When you graduated from school and got your first job, you probably didn’t make a ton of money, but you did get paid. And so, as we talk about the transition from graduating work and entering retirement, think about what you did all those years ago: You got paid.

Because in retirement, you may not have a steady paycheck, but you still need to have a steady stream of income. Sure, some will buy stocks in hopes of selling at a higher price, but as Dick Young says “Survival Guy, hope is not a strategy. Never will be. Don’t forget that.”

I won’t ever forget how the foundation of a retirement portfolio should be on income or cash. In other words, on the quantitative, not the qualitative, like prices that come and go with the tides. When you first started working, you wouldn’t think of working for free. Why would you think that should change in your retirement life? Get paid, then worry about prices. You got this.

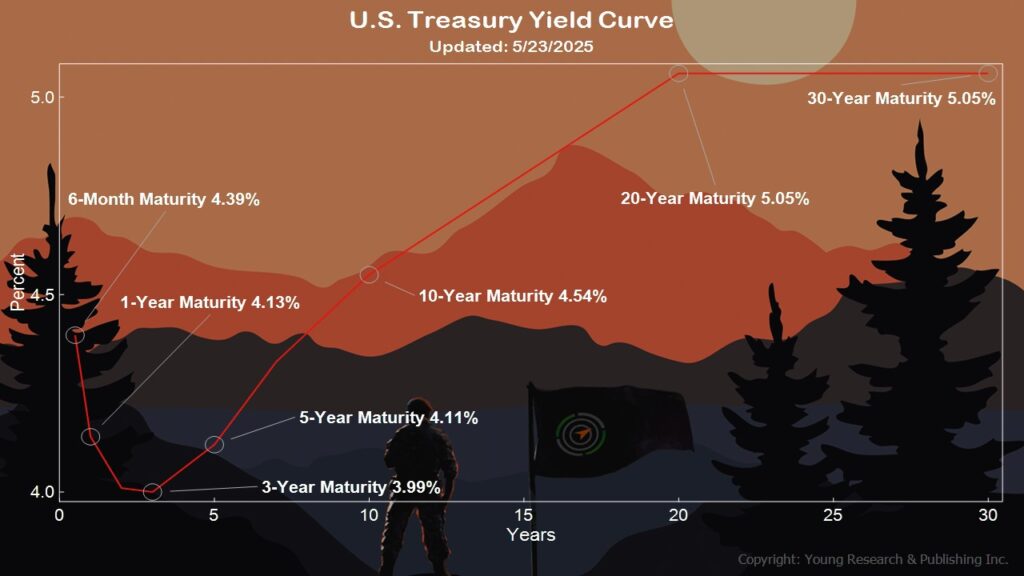

How much income can you expect? You can begin your journey by using Dick Young’s favorite investment tool, the yield curve. Run your finger along the yield curve, and you quickly begin to understand time, money, and risk.

Do not look at the yield curve and then invest like a Michael Jackson song trying to “beat it.” Understand this is the current lay of the land, and anything beyond that will carry different risks. I prefer to keep the risk to a minimum and not push the boundaries. That lesson will be taught the hard way or the easy way, but either way, it will be taught.

Action Line: We all need to get paid, no matter what age we are. And if you have a chance to see the Michael Jackson show, do. We loved it. When you want to discuss getting paid by your portfolio, email me at ejsmith@yoursurvivalguy.com. And click here to subscribe to my free monthly Survive & Thrive letter.

Read the entire series here.