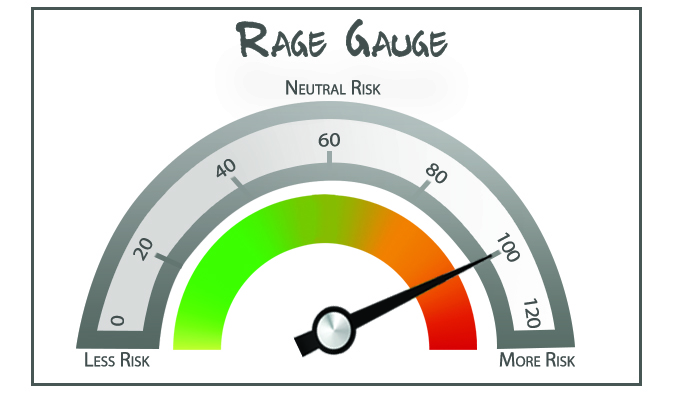

Your Survival Guy’s RAGE Gauge is in, and it’s about the same as last month, not pretty, but what did you expect me to say? The big guns are coming out after the Federal Reserve to cut rates.

David Malpass is one of them.

As a former undersecretary of the U.S. Treasury 2017-2019, president of the World Bank 2019-23, and well-respected economist (notably by President Trump and Your Survival Guy), points out in his WSJ critique of the Federal Reserve, it’s time to cut rates.

Titled, “The Federal Reserve Doesn’t Have to Be an Enemy of Growth: A larger-than-expected September rate cut, and broad reforms would make America prosperous again.”

The following quote caught my eye and made me think of you, “High rates today are helping wealthy Americans, money market funds and bank earnings, but they hurt production and price competition. Corporate bankruptcy filings in June hit a 15-year high (Your Survival Guy’s emphasis).”

Clearly, there’s a battle in the streets of Jackson Hole to cut rates, but let’s not forget Main Street investors are finally getting some bang for their buck in money markets, too, not just the wealthy.

You have the “haves” and the “have yachts,” both groups benefiting from higher stock prices. But the haves, my successful Americans, those who have saved ‘til it hurts and worked for as long as they could, should be rewarded with T-bill or risk-free rates they can sink their teeth into. The “have yachts” don’t lose much sleep thinking about risk-free rates.

Yes, rates could be lower and probably will be in September, which makes now a good time for Main Street investors to develop a fixed income plan they can live with through thick and thin. This has been a too-good-to-be-true stock market for everyone, and it may continue to be so under President Trump’s leadership. But let’s not forget stocks don’t go up forever, and when they drop, that is not the time to realize you have too much risk in your portfolio.

Action Line: When you want to talk about preparing your portfolio with a plan for retirement, email me at ejsmith@yoursurvivalguy.com. And click here to subscribe to my free monthly Survive & Thrive letter.