Originally posted July 18, 2018.

My appreciation for Andy Kessler’s way of thinking began with Wall Street Meat and Running Money. A few years ago I had the opportunity to hear him speak at a Cato 200 gathering in Laguna Beach, CA. I continue to keep up with him through his commentary at the WSJ where, in this piece, he shares some thoughts from another great mind, futurist George Gilder:

My friend the futurist George Gilder outlines a theory in “Life After Google,” his forthcoming book. He suggests that while advertising prices might be correct, the free-service model cannot deliver sustainable growth. Mr. Gilder explains that Google “achieved unprecedented scale by a commitment to ‘free.’ But free flow is not cash flow. It bypasses the entrepreneurial learning that is conveyed through the remorseless messaging of price. Without prices, all that is left to confine consumption is the scarcity of time. Beyond the scores of hours a week for its smartphone customers, time is closing in on Google.”

Google’s centralized architecture also could come under attack from the huge decentralized infrastructure scaling up to mine bitcoins. Even if bitcoin drops below $1,000, the installed glut of global blockchain servers could, Mr. Gilder argues, “marshal a virtual planetary parallel computer that dwarfs the CPU and GPU arrays in Google data centers with their mere millions of servers.”

Mr. Gilder notes: “The cryptocosm can mobilize computer power in volumes that dwarf even the data centers of the leviathans. In this case, the advances in computer science pioneered at Google serve to emancipate the world from Google’s silos.” This may be a way off, but investment implications come sooner than you think.

Read more here.

Life After Google

There will be Life After Google as explained in futurist George Gilder’s book by the same name. Because when we use Google’s products for free, you and I give them a free pass to do what they will with our data. Who are we to complain if Google mishandles the security of our data?

“You fools it was free,” they counter. But what if there’s a universe, a cryptocosm, that provides search on a much larger scale where we own our data through a blockchain?

Imagine musicians, artists, and other creators whose work has been essentially stolen by the “everything is free” Google, owning the rights for their work. What if in the future individuals receive credits from a trustless ecosystem locked in place with blockchain.

This is only the beginning of what may be an incredible demand from individuals to own their work in a secure manner that creates a most transformational shift to a life after Google. Stay tuned.

At Google: You Are the Product

You instinctively know something evil is going on when a company’s motto is “Don’t be Evil.” When Google offers you “free” services (Gmail for example)—you’re the product.

Will Google be able to compete against a cryptocosm several orders of magnitude larger than it could ever become? At the heart of the matter is big data. Googlers feel big data has all the answers—but big data is no match for human touch and emotional intelligence. Would you trust software to drive your family today?

At the heart of self-driving cars is a battle of software (Google) vs. human vision. In the first camp is Google’s Waymo, Elon Musk’s Tesla, and Uber, explains futurist George Gilder, author of Life After Google. They, and a host of other autonomy projects are over-hyped schemes. Imagine seeing 50 times better than the so called self-driving vehicles today (they’re more like assisted driving systems).

While others are enhancing existing lidar, radar, and camera systems with artificial intelligence, big data, mapping and software, explains Gilder, Russell is preoccupied with optics, lasers, and machine vision. Russell understands no amount of big data can make up for bad data from hopelessly inadequate vision systems.

Russell’s work focuses on lidar (light detection and ranging) systems that evaluate the world around them, explains Gilder. “Russell understood from the outset that if the car cannot deliver an utterly reliable real-time image and interpretation of the road ahead for at least two hundred meters in the dark, with just 10 percent reflectivity, it is a death-trap.”

There will be a Life without Google. And if entrepreneurs like Russell have anything to do with it, and he will, then it will be a life with perhaps a lot less evil.

Cryptocosm: And What Comes Next

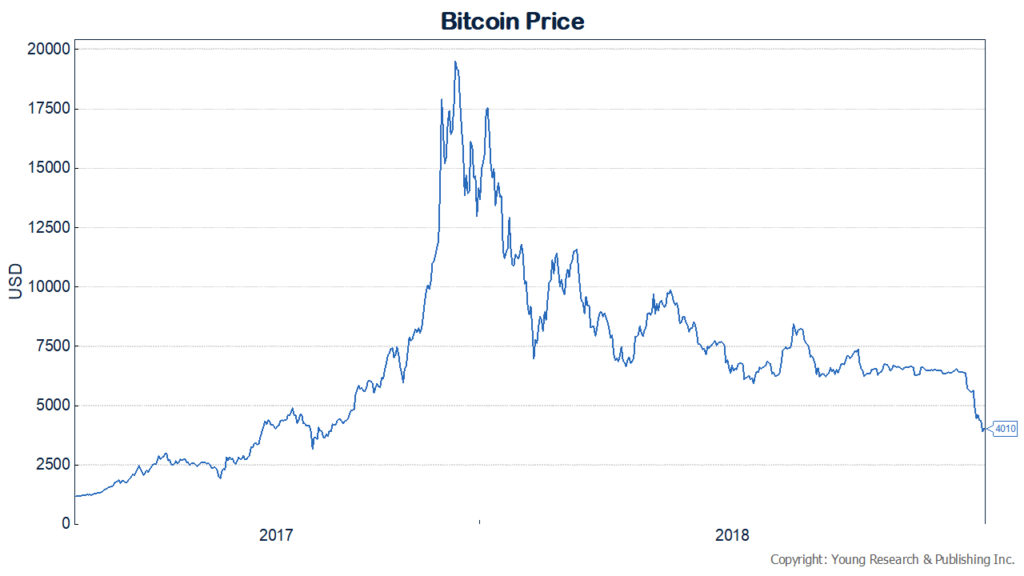

You’re witnessing what happens when markets dry-up as shown here with bitcoin (see chart below). I’ve been warning readers about what George Gilder calls the “cryptocosm.” If you have been hitching your wagon to cryptocurrencies, you might have endured a rude awakening this week.

Steven Russolillo, writing at The Wall Street Journal, calls it bitcoin’s “Week from Hell.” He explains

Now, another worry has emerged: Cryptocurrency miners, the outfits that solve complex equations to generate new digital coins, seem to be losing interest. The amount of computing effort expended by miners, known as the hash rate, has started falling.

The hash rate rose for much of the year even as cryptocurrency prices slumped, suggesting people remained optimistic prices would bounce back. But it has fallen sharply in recent weeks, according to Blockchain Ltd., a cryptocurrency-wallet service and data firm. That suggests fewer miners are jumping into the network.

“Bitcoin’s value is always driven by the intensity of demand and supply,” says Edith Yeung, a partner at 500 Startups, an early-stage venture fund. “If the miners stop mining, bitcoin will not function…and the overall market will lose confidence. If there is no confidence, people will freak out and sell even more.”

Rival digital currencies such as ripple and ether have also fallen sharply. The total market value of cryptocurrencies stands at about $130 billion, down from a record high above $800 billion in January, according to research site CoinMarketCap.

The sour mood stands in contrast to a year ago, when cryptocurrencies captured the imagination of individual investors as prices skyrocketed.

Mr. Gu, whose blockchain investment fund in Singapore manages about $400 million in assets, is optimistic the market will recover. “Money is made when there is blood in the streets,” he said.

But others say there could still be pain ahead.

“It’s hard to look at the price charts of the big crypto assets and not cringe,” Fred Wilson, a partner at Union Square Ventures in New York and an early bitcoin investor, wrote on his blog. He drew a parallel to the moves seen when the tech bubble burst.

Back then, Amazon.com Inc. lost 95% of its value from December 1999 through October 2001. The online retail giant has long since recovered. “I think things will get worse before they get better,” Mr. Wilson said.

Read more here.

The Vast Opportunities of Blockchain

Operations Management? When I was at Babson College one of our core curriculum courses was Operations Management. And, at the time, I didn’t see the vast opportunities that would unfold from this course.

Who wants to spend a career figuring out how to piece together a supply chain or re-tool a factory?

Then, when I had an internship at an online grocery delivery start-up, I recognized how fruitful a career in Ops could actually be.

Fast forward to today and if you’re an Ops wizard, companies like Walmart or Amazon want to talk with you.

Sometimes it’s hard to see the forest through the trees.

Over the weekend, I read Babson Magazine and the article “Get to Know Blockchain,” which instantly reminded me of my experience with Operations Management and perhaps the vast opportunities we have yet to experience with blockchain.

Hey, if you want to track the origin of that romaine lettuce in your Caesar salad, you might be able to do it. The revolution in blockchain is coming. Stay tuned.

Donna Coco writes at Babson Magazine:

Perhaps one of the most publicized applications is in the food industry, with Walmart and reportedly 10 other large companies working together to create a blockchain that tracks their food supply chains. IBM is providing the technology and calls the initiative the IBM Food Trust. An important goal—in addition to improved transparency, standards, and record keeping—is better handling of food recalls. Because blockchain would capture data along all points of the supply chain, it would allow for quick identification and tracking of problems. Faster recalls of unsafe foods should benefit not only consumers but companies, too, because they can avoid the often huge losses associated with these recalls.

“What happens now is someone says the romaine lettuce is tainted, and suddenly everyone across all of the Western part of the United States is throwing out romaine lettuce,” says Rachel Greenberger, MBA’11, adjunct lecturer and director of Food Sol at Babson. “Blockchain lets a company immediately find out which farm or pool of romaine lettuce in a specific area is contaminated and recall that product, leaving everybody else alone.”

Greenberger believes the potential for blockchain to change the way the food industry functions—improving methods for proof of provenance, increasing safety and efficiency, reducing waste—is enormous. Although she says it’s still too early to know exactly how blockchain will play out, Greenberger thinks it will be adopted quickly if there is money to be made. “Right now, there are still a lot of fax machines and paper and human error. We have one of the safest food supply chains in the world, and yet there are a lot of gaps in its management,” she says. “If a giant company, like Walmart, for example, adopts blockchain, then because of its size and command over the industry, many smaller players will have to get on the Walmart chain as well.”

Entrepreneurs in the food industry should be learning about blockchain and watching its evolution, she continues. “If this gets adopted by major players in the food industry who call the shots on how everything else comes down, then if you want to sell to them, you will have to be thinking about blockchain as part of the way that you move and share data,” Greenberger says. “It’s early. There are not enough cases in the food industry yet. But I tell entrepreneurs to keep on this. It could change everything. You need to know it.”

Read more here.