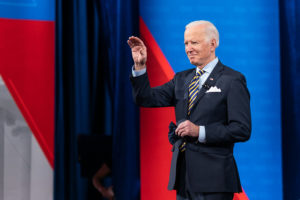

You wonder what you can do when Joe Biden and the Fed are actively seeking to destroy the value of your savings by pushing up inflation.

Wait, you didn’t think this inflation was an accident, did you? The Fed has been talking about how it wants to push inflation higher for months, even years. And Joe Biden’s answer to the worker shortage is “pay more,” which of course means, charge more as well.

The reports are in, and their plan is working. Your savings are being crushed.

Gwynn Guilford reports on the inflation hitting America in The Wall Street Journal, writing:

Inflation remained elevated in July, as the economy continued to rebound amid pandemic-related shortages of labor and supplies.

The Labor Department reported Wednesday that its consumer-price index rose 5.4% in July from a year earlier, the same pace as in June and the highest 12-month rate since 2008.

The CPI climbed a seasonally adjusted 0.5% in July from June, a slightly cooler pace than its 0.9% increase in June from May.

The index measures what consumers pay for goods and services, including groceries, clothes, restaurant meals, recreation and vehicles. The so-called core price index, which excludes the often volatile categories of food and energy, increased 4.3% from a year before.

Inflation has heated up this year for several reasons. U.S. gross domestic product rose at a rapid 6.5% seasonally adjusted annual rate in the second quarter, powered by consumer spending that climbed at an 11.8% pace as more people received vaccinations, businesses reopened and trillions of dollars in federal aid flowed through the economy.

Prices in categories hit hardest by the Covid-19 pandemic are still recovering to pre-pandemic levels, including for air travel, apparel, entertainment and recreation. Those price increases should slow once prices return to more normal levels, though the outbreak of the Delta variant of the Covid-19 virus could delay that process, many economists say.

Booming demand as the economy reopens has outpaced the ability of businesses to keep up. Many companies are passing on higher labor and materials costs to consumers. The shortage of semiconductors that has crimped auto production has caused prices to soar for new and used vehicles, as well as rentals.

Action Line: Inflation is a tax. It decreases the value of your savings while allowing governments to collect higher income and sales taxes to pay down old debts borrowed in stronger dollars with weaker dollars. It’s another case of you invest, and they win.