“Monday’s madness is a reminder that investing in stocks doesn’t automatically make people rich. Twice in the past 20 years—between 2000 and 2002, and again between 2007 and 2009—the stock market has cut investors’ wealth roughly in half,” writes Jason Zweig at the WSJ.

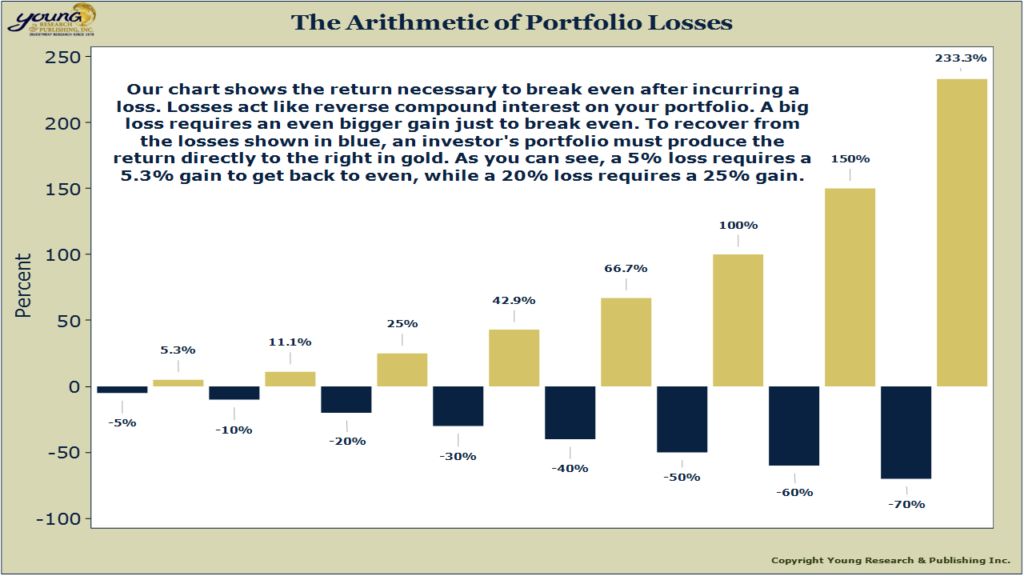

When you think about the mathematics of investment losses (see chart below), you quickly realize how difficult it becomes to get back to square one, especially for retirees.

And when you think about it in terms of real dollars—seeing $1 million decline to $500,000—imagine how many hours you have to work to make that kind of money.

If you can’t afford to lose that kind of money then organize your finances accordingly because this mini pull back was nothing. Wait until the madness really sets in like it has twice over the past 20 years.

Zweig writes:

The novelist Joseph Conrad understood human nature. In his memoir, “A Personal Record,” published in 1912, he recounted a chilling story from his family’s history in Poland.

After a troop of Cossacks invaded the grounds of the home of Conrad’s wealthy grand uncle, dozens of peasants surged in and around the house. A loyal servant and a local priest placated the crowd, and the tension began to dissipate.

Then, as much of the crowd started to head home, one of the peasants stepped to the window. He bumped into a dainty table; as it hit the floor, coins clinked inside it. He bashed it open, and gold coins spilled out.

Instantly, the crowd shifted from retreat to rampage. They swarmed inside and “smashed everything in the house, ripping with knives, splitting with hatchets, so that, as the servant said, there were no two pieces of wood holding together left in the whole house.”

That’s what markets are like. Tens of millions of people don’t always act rationally in response to new information; often, they react to nothing but how they think other people are acting or will act. Logic can melt into emotion in the blink of an eye.

Monday’s madness is a reminder that investing in stocks doesn’t automatically make people rich. Twice in the past 20 years—between 2000 and 2002, and again between 2007 and 2009—the stock market has cut investors’ wealth roughly in half.

No one can say when that will happen again, but everyone should know that it can—and very well might. If a 6% daily drop makes you squirm, then you probably have too much invested in stocks for your own psychological good.

Read more here.