When legendary Dow Theorist Richard Russell was still alive, he wrote about the three phases of a bull stock market. He’d write to his valued readers that you know you’re in the third phase when everyone’s talking about stocks (or dogecoin, or bitcoin, etc.).

The third phase of a bull market is full of FOMOs—buyers with a “fear of missing out” on the next best thing, like lemmings jumping off a cliff. The third phase is crazy, fueled by emotion, with a narrative that goes something like this: It’s different this time.

Well, yes, every day is different. And there are plenty of stories telling you why the market is different this time. But that doesn’t make it a good market. It just provides a narrative for today’s prices, good or bad.

The latest narrative is the government’s belief in MMT or modern monetary theory—a post-Keynesian dream that without fail ends as a nightmare. How can printing more money be healthy for the economy? It’s not. At the end of the day, pouring too much money into an economy is like flooding an engine. No matter how much gas you give your Ford F-150, it won’t become a Bugatti Chiron.

In the end, too much fuel just makes a mess of your truck. And, yes, knowing when the third phase of the bull market will end is tricky. It’s not like you pop the hood, see all the gas, and scream: “No one light a match!” It’s not that obvious.

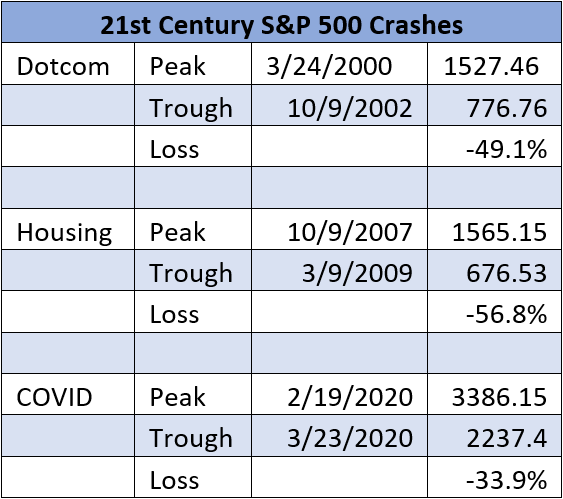

Action Line: Unfortunately, history has a way of repeating itself. And I’m not talking about the 70s. My twenty-year-old daughter has already lived through three major cracks in the market. And by the looks of things, it’s not much different today than when she was born.

Yes, we’re emerging from the Covid fog, but, just make sure you’ve got a clear head about you. Stay on target by clicking here to sign up for my Survive and Thrive newsletter, a monthly reminder to focus on what matters.

Yes, we’re emerging from the Covid fog, but, just make sure you’ve got a clear head about you. Stay on target by clicking here to sign up for my Survive and Thrive newsletter, a monthly reminder to focus on what matters.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Breaking: New Rules on Trillions in IRAs and 401(k)s - April 24, 2024

- When You’re in Control, You Have Opportunities - April 24, 2024

- Newport, Rhode Island: Sailing, Mansions, and High Taxes - April 24, 2024

- Yes, Money Can Buy You Happiness - April 23, 2024

- State Income Taxes and the 2024 NFL Draft Class - April 23, 2024