The Wall Street Journal’s Mia Lamar has written a profile of the high-risk Singaporean hedge fund, Quantedge Capital Pte Ltd. The fund has had wild success, raking in 27% average annualized returns since inception in 2006. No one can scoff at the those Madoff-like returns. But it’s something the fund wrote in its August investor letter that stuck out to me. “…Our investment model delivers high returns over time, at the cost of unpleasant bumps along the way.”

Investors nearing retirement, or those already enjoying their life after work, don’t have the time or tolerance for “unpleasant bumps.” A strategy that avoids big drops in portfolio values can set the retiree’s mind at ease and prevent savers from trying to play catch up by adopting even riskier strategies.

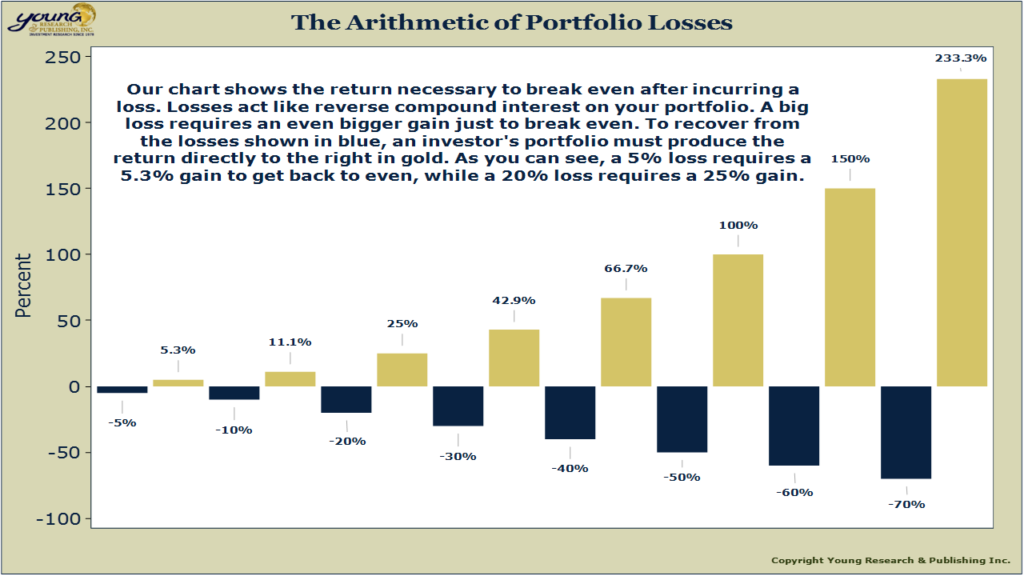

Take a look at my chart on the Arithmetic of Portfolio Losses below. Taking a “small” loss of 5% demands you generate a 5.3% return to get back to even. But taking a loss of 40% demands you generate 66.7% to get back to even. In retirement you don’t have that kind of time. Adopting a strategy that avoids risk in the first place, and generates regular income for your expenses will put any investor’s mind at ease in retirement.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Yes, Money Can Buy You Happiness - April 23, 2024

- State Income Taxes and the 2024 NFL Draft Class - April 23, 2024

- This ARK is Sinking - April 23, 2024

- “That’s Why I Hired You,” They Tell Me - April 22, 2024

- The Silver Lining of Higher Interest Rates - April 22, 2024