Back in May I highlighted the analysis of Dan Loeb of Third Point LLC who, in April, said “There is no doubt that we are in the first innings of a washout in hedge funds.” He was right, and hedge fund prospects are dropping like dominoes around the world. Today The Wall Street Journal ran a big cover story on the withdrawals plaguing previously anointed hedge funds Brevan Howard and Tudor Investment Corp. Laurence Fletcher and Gregory Zuckerman, writing in the WSJ, get right to the point, “The funds’ problem is clear: They just aren’t performing.”

Hedge funds offer clients great rewards based on the willingness and ability to take on risk. When things are going well, clients are happy to pay hedge funds’ extortionate fees of 2% of assets and 20% of profits (or more!). But when performance flags, clients rush for the exits.

Hedge funds and actively managed mutual funds have been underperforming since financial markets began their rebound in early 2009. The average hedge fund is up 3% this year through the end of July, according to researcher HFR Inc., less than half the S&P 500’s rise, including dividends.

Funds in the $2.9 trillion hedge-fund sector have now experienced three consecutive quarters of withdrawals for the first time since 2009, according to HFR.

Brevan Howard’s master fund was one of the star performers during the credit crisis, but is now on pace for its third straight calendar year of losses. Investors withdrew more than $3 billion from its flagship fund in the first half of this year, according to letters sent to investors and calculations by The Wall Street Journal based on the fund’s asset levels and performance.

For the year through August, two key Tudor hedge funds were down about 3%, according to investors, well below the overall market. On Tuesday, the firm reduced its workforce by about 15%, or about 60 employees, including money managers as well as other staff, according to people familiar with the matter.

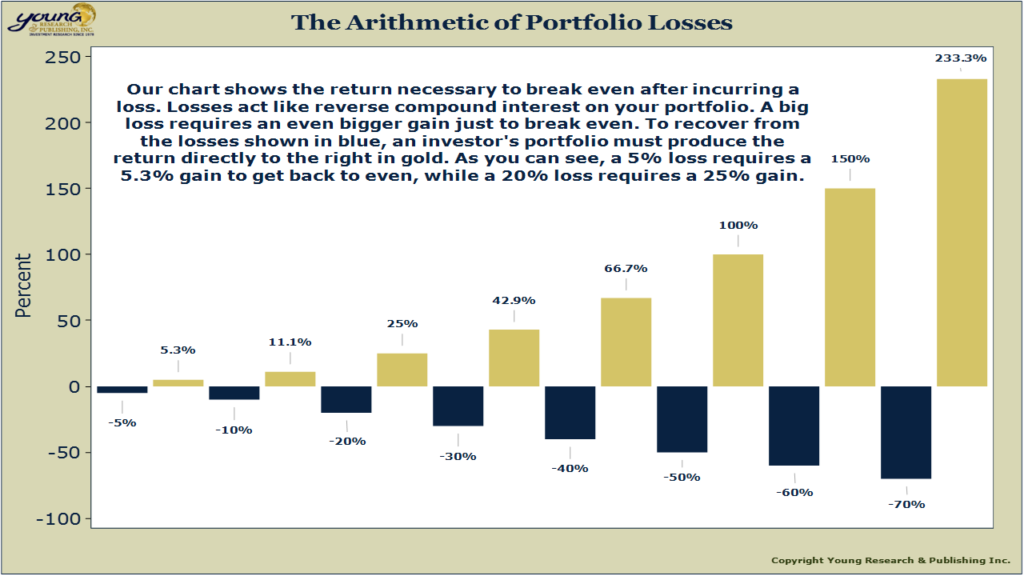

Rather than riding the risk roller coaster, retired and soon to be retired investors should focus on a policy of risk reduction and compound interest. Even a small decline in portfolio value requires time to recover from. Take a look at my chart of The Arithmetic of Portfolio Losses below. The blue bars represent possible declines in portfolio value, and the gold bars are the necessary increases in portfolio value to return to even. The gold bars represent the necessary return that must be generated to recover. As you can see, the demands on return are even higher after a big loss, meaning investors will have to take on even more risk to achieve their retirement goals. Exorbitant risk taking simply isn’t recommended for retired and soon to be retired investors who are depending on their portfolios to take them through their golden years.