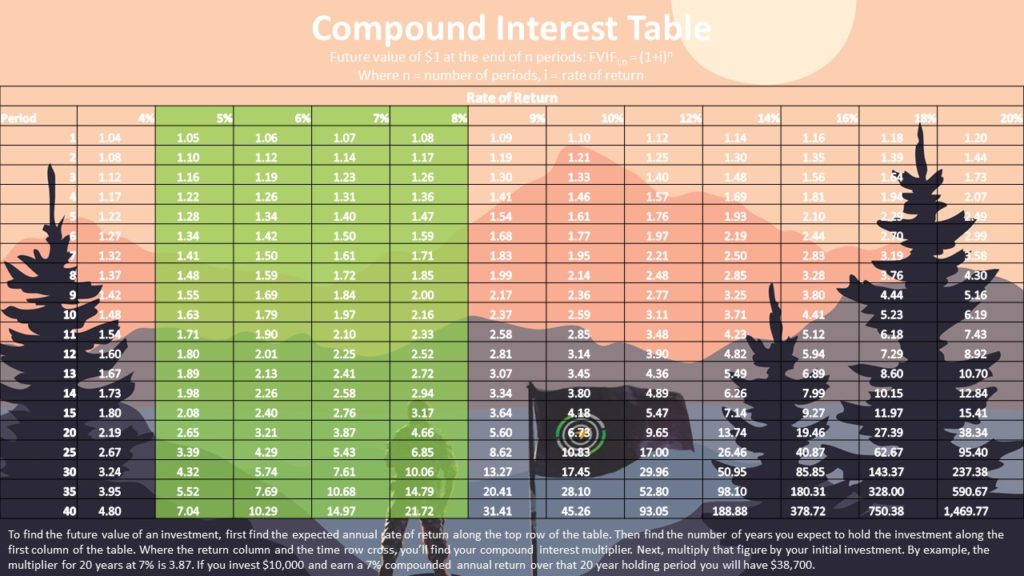

Your job is not about how much money you leave to your children (maybe a little bit). Your job is to educate them about money, so when they get their hands on it, they don’t blow it. The gift that keeps on giving will always be compound interest.

Financial Planning: Paying for Your Retirement Life

You worked most of your adult life, even your teenage years. You saved ‘til it hurt and lived within your means. Now you have more money than you ever dreamed you’d have and no paycheck to fall back upon. I know. It’s terrifying. That’s OK. Your Survival Guy spends a good part of my day working with investors like you, helping you create a plan to pay for your retirement life.

As a client recently emailed, “I am no expert on sequencing withdrawals, tax implications, RMDs, and the like. My actions in progress at this point are developing ‘must spend’ and ‘like to spend’ expense scenarios and sharing that with you, along with my portfolio outside of Fidelity and sources of income (401K/ESOP/NQDP) from my employer.”

This is a great start, the must spend, and the like to spend. It gives you a lay of the land and helps to develop a baseline. But when it comes to investment returns, I want you to be as conservative as possible. I’m not a fan of using high single or low double-digit return expectations and then running a Monte Carlo simulation. You and I know sometimes life doesn’t play out as planned. I want to help you plan for those times.

When Your Spouse Asks: How’s Our Money Honey?

When your spouse asks, “How’s our money, honey?” you immediately think, “It was doing fine.” And a little voice knowingly asks, “Want to get away?”

When markets are down, questions like, “Hi, Bob, how’s our money doing?” are asked. Phones ring. Pencils get sharpened. And the reading and studying begin.

Too late.

Because in my regular conversations with you, some months are up, and some months are down. I don’t look at where the markets are to decide when to pick up the phone. Investing is not a short-term endeavor, and it is nearly impossible to explain to a spouse, especially one who hasn’t been part of the planning process.

That’s why it needs to be a team effort.

Because when you’re both retired, you’re making no money from a job. It’s like you’re back to the future, not knowing what it feels like to work for a wage.

The difference now is that you can’t exactly live footloose and fancy free because you have something to lose: money. You’re working with more money and more savings than you ever had, and you want to keep it that way. Sure, you can work part-time as a Walmart greeter, but you’d better have a good attitude. You’d better be able to smile like nothing’s wrong.

Which is why I’m afraid to say, the tough conversations between spouses are going to be more regular. It’s why you both need to be on the same page to avoid making decisions that may hurt you just because you want to feel better.

It’s why you want to be with a fiduciary like Your Survival Guy who can make unemotional decisions for highly emotional subjects.

In times like these, you want the calmness and peace of mind you deserve. You spent a lifetime saving to get where you are, and quite frankly, you don’t want to deal with it anymore. I do. Email me at ejsmith@yoursurvivalguy.com.

Survive and Thrive this month.

Warm regards,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

P.S. When Your Survival Guy was a kid, my dad and I rented a canoe and explored Fort Wilderness in Walt Disney World by water. That’s where I saw my first armadillo. They were rooting in the dirt a little too close to shore for my comfort level. Being from New England, I wasn’t quite sure what I was seeing.

Were they friendly? Aggressive? I didn’t know. But I knew I wasn’t interested in finding out. Not having the best control of our vessel, our limited paddling skills kept getting us stuck on shore. I wasn’t freaking out. I was in the front, and we kept getting too close to these little creatures. Panicked, I repeated frantically, “Dad, back up! We need to get off this beach.”

“It’s fine,” he said, “They’re harmless, they won’t bother us.”

That didn’t help my condition.

When I think about that morning, I probably looked like a cartoon character running on air, tipping the canoe every which way, trying to get away.

Several years later, in my early twenties, you can imagine my surprise visiting Becky’s house for the first time and seeing a wood carving of an armadillo in their living room. “That was a gift,” she told me, “His book was about being a financial armadillo.”

You can’t make this stuff up.

I have a copy of the book on my desk staring at me as I write to you. Here’s five rules you need to know to be a financial armadillo and become a compounding machine, written by Dick Young himself:

- Take a pledge of allegiance each day to your most trusted investor ally, compound interest. Learning how to better harness the awesome power of compound interest assures you of long-term success. It is interest on interest that allows you to invest like the world’s most successful capitalist, Warren Buffett.

- Commit to memory the first two rules of investing. Rule #1: Do no lose your capital. Rule #2: Do not forget Rule #1.

- Ruthlessly slash, hack and chop your investor costs. None of us knows the future for certain. Yet while you may not know the future, you sure as heck can know your costs today. Most mutual funds and annuities are high-cost breeders. Get rid of these leeches. You win every day by keeping your costs low.

- Armor-plate yourself against the taxman. Your best strategy is to hold trading to an absolute minimum. The mutual fund arena is fraught with trading excess. The average turnover rate is 80%, or more than 10 times what I target in my own account and advise for you. In every mutual fund’s annual and semiannual reports is a statistical display of portfolio turnover. Aim for 40% or less for your CORE funds. Don’t forget, each time a mutual fund manager sells a stock at a profit, you get a tax bill. These guys invest with no regard for your tax bill or your devotion to compound interest. You simply cannot pay enough attention to mutual fund portfolio turnover.

- Diversify, diversify, diversify. Proper diversification will help you sleep well during bear stock markets. We have not seen a bear market in years, and we are all, quite honestly, spoiled. Today is a dangerous time in the annals of the stock market and the least safe time in the last 16 years to be inadequately diversified. Sooner or later, the music will stop, and you do not want to be the one left without a chair. You want to properly diversify yourself before it’s too late. You will never regret your diligence.

P.P.S. “I have more money than I ever dreamed I’d have,” you tell me in my conversations with you. And I understand why you say it. Because when you respect how you got it, you appreciate what you have and are surprised at how much it has become.

Let’s think about that for a minute. When you tell me how you’re surprised by how well it’s all worked out, I immediately understand you. I know it wasn’t luck, and I have a good idea what makes you tick. Because there are plenty of morons out there who, ironically, look like they “have it all” but who do not respect money and will never have enough of it.

Think about them for a minute, all the unhappily rich. They always want more. They’re never satisfied. Their lives are a mess. And to borrow a phrase, all for different reasons.

The wealthy investors I know are not motivated by money. Surprisingly or not, money is not what brings them happiness. It’s nice to have, no doubt. But it’s not what makes them tick.

What you all tend to have in common is an understanding, a respect, for how you made it. You lived the hours, days, weeks, and years it took to save ‘til it hurt and live within your means. And even if you weren’t happy to do it, though many of you were, you could see the light at the end of the tunnel.

Money is serious business. Is there a more serious one? Lives depend upon it. You can’t rework years gone by. And the way my fairly wealthy readers made it, working for a living, would take another lifetime to do. Not happening.

I’ll never forget, not too long ago, when Dick Young said, “Survival Guy, I made more money last year than I ever have. Don’t let anyone tell you compound interest doesn’t work.”

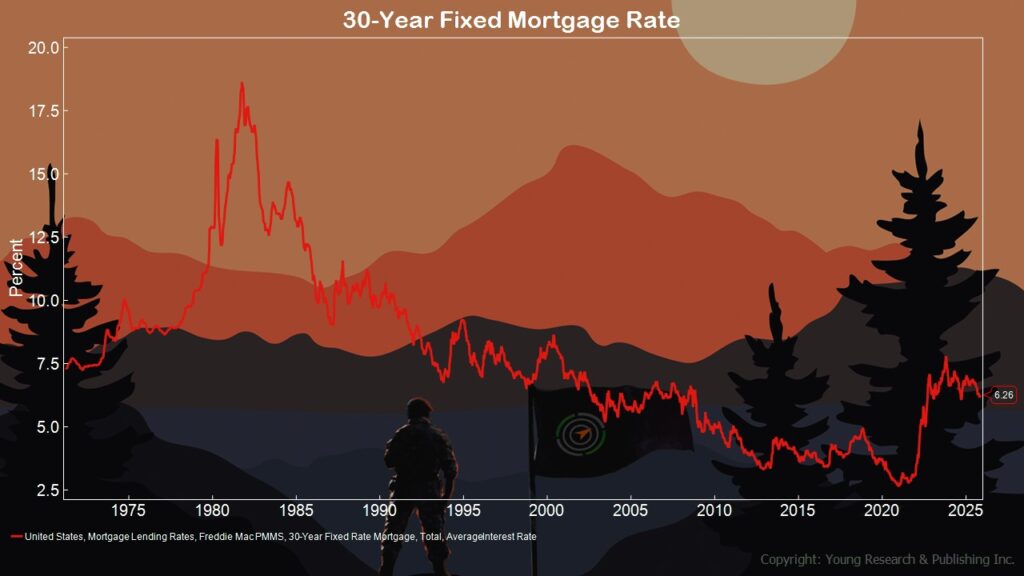

P.P.P.S. I want you to get into real estate ownership. Rates may not be coming down, but neither is inflation. Telis Demos explains the rising number of refinance applications in The Wall Street Journal, writing:

“Marry the house, date the rate,” real-estate agents have been known to advise prospective buyers. Now, Americans are jumping on opportunities to refinance and save money on their monthly mortgage payments. But what is the market going to make them pay for that privilege?

The recent decrease in mortgage rates has led to a pop in the number of people who are looking to refinance home loans they took out when rates were closer to 7% or 8%. The Mortgage Bankers Association’s weekly refinance application activity index in mid-November was more than double what it was a year prior.

That isn’t a surprising reaction to falling 30-year fixed mortgage rates. The weekly national average has gone from around 6.8% a year ago to under 6.3% now, according to Freddie Mac tracking. But the extreme speed at which people are moving to find new rates has been startling.

Historically, even people who always intended to refinance at some point have tended to wait until they have a big incentive in the form of a decline in rates. Refinancing can be a time-consuming process, with costs ranging from appraisals to lawyers.

Nowadays, though, people are moving much faster than they used to. At the pace of prepayments in October, over half of the balances of mortgages with an incentive to lower their interest rate by an average of 0.75 percentage point would be paid down early over the course of a full year, according to data on 6- to 24-month-old Freddie Mac loans compiled by the alternative-asset manager Mariner Investment Group’s Bright Meadow Capital team.

You can see in the charts below the falling mortgage rates and the rising number of refinance applications.

Download this post as a PDF by clicking here.