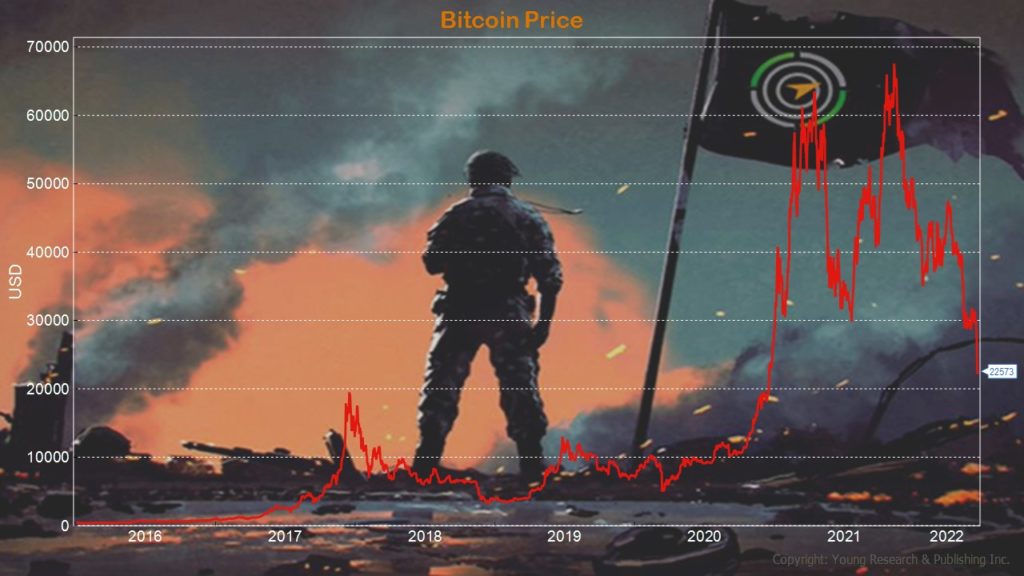

Many cryptocurrency speculators are just now waking up to the extreme levels of risk they assumed when buying their crypto assets. Prices for cryptocurrencies across the board have fallen dramatically, as can be seen in bitcoin’s fall of -51.25% year-to-date, and -66.6% since its peak in November 2021, only eight months ago.

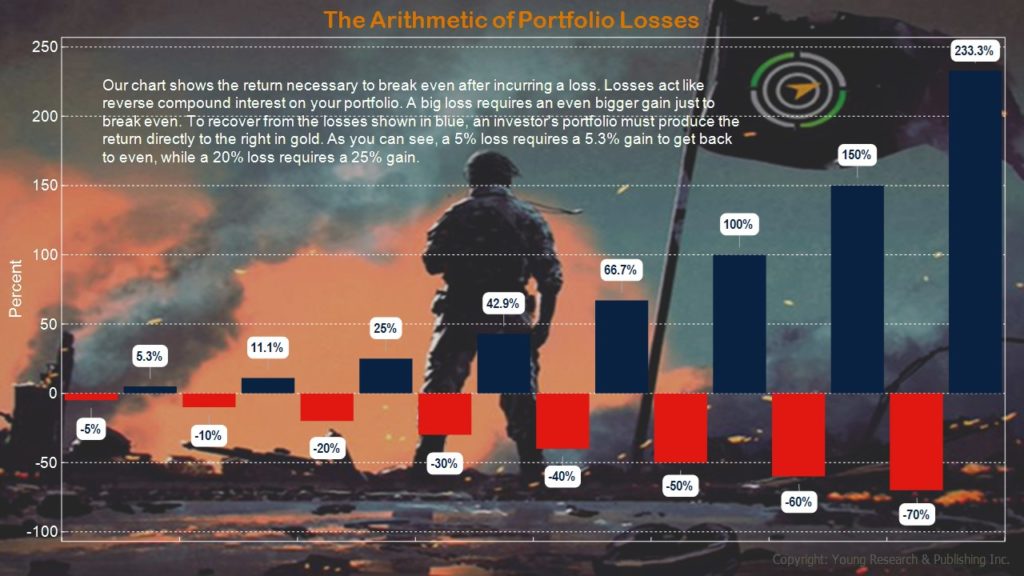

Now crypto speculators have to calculate how much it will take to get them back to even. It’s not a small amount. Even the volatility of crypto might not be enough to get them there soon.

A 70% loss in crypto, which for peak investors is only a hair’s breadth away, will demand a future return of 233.3% to just get back to even. Is that the kind of volatility your portfolio can handle?

In The Wall Street Journal, Vicky Ge Huang explains the anxiety crypto speculators are feeling, writing:

Crypto was all the rage in 2021. This week, it came crashing down.

The tailspin started late Sunday. One of the largest crypto lending platforms, Celsius Network LLC, unexpectedly told customers that it was pausing all withdrawals, swaps and transfers between accounts due to extreme market conditions.

Celsius customers panicked, and people with money in other crypto platforms started to wonder if they would be next.

The anxiety spread quickly. Prices for bitcoin and ether tumbled about 15% on Monday and continued to fall throughout the week, piling onto the decline that has plagued them all year. The digital currencies are down 54% and 70%, respectively, year to date, according to CoinDesk data.

On Tuesday, Coinbase Global Inc., the largest crypto exchange in the U.S., said it would cut its workforce by about 18%. In a letter, Chief Executive Brian Armstrong said that the company had grown too quickly and that a potential recession “could lead to another crypto winter.”

Two other prominent crypto companies, Crypto.com and BlockFi, also announced layoffs.

“It sucks right now,” said Jeff Dorman, chief investment officer at Arca, a digital-asset investment firm. “Companies are laying people off, activity is down, crypto is back to being the laughingstock of Wall Street.”

Action Line: If you want to build a successful retirement, you need to invest, not speculate. And you need to focus on a return of capital before worrying about a return on capital. If you need help building a plan that works for you, let’s talk.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024

- Investing Is Math - April 25, 2024

- Breaking: New Rules on Trillions in IRAs and 401(k)s - April 24, 2024

- When You’re in Control, You Have Opportunities - April 24, 2024