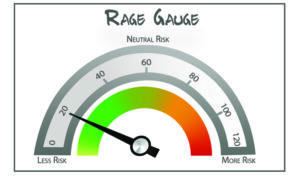

My goal for you with my monthly RAGE Gauge is to provide you with a quick reading of how risk is being perceived right now—how risk is being interpreted.

My goal for you with my monthly RAGE Gauge is to provide you with a quick reading of how risk is being perceived right now—how risk is being interpreted.

In my line of work, there is never enough attention given to downside protection—keeping what you have—too much energy is wasted thinking about keeping up with the other guy.

In that world, the grass is always greener because of: How much “they” have, where their kids go to school, what they do for a living, and where they live. “They,” take up an enormous amount of energy.

A more efficient use of energy focuses on what you do to protect what you have and how you keep your family safe. I believe that is what connects you and me, and why you’re reading this.

With that in mind, we need to know how “they” are measuring risk. It helps us protect what we have because “they” can create a lot of problems in the world.

With that in mind, “they” are simply not paying enough attention to today’s risks. It’s why this month’s reading—the lowest on record—is reading low risk. “They” are not factoring in enough risk, right now.

You and I are living through a crisis in yield. We need to recognize that risk, and prepare accordingly. “They” are certainly not paying attention.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Is Your Retirement Life a Mess? Let’s Talk - April 18, 2024

- Your Survival Guy Learns from Marie Kondo - April 18, 2024

- Don’t Be Left High and Dry - April 18, 2024

- April RAGE Gauge: Real Gold Prices - April 18, 2024

- This Is about Your Survival, Not Anyone Else’s - April 17, 2024