UPDATE 4.8.25: In times like these, when markets are volatile, it’s important to remember that you can’t let the perfect be the enemy of the good. Don’t wait for the “best” moment to make a good decision. A good decision now is better than the “best” decision when it’s already too late.

Originally posted on March 6, 2023.

Wouldn’t it be a shame if, five years from now, you’re earning peanuts on your savings? That’s a real risk. Because if the Fed backs itself into a corner, the economy gets into a pickle (and who knows what else), it may be forced to cut rates. At least, that’s what the talking heads are saying.

You know I don’t like predicting interest rates.

Predictions are cheap. Everyone has one. And they’re not a worthwhile endeavor. I’m Your Survival Guy, not “Mr. What If This Happens.”

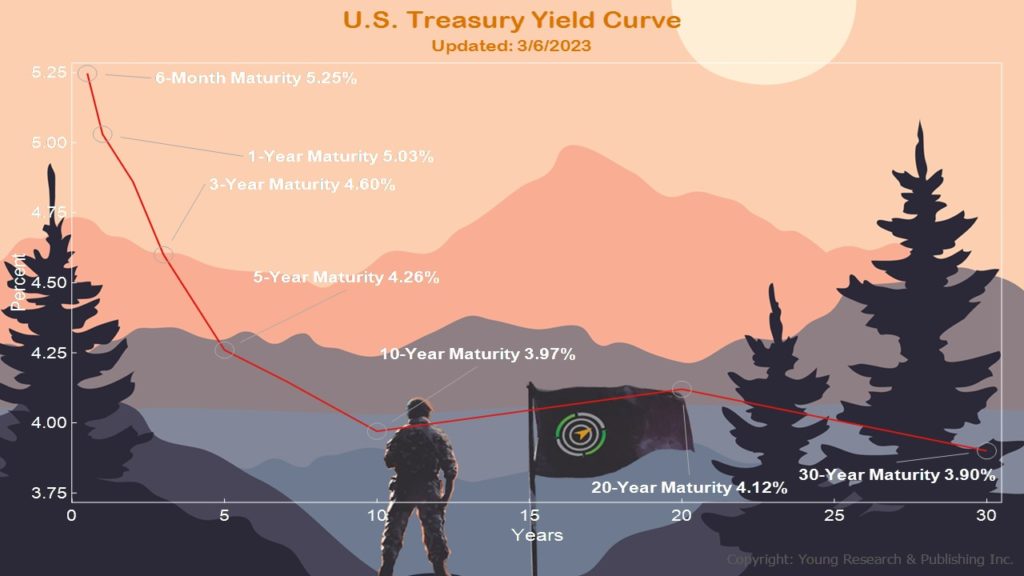

I like to take action based on what’s in front of me. And what I’m seeing now are attractive enough rates that I can sink my teeth into. Did you catch what I said? Let me repeat: attractive enough. That’s right. Rates that have some staying power. Notice I’m not saying “the best” rates. I’m OK with attractive enough. Too many investors miss the boat completely by waiting for the SSV “Best.”.

Look, don’t take my word for it. Just look at the facts. Rates were nailed to the floor, pinning the saving class down like a defeated Antman. You know the Fed can use its “super” powers to make it happen again. Just imagine if rates plummet back to zero. There will be—not there might—there will be serious re-investment risk when your CDs come due. The sun may not come out tomorrow.

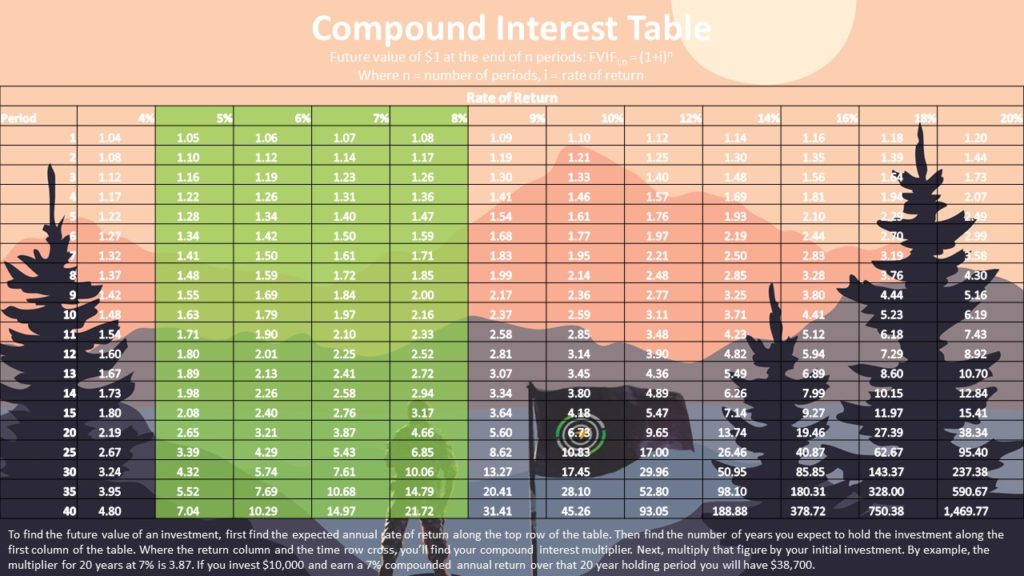

Action Line: Stick with me. Don’t get too cute with your cash. Lock some of it up with some decent enough yields that will last you a good chunk of your retirement. Don’t let “the best” get in the way of “attractive.” Put time on your side. When you’re serious, and you want to talk, let me know.

Click to enlarge the charts.