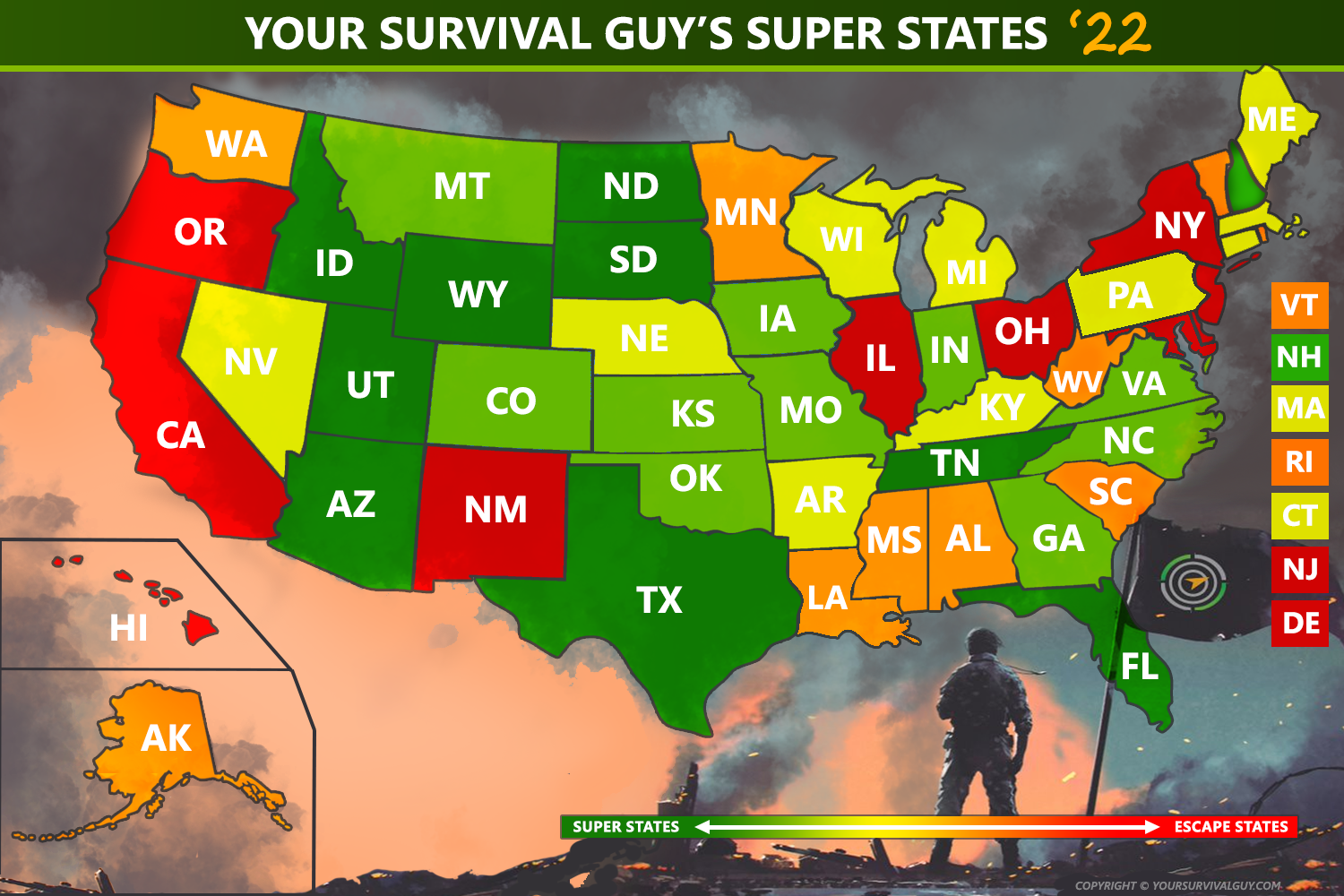

Americans living in big cities in states where governors have gone wild with shutdowns, but allowed riots to rule the streets are trying to escape.

The COVID-19 pandemic and the rioting that has followed it have accelerated the exodus from many of the big tax cities Americans were already trying to flee the big city blues.

They’re seeking some shelter away from it all.

Many of them are heading to the suburbs or the exurbs, but many of them are also heading to the lower cost, smaller cities in the South, and West that were already popular destinations for escapees before chaos struck.

Liz Lucking explains at Mansion Global:

Phoenix, Sacramento and Las Vegas were the most favored destinations for U.S. homebuyers looking for a major relocation in April and May, according to Thursday’s migration report from Redfin.

A record 27% of Redfin users searched for homes outside their metro area during the two-month window, the peak of the coronavirus crisis in the U.S.

The figure, based on a sample of more than 1 million users, is the highest recorded since Redfin began reporting net migration data in early 2017, and was likely bolstered by more people considering moves to quieter, less crowded areas with more square footage, Redfin said.

While contributing to demand, buyers looking to relocate as a result of the coronavirus are not the exclusive drivers of out-of-town interest, and the “long-term impact of the pandemic on people actually moving from one part of the country to another remains to be seen,” Redfin economist Taylor Marr, said in the report.

“People are starting to take the plunge and move away from big, expensive cities, though most of them were probably already considering a lifestyle change,” Mr. Marr said. “The pandemic and the work-from-home opportunities that come with it [are] accelerating migration patterns that were already in place toward relatively affordable parts of the country.”

You have read here that it’s important to do some investigation when you’re choosing where to retire.

Look for a place that’s small, cheap, and safe–somewhere you can live in your dream community, not a nightmare.

P.S. The portfolio manager of the Vanguard GNMA Fund, Michael Garrett is set to retire this year. Here’s a bit about Garrett, and the GNMA fund’s future from CityWire.com:

Veteran Wellington portfolio manager Michael F. Garrett is to retire this year, according to a filing with the Securities and Exchange Commission.

Citywire + rated Garrett is listed on five funds subadvised by Wellington. These are the:

- Vanguard GNMA ($21.8 billion)

- SEI Short-Duration Government ($696.2 million)

- SEI GNMA ($64.8 million)

- Hartford Quality Bond ($128.2 million)

- Hartford US Government Securities HLS ($335.4 million)

Garrett has been with Wellington for 20 years, according to his LinkedIn profile. He will retire on June 30, 2020.

On the Vanguard GNMA fund, Garrett is the sole manager and Wellington is the sole subadvisor. The fund is ranked second out of 13 GNMA funds tracked by Citywire for three-year total returns to the end of April. During that time it was up 4.5% compared with the category average, which was up 3.5%, and the Bloomberg Barclays GNMA TR index, which was up 4.6%.

According to a spokeswoman for Vanguard, Wellington portfolio managers Brian Conroy and Citywire AA-rated Joseph F. Marvan have been added to the Vanguard GNMA fund. They will replace Garrett after his retirement this year.

A spokeswoman for Wellington did not return a request for comment before publication.