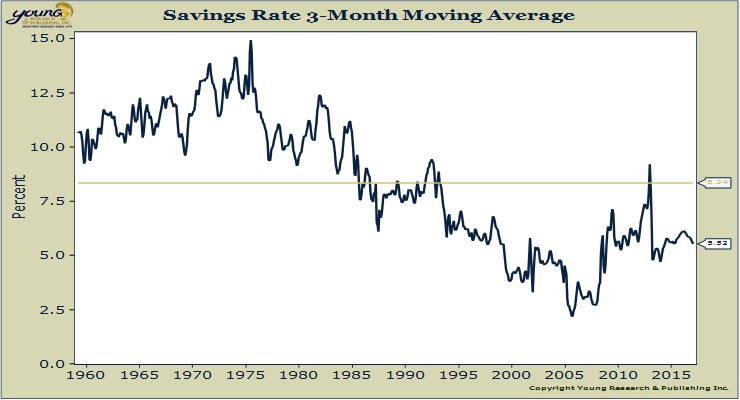

At Bloomberg, Suzanne Woolley writes that only 41% of workers have attempted to determine how much money they’ll need to save to retire comfortably. Of those who took a crack at figuring out how much they’d need, 37% say a million dollars or more. Take a look at my chart of the Savings Rate below. You can see that Americans are saving nearly 3% below the long term average today. You can bet most who need a million dollars aren’t anywhere near that goal today. Woolley writes:

At Bloomberg, Suzanne Woolley writes that only 41% of workers have attempted to determine how much money they’ll need to save to retire comfortably. Of those who took a crack at figuring out how much they’d need, 37% say a million dollars or more. Take a look at my chart of the Savings Rate below. You can see that Americans are saving nearly 3% below the long term average today. You can bet most who need a million dollars aren’t anywhere near that goal today. Woolley writes:

EBRI [the Employee Benefit Research Institute] doesn’t have data on how many people actually wind up retiring with a nest egg of $1 million or more, but it does have a database of 401(k) plans that covers roughly half the market, and it shows that 10 percent of plan participants have at least $200,000 stashed away, said Craig Copeland, a senior research associate at EBRI. For people in their 60s, it’s 30 percent. Even that is a very small minority of American workers.

Many will never get near the $1 million mark without a huge savings push. Asked about their current savings, not including the value of a primary residence or a defined-benefit (old-fashioned) pension plan, only 20 percent of workers said they had saved $250,000 or more. Forty-seven percent had saved less than $25,000, and 24 percent of those people had saved less than $1,000.

I can’t stress the importance of saving early-and saving until it hurts-enough. The earlier and more you save, the stronger the power of compound interest will work for you.

Read more from Woolley here.