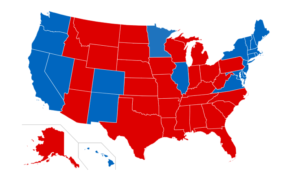

Click here to visit Richardcyoung.com’s Liberty & Freedom map. There you can see how your state’s tax picture compares to all the others’.

One of the less touted but possibly most significant outcomes of the Trump tax reform was forcing states into greater competition over taxation. States with already high taxes had the sheet pulled off their ugly policies. The tax reform bill stripped those high taxing states of the federal deductions that had masked their inefficient policies. With all states now competing on an even playing field, citizens are getting a first hand look at just how badly their states have been bilking them.

At the Cato Institute, Chris Edwards writes that high income earners, who were already fleeing high tax states, will continue to do so, and states with high taxes need to “up their game,” if they want to keep any of their citizens. Edwards writes:

High earners are the hardest hit by the new tax cap, and the IRS data show that they were already moving to low-tax states. For the 25 highest-tax states, the average migration ratio for those earning more than $200,000 was 0.84, meaning large net out-migration. For the 25 lowest-tax states, the average ratio was 1.37, meaning large net in-migration.

New York had the lowest ratio for high earners at 0.49, while Florida had the highest at 2.62. High earners love Florida’s lack of income and estate taxes, and there has been a steady stream of high-paying financial firms moving to Florida from the Northeast for that reason.

The effort by New York and other states to fight the deduction cap is a dead end, and the IRS has already ruled against some of the state workaround schemes.

The stark reality for high-tax states is that they need to improve the efficiency of their public services and give taxpayers more value for their money.

In 2015, New York’s total state and local tax burden was 14.9 percent of personal income, which was almost twice Florida’s burden of 7.6 percent. Unless you think that New York’s public services are twice as good as Florida’s, the higher tax costs in the Empire State are simply a rip-off. For a family making, say, $100,000 a year, that 7.3-point difference means $7,300 in tax savings by moving to Florida.

Such tax differences are enough for some families to pack their bags and move, especially when low-tax states such as Florida and Texas also offer warmer weather and lower housing costs.

[New York Governor Andrew] Cuomo and leaders of other high-tax states need to accept that the GOP tax law has ushered in a new era of state tax competition. The smart way forward for chronic migration losers such as New York is to up their game and deliver better services at lower costs.

Read more here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Is Your Retirement Life a Mess? Let’s Talk - April 18, 2024

- Your Survival Guy Learns from Marie Kondo - April 18, 2024

- Don’t Be Left High and Dry - April 18, 2024

- April RAGE Gauge: Real Gold Prices - April 18, 2024

- This Is about Your Survival, Not Anyone Else’s - April 17, 2024