Here Dan Mitchell of the Cato Institute discusses why some states deserve kudos for their tax policies, and some states deserve mockery.

Here Dan Mitchell of the Cato Institute discusses why some states deserve kudos for their tax policies, and some states deserve mockery.

Just like with nations, there are many factors that determine whether a state is hindering or enabling economic growth.

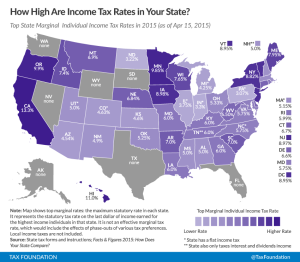

But I’m very drawn to one variable, which is whether there’s a state income tax.

If the answer is no, then it’s quite likely that it will enjoy better-than-average economic performance (and if a state makes the mistake of having an income tax, then a flat tax will be considerably less destructive than a so-called progressive tax).Which explains my two main lessons for state tax policy.

FLASHBACK VIDEO: Dan Mitchell Debating Whether States Should Abolish Income Taxes or Impose Class-Warfare Tax Rates