Last month, a quiet change happened in New England when the region’s last operating coal power plant was turned off. In Bow, New Hampshire, Merrimack Station ceased commercial operations, and the New England power grid became the first regional grid in America to run without an operating coal plant (NY has its own state grid, which ended coal generation in 2020).

So is that a good thing? Energy Secretary Chris Wright said at a Reuters Newsmaker event shortly after Merrimack Station’s closure that “Energy sobriety has returned to Washington, D.C. Our focus is on Americans and the price of utility and avoiding blackouts. We’ve got to stop existing firm capacity from retirement. I would say the majority of that coal capacity will stay online.” Reuters reports:

The administration is also prepared to use its emergency powers to extend the life of coal-fired plants, he said.

Last month, Wright extended his emergency order to keep a Michigan coal plant running, even though the plant’s operator had been planning to shut permanently for economic reasons.

The Energy Department also ordered a gas and oil-fired power plant, slated for retirement in Pennsylvania, to continue operating.

Wright said more plants should expect similar orders, which fall under grid stability provisions in the Federal Power Act.

So far, Wright hasn’t made an attempt to keep Merrimack Station active. The New Hampshire Bulletin reports:

News of the closure came on the same day the Trump administration announced plans to resuscitate the coal sector by opening millions of acres of federal land to mining operations and investing $625 million in life-extending upgrades for coal plants. The administration had already released a blueprint for rolling back coal-related environmental regulations.

The announcement was the latest offensive in the administration’s pro-coal agenda. The federal government has twice extended the scheduled closure date of the coal-burning J.H. Campbell plant in Michigan, and U.S. Energy Secretary Chris Wright has declared it a mission of the administration to keep coal plants open, saying the facilities are needed to ensure grid reliability and lower prices.

However, the closure in New Hampshire — so far undisputed by the federal government — demonstrates that prolonging operations at some facilities just doesn’t make economic sense for their owners.

“Coal has been incredibly challenged in the New England market for over a decade,” said Dan Dolan, president of the New England Power Generators Association.

Merrimack Station, a 438-megawatt power plant, came online in the 1960s and provided baseload power to the New England region for decades. Gradually, though, natural gas — which is cheaper and more efficient — took over the regional market. In 2000, gas-fired plants generated less than 15% of the region’s electricity; last year, they produced more than half.

America has an immediate need for more power to feed the growth of artificial intelligence data center demand. Big tech firms prefer nuclear generation that doesn’t emit any pollutants, but a large scale ramp up isn’t imminent as it takes so long to add nuclear capacity to the grid. The next choice would be natural gas, but turbine producers are already running near maximum capacity. Recently, they’ve announced plans to increase capacity, but that could take some time. Utility Dive reports:

- Mitsubishi Heavy Industries plans to double its manufacturing capacity of gas turbines over the next two years in response to spiking demand and a backlog of orders, Bloomberg reported Sunday. Average wait times for gas turbine delivery have recently increased by several years.

- GE Vernova, another gas turbine manufacturer, announced on Aug. 19 that it is investing $41 million to enhance the manufacturing of its H65 and H84 generators, used in the company’s HA gas turbines. Siemens Energy, another gas turbine manufacturer, announced in December last year that it’s adding 61,000 sq ft to a facility that makes blades and vanes for its turbines.

- “An individual [original equipment manufacturer] doubling production could increase overall output by 15-40% based on historic data,” Bobby Noble, senior program manager of gas turbine research and development at the Electric Power Research Institute. “It should help over time, but it is likely not enough to drastically reduce [wait times].”

With long wait times for nuclear and for gas turbines, power producers may look to inexpensive coal generation. Energy Secretary Chris Wright and the Trump administration are supporting coal with a renewal of the National Coal Council in June. The Energy Department announced:

U.S. Secretary of Energy Chris Wright is advancing President Donald J. Trump’s commitment to reinvigorating America’s coal industry by renewing the charter for the National Coal Council (NCC), a Federal Advisory Committee that was terminated during the Biden administration. This follows the President’s April 2025 Executive Order, calling for America to take aggressive action on coal. The coal industry supports hundreds of thousands of jobs and adds tens of billions to the U.S. economy each year.

Coal production has long been the backbone of American energy prosperity, ensuring affordable and reliable power. As electricity demand surges, driven by manufacturing growth and the expanding needs of artificial intelligence and data centers, the NCC will provide critical guidance on coal’s role in strengthening the U.S. energy landscape.

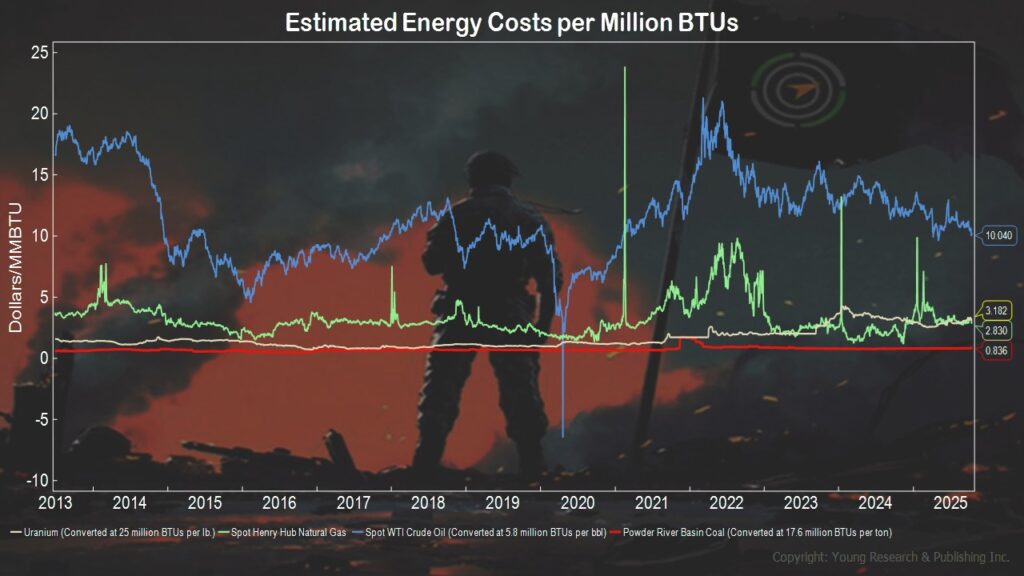

On a BTU basis, coal from Wyoming’s Powder River Basin is much cheaper than natural gas, nuclear, and oil in the United States.

Action Line: Click here to follow America’s energy future with Your Survival Guy in my free monthly Survive & Thrive letter.