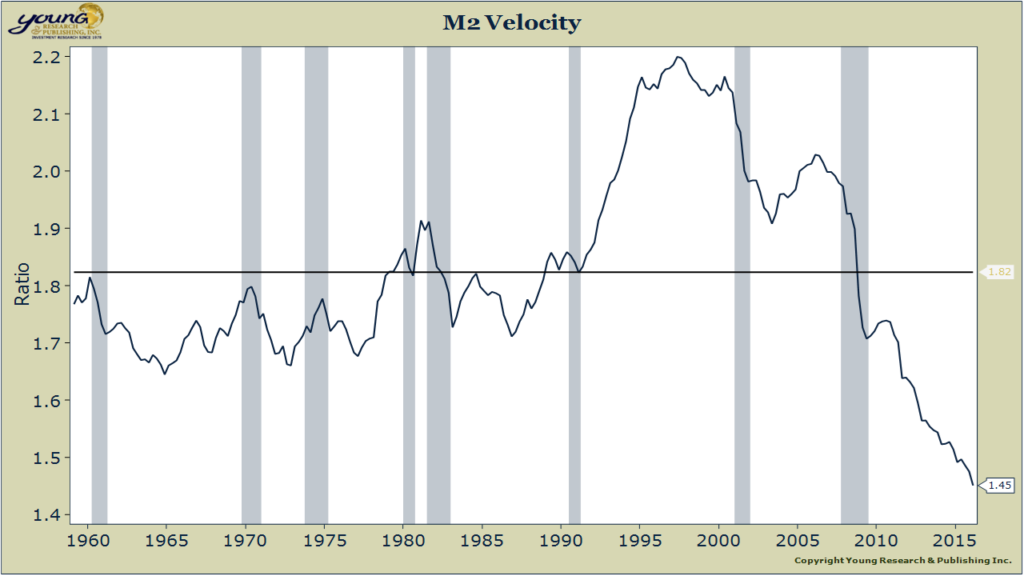

At one time, velocity, the speed at which the monetary base is spent (measured as GDP/M2), was a reasonably reliable indicator of America’s position in the business cycle. More often than not, if velocity was tanking, it was a good bet the country was in recession. Today though, after years of unconventional monetary policy, velocity is no longer a reliable business cycle indicator.

If you’re not an economist or don’t work in the world of finance, you may be asking, “so what?” There are a number of practical reasons you might pay attention to velocity. For one, when velocity ticks up it can signal inflation ahead. And with velocity falling so far for so long, it’s possible there could be a neck snapping reversal if the growth rate of GDP ever begins to outpace the growth rate of M2.

So what happens when velocity increases? Businesses, and individuals spend money at a faster rate. In turn they may increase prices and demand higher wages. So far, GDP growth hasn’t taken off. And growth may slow further before it accelerates. But if and when it does, the chart of velocity below illustrates that inflationary tinder is piled high and the slightest spark could set it off.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- “Happy I Found Richard C. Young’s Intelligence Report” - April 16, 2024

- Residents Lose Faith in Blue Cities - April 16, 2024

- Want to Make and Keep Generational Wealth? - April 16, 2024

- Your Retirement Life: Watching The Masters and More - April 15, 2024

- Fight Food Inflation with Gold - April 15, 2024