Where will you live in retirement? Having recently been to New York City it’s a wonderful place to visit, but nowhere I’d like to spend most of my time. Plus, who can afford it? Check out the quote at the end of this piece. But first…

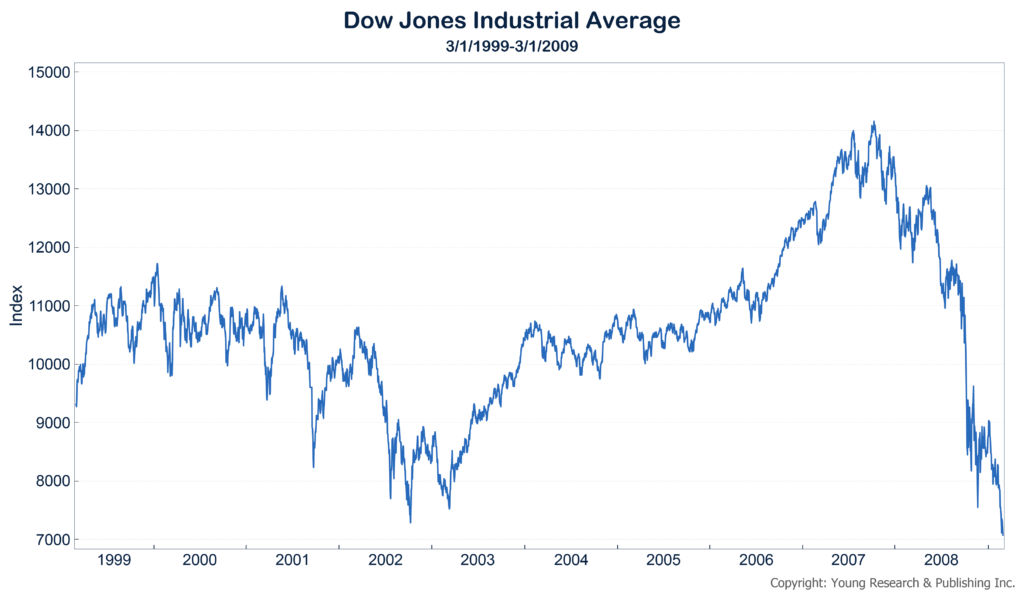

Imagine retiring in 1999 and dreaming about the trips you would take using the profits from the stock market. Well for ten-years hence, the Dow lost money. That’s right, from March 1999 to March 2009 the Dow went from over 9,800 to just under 7,300—not including dividends. And that’s the key. For dividend-centric investors, living through such periods of market despair is doable.

Another key for the retired or soon to be retired investor is balance. When markets go to pot, it’s balance, in this case bonds, that may very well save the day for you.

Allow me to share with you some commentary from one of my favorite stock market prognosticators, the late, great Richard Russell, who wrote to his beloved readers the following in his December 20, 2000 Dow Theory Letters:

INVESTMENT POSITION:

The bear remains in the box. And it shouldn’t be hard to figure out my investment position. Let me put it this way. In a bull market the problem is to take advantage of generally rising prices. Conversely, in a bear market the idea is simple enough – the idea is to try to avoid losses I’m proceeding on the thesis that this bear market is going to be hard on business. If this proves correct, then (1) investors are going to forsake the concept of growth and slowly come to the thesis that income is going to become more important than growth.

(2) As the economy slows and as the bear market moves on, stockholders will find themselves holding stocks that are declining and stocks that throw off no income. Since the economy will be slowing, there will be a rising desire for income. Families will find that they need income to pay off their debt.

(3) The best place to obtain income in a bear market is in high-grade bonds. This is particularly true in this bear market because the average yield on stocks is a ridiculous 1 .5% and in the case of a huge number of stocks there are no dividends at all. Never have I seen so many stocks that are dividendless. This is going to be a huge problem as the bear market rolls along.

New York:– A full-page story in a recent NY Times (Nov. 26) starts, “The State of Life in the City: Packed Like Sardines .” Ah yes, how I remember the subway coming home from school . Cattle have never been packed so tight.

It was eerie, it was Manhattan.

I left my home town of New York in 1.961 . That was the last year that you could park your car in midtown Manhattan without getting a ticket or without someone breaking into it. Also, I felt the crowds were beginning to get a bit too thick. Just too many people – and that was back in 1961 .

Today the situation is a LOT worse. The Times writes about two people who “headed to a fashionable downtown restaurant with a reservation on an unfashionable Tuesday at 8PM – made after they gave up trying to go out on weekends because every restaurant, movie or jazz club always seemed to be booked. When they arrived, the restaurant was packed and their table was in use . They were offered drinks on the house, but bodies were three-deep at the bar. They were finally seated 70 minutes late.”

The article continues, “Chris Lopes, 24, an electrician, says, `I hate it, I hate it, I just hate it. I don’t like breathing other people’s breath, I like kissing my wife when I get home,. not the guy sitting next to me on the trains at 5 :30 in the morning. It’s disgusting.”

“A computer operator who commutes says `I just literally want to scream, `Don’t touch me, don’t touch me! Everybody, just let me sit or stand in enough human space not to be mauled for an hour. All joking aside, part of the reason why the city is so hostile is because you’re treated like an animal twice a day’. “