UK pension funds that were engineering their way around the Bank of England’s super low-interest rates have now had to be saved by, you guessed it, the Bank of England, from its rapidly increasing interest rates. The Bank of England’s gilt bailout is based on guilt for pensions that were recklessly exposed to LDIs. Such action promotes more of the same behavior if the BOE is always there as a safety net. The pro-growth supply-side tax cuts are being blamed, but that’s misplaced. A mirror might be a good tool for the elites. The Wall Street Journal’s Paul Hannon reports:

The central bank also said it would launch a Temporary Expanded Collateral Repo Facility to provide cash in exchange for gilts to banks on behalf of clients managing Liability Driven Investment funds.

LDIs were at the forefront of the central bank’s concerns about the impact of rising gilt yields on the stability of the U.K.’s financial system in the days following the announcement of tax cuts.

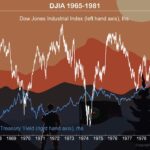

They are used primarily by pension funds to match long term liabilities they have to retirees with less capital than they would by owning regular long-dated government bonds. But they expose the funds to losses if rates shoot up quickly. LDI funds became increasingly popular during the long stretch of ultralow interest rates of the past decade. Regulatory changes also encouraged their use.

“This facility will enable banks to help to ease liquidity pressures facing their client LDI funds through liquidity insurance operations, which will run beyond the end of this week,” the BOE said.

The central bank said it would also make one of its existing, permanent repo windows available to banks acting to help LDI fund clients.

“Beyond the end of this week’s operations, the Bank will continue to work with the U.K. authorities and regulators to ensure that the LDI industry operates on a more resilient basis in future,” the BOE said.

The central bank presented its initial intervention in the gilts market as a way of giving pension funds time to adjust to big moves in bond prices without creating a self-fulfilling downward spiral.

In a letter to lawmakers last week, BOE Deputy Gov. Jon Cunliffe described the surge in long-dated gilt yields as “unprecedented” and said it could have forced LDI funds to unload government bonds.

“With the gilt market unable to absorb further large sales, had large sales been attempted yields would have been pushed even higher, forcing further gilt sales in an attempt to maintain solvency,” Mr. Cunliffe wrote. “This would have led to a self-reinforcing spiral of price falls and further pressure to sell gilts.”

Action Line: A similar cycle of inflate-deflate-inflate again is happening in the United States, with American pension fund managers equally as baffled as their UK counterparts. Don’t trust your savings to pension managers’ financial engineering methods. Instead, work on building a portfolio that relies on income. If you need help, let’s talk. In the meantime, click here to subscribe to my free monthly Survive & Thrive letter, and you’ll learn more about me and how I help American families improve their personal and financial security.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Is Your Retirement Life a Mess? Let’s Talk - April 18, 2024

- Your Survival Guy Learns from Marie Kondo - April 18, 2024

- April RAGE Gauge: Real Gold Prices - April 18, 2024

- This Is about Your Survival, Not Anyone Else’s - April 17, 2024

- The Grid Pushed to Its Limits - April 17, 2024